Car GPS Navigation System Market Research Report

Car GPS Navigation System Market - Global Industry Size & Growth Analysis 2024-2030

Global Car GPS Navigation System Market is segmented by Application (Passenger Vehicles, Commercial Vehicles), Type (GPS Systems, Navigation Software), and Geography (North America, LATAM, West Europe, Central & Eastern Europe, Northern Europe, Southern Europe, East Asia, Southeast Asia, South Asia, Central Asia, Oceania, MEA)

Pricing

Industry Overview

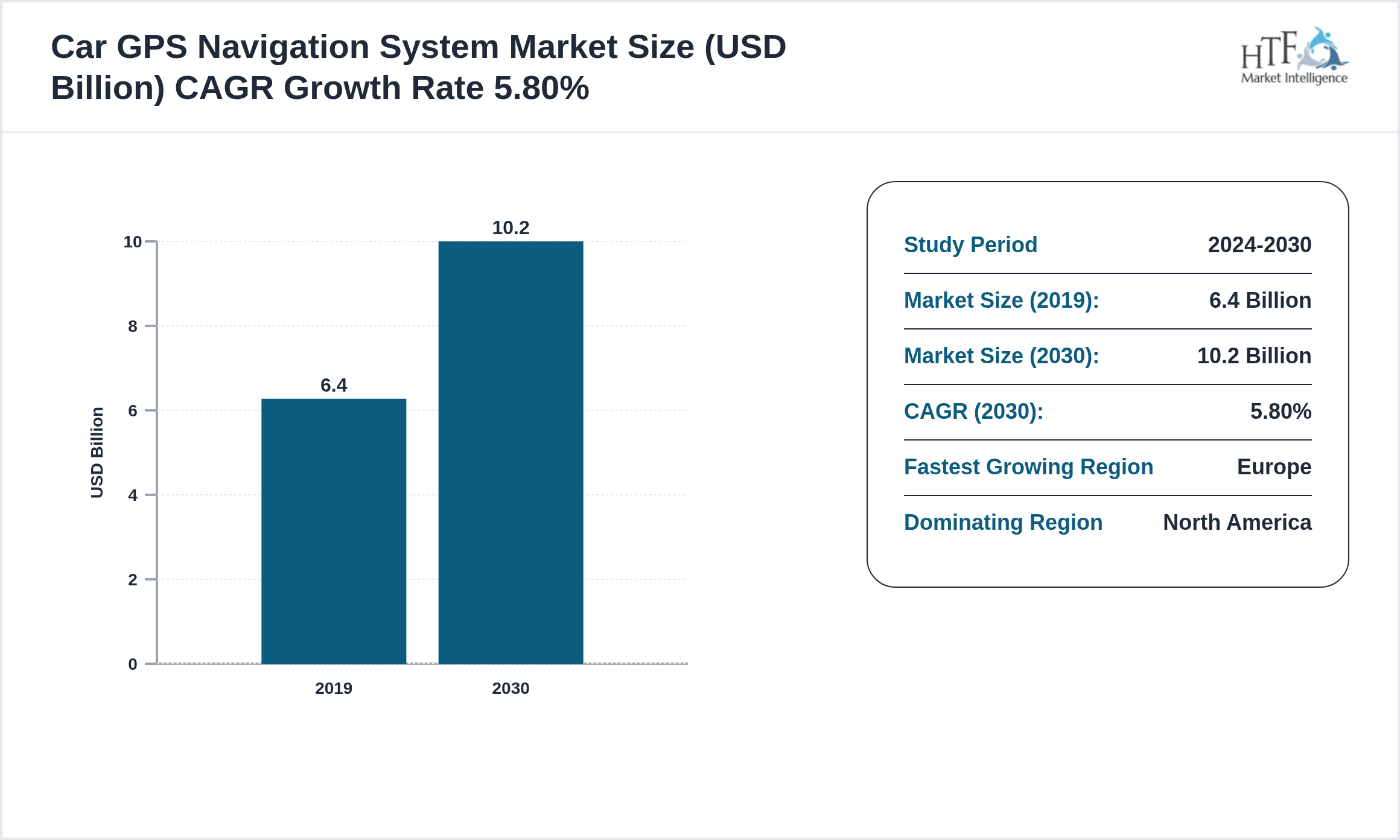

The Car GPS Navigation System Market is expected to reach 10.2 Billion by 2030 and is growing at a CAGR of5.80% between 2019 to 2030.

The GPS navigation system market in Asia-Pacific is expanding due to the increasing demand for in-car navigation systems and smartphone integration. It helps drivers navigate and avoid traffic with real-time updates.

The consumer goods market consists of various components, including product categories (durable and non-durable goods), distribution channels (retail stores, e-commerce, and wholesalers), and market segmentation based on demographics and consumer behavior. Marketing strategies, such as advertising and branding, play a crucial role in attracting consumers, while trends like sustainability and health consciousness influence purchasing decisions. Additionally, the regulatory environment impacts product development, and effective supply chain management ensures timely delivery. Pricing strategies must consider competition and consumer demand to optimize sales. Together, these elements shape the dynamics of the consumer goods market.

Market Segmentation

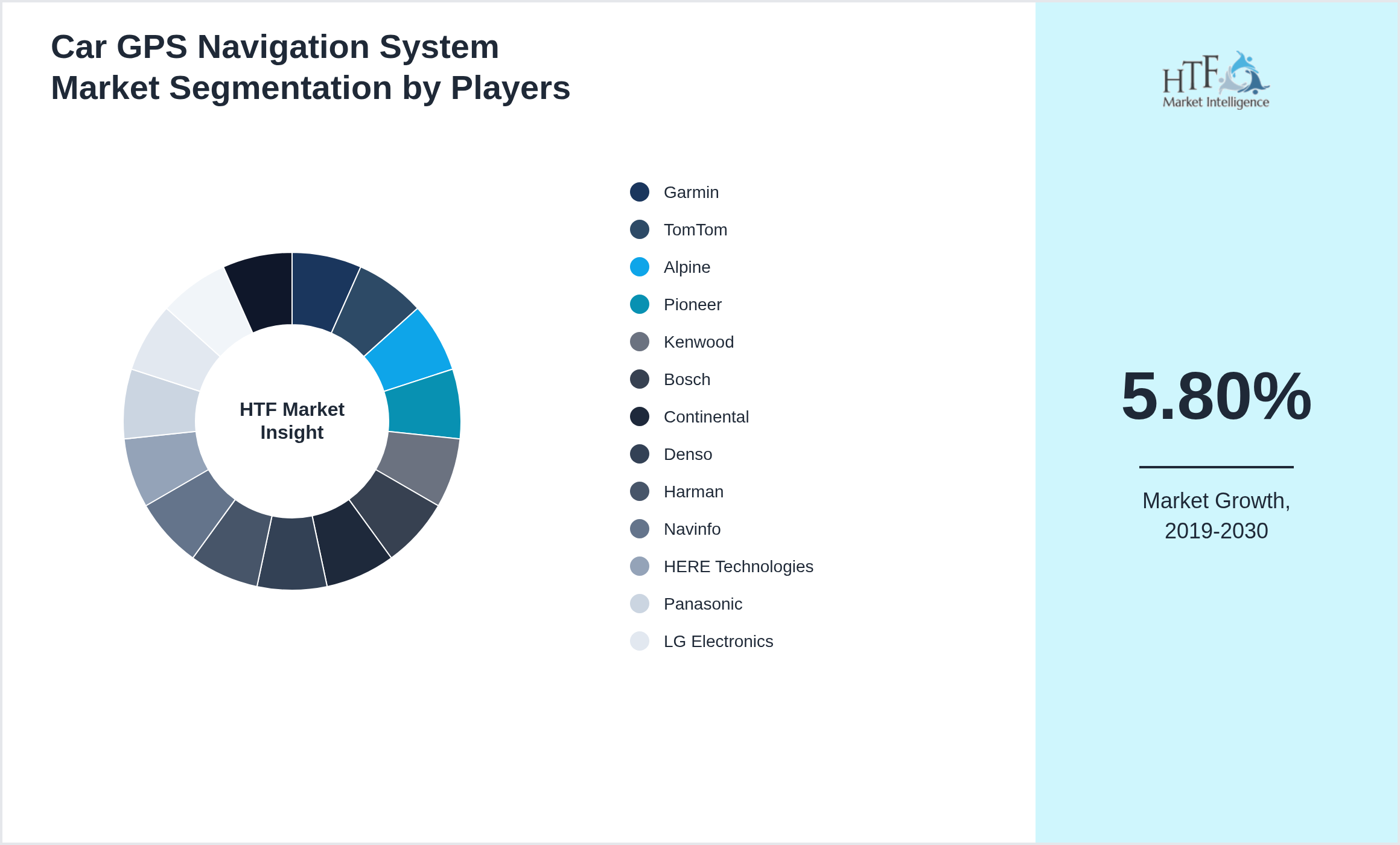

Selecting segmentation criteria in Garmin, TomTom, Alpine, Pioneer, Kenwood, Bosch, Continental, Denso, Harman, Navinfo, HERE Technologies, Panasonic, LG Electronics, Garmin, Qualcomm involves several key steps. Researchers begin by defining their objectives, such as understanding consumer behavior or identifying market opportunities. They then gather relevant data on demographics, psychographics, and buying behavior. Next, they identify segmentation variables like age, location, lifestyle, and purchase patterns. Using analytical tools, they analyze the data to find distinct market segments and evaluate their attractiveness based on size, growth potential, and alignment with business goals. Detailed profiles are created for each segment, and the most promising ones are selected for targeting. Finally, tailored marketing strategies are developed, and the performance of these strategies is monitored and adjusted as needed. This process ensures that segmentation effectively identifies valuable market opportunities and aligns with strategic goals.

The North AmericaRegion holds a dominant market share, primarily driven by growing consumption patterns, a rising population, and robust economic activity that fuels market demand. Meanwhile, the Europe Region is experiencing the fastest growth, propelled by increasing infrastructure developments, expanding industrial activities, and a surge in consumer demand, positioning it as a key driver for future market expansion.

Segmentation by Type

- • GPS Systems

- • Navigation Software

Segmentation by Application

- • Passenger Vehicles

- • Commercial Vehicles

Regional Insight

The Car GPS Navigation System varies widely by region, reflecting diverse economic conditions and consumer preferences. In North America, the focus is on convenience and premium products, driven by high disposable incomes and a strong e-commerce sector. Europe’s market is fragmented, with Western countries emphasizing luxury and organic goods, while Eastern Europe sees rapid growth. Asia-Pacific is a fast-growing region with high demand for both high-tech and affordable products, driven by urbanization and rising middle-class incomes. Latin America prioritizes affordability amidst economic fluctuations, with Brazil and Mexico leading in market growth. In the Middle East and Africa, market trends are influenced by cultural preferences, with luxury goods prominent in the Gulf States and gradual growth in sub-Saharan Africa. Global trends like sustainability and digital transformation are impacting all regions.

The North Americadominant region currently dominates the market share, fueled by increasing consumption, population growth, and sustained economic progress that collectively enhance market demand. Conversely, the Europeis thefastest-growing that is rapidly becoming the fastest-growing region, driven by significant infrastructure investments, industrial expansion, and rising consumer demand.

- North America

- LATAM

- West Europe

- Central & Eastern Europe

- Northern Europe

- Southern Europe

- East Asia

- Southeast Asia

- South Asia

- Central Asia

- Oceania

- MEA

Key Players

The companies highlighted in this profile were selected based on insights from primary experts and an evaluation of their market penetration, product offerings, and geographical reach:

- • Garmin

- • TomTom

- • Alpine

- • Pioneer

- • Kenwood

- • Bosch

- • Continental

- • Denso

- • Harman

- • Navinfo

- • HERE Technologies

- • Panasonic

- • LG Electronics

- • Garmin

- • Qualcomm

Merger & Acquisition

Report Infographics:

| Report Features | Details |

| Base Year | 2019 |

| Based Year Market Size 2019 | 6.4 Billion |

| Historical Period Market Size 2024 | USD Million ZZ |

| CAGR (2019to 2030) | 5.80% |

| Forecast Period | 2019 to 2030 |

| Forecasted Period Market Size 2030 | 10.2 Billion |

| Scope of the Report | GPS Systems, Navigation Software, Passenger Vehicles, Commercial Vehicles |

| Regions Covered | North America, Europe, Asia Pacific, South America, and MEA |

| Year-on-Year Growth | 6.00% |

| Companies Covered | Garmin, TomTom, Alpine, Pioneer, Kenwood, Bosch, Continental, Denso, Harman, Navinfo, HERE Technologies, Panasonic, LG Electronics, Garmin, Qualcomm |

| Customization Scope | 15% Free Customization (For EG) |

| Delivery Format | PDF and Excel through Email |

Car GPS Navigation System Market Dynamics

TheCar GPS Navigation System is driven by factors such as increasing demand in end-use industries, technological advancements, research and development (R&D), economic growth, and increasing global trade.

Influencing Trend:

- • Integration with mobile apps

- • rise of autonomous vehicle navigation systems.

- • Opportunities in the growing electric vehicle market

- • demand for advanced navigation features in autonomous vehicles.

- • Competition from smartphone-based navigation

- • challenges in integrating with vehicle systems.

- • Opportunities in the growing electric vehicle market

- • demand for advanced navigation features in autonomous vehicles.

Regulatory Framework

The regulatory framework for the Car GPS Navigation System ensures product safety, fair competition, and consumer protection. It encompasses setting standards for product quality and safety, enforcing truthful advertising and labeling, and implementing environmental sustainability practices. Regulations include robust procedures for product recalls, data protection, and anti-competitive practices, while also overseeing import/export controls and intellectual property rights. Regulatory bodies enforce these rules through inspections and penalties, and consumer education programs help individuals make informed decisions. This framework aims to protect consumers, promote fair market conditions, and encourage ethical business practices.

Competitive Insights

The key players in the Car GPS Navigation System are intensifying their focus on research and development (R&D) activities to innovate and stay competitive. Major companies, such as Garmin, TomTom, Alpine, Pioneer, Kenwood, Bosch, Continental, Denso, Harman, Navinfo, HERE Technologies, Panasonic, LG Electronics, Garmin, Qualcomm are heavily investing in R&D to develop new products and improve existing ones. This strategic emphasis on innovation is driving significant advancements in product formulation and the introduction of sustainable and eco-friendly products.

Moreover, these established industry leaders are actively pursuing acquisitions of smaller companies to expand their regional presence and enhance their market share. These acquisitions not only help in diversifying their product portfolios but also provide access to new technologies and markets. This consolidation trend is a critical factor in the growth of the consumer goods industry, as it enables larger companies to streamline operations, reduce costs, and increase their competitive edge.

In addition to R&D and acquisitions, there is a notable shift towards green investments among key players in the consumer goods industry. Companies are increasingly committing resources to sustainable practices and the development of environmentally friendly products. This green investment is in response to growing consumer demand for sustainable solutions and stringent environmental regulations. By prioritizing sustainability, these companies are not only contributing to environmental protection but also positioning themselves as leaders in the green movement, thereby fueling market growth.

Research Methodology

The research methodology for the consumer goods industry involves several key steps to ensure comprehensive and actionable insights. First, the research objectives are clearly defined, focusing on aspects like consumer behavior, market opportunities, competitive dynamics, or regulatory impacts. A thorough literature review follows, drawing from academic journals, industry reports, government publications, and market analyses to establish a knowledge base and identify research gaps. Data collection encompasses both primary methods, such as surveys, interviews, and focus groups with consumers and industry experts, and secondary methods, including analysis of market reports, government data, and industry publications. Quantitative data is analyzed using statistical tools to identify patterns and market segments, while qualitative data from interviews and focus groups is examined to extract key themes and insights.

The market is then segmented based on demographics, psychographics, geography, and purchasing behavior, and competitive analysis is conducted to evaluate key players' strategies and strengths. Trend analysis identifies current and emerging industry trends. Findings are compiled into a detailed report with data visualizations and strategic recommendations. The research is validated and refined through cross-checking and expert feedback, and a framework for continuous monitoring is established to keep the research current and relevant.

Car GPS Navigation System - Table of Contents

Chapter 1: Market Preface

Chapter 2: Strategic Overview

Chapter 3: Global Car GPS Navigation System Market Business Environment & Changing Dynamics

Chapter 4: Global Car GPS Navigation System Industry Factors Assessment

Chapter 5: Car GPS Navigation System : Competition Benchmarking & Performance Evaluation

Chapter 6: Global Car GPS Navigation System Market: Company Profiles

Chapter 7: Global Car GPS Navigation System by Type & Application (2024-2030)

Chapter 8: North America Car GPS Navigation System Market Breakdown by Country, Type & Application

Chapter 9: Europe Car GPS Navigation System Market Breakdown by Country, Type & Application

Chapter 10: Asia Pacific Car GPS Navigation System Market Breakdown by Country, Type & Application

Chapter 11: Latin America Car GPS Navigation System Market Breakdown by Country, Type & Application

Chapter 12: Middle East & Africa Car GPS Navigation System Market Breakdown by Country, Type & Application

Chapter 13: Research Finding and Conclusion

Frequently Asked Questions (FAQ):

The Compact Track Loaders market is expected to see value worth 5.3 Billion in 2025.

North America currently leads the market with approximately 45% market share, followed by Europe at 28% and Asia-Pacific at 22%. The remaining regions account for 5% of the global market.

Key growth drivers include increasing construction activities, rising demand for versatile equipment in agriculture, technological advancements in track loader design, and growing preference for compact equipment in urban construction projects.