Gasifier Balance of Plant Components Market Research Report

Gasifier Balance of Plant Components Market - Global Share, Size & Changing Dynamics 2024-2030

Global Gasifier Balance of Plant Components Market is segmented by Application (Power generation industry, Renewable energy industry, Industrial processes, Waste-to-energy, Biomass energy), Type (Gas cleaning systems, Heat recovery systems, Gas turbines, Gas engines, Power generation systems), and Geography (North America, LATAM, West Europe, Central & Eastern Europe, Northern Europe, Southern Europe, East Asia, Southeast Asia, South Asia, Central Asia, Oceania, MEA)

Pricing

Industry Overview

The Gasifier Balance of Plant (BOP) Components Market pertains to the components and systems that support the operation of gasifiers, which are used for converting biomass, coal, and other feedstocks into syngas for power generation. The BOP includes all the necessary infrastructure and equipment, such as gas compressors, filters, valves, and control systems, that enable the smooth functioning of the gasification process. The market is driven by the growing adoption of gasification technologies in energy production due to their environmental benefits, such as lower carbon emissions compared to traditional fossil fuels. The increasing demand for renewable energy and clean power generation is a major driver of the market. Moreover, advancements in gasification technology, along with government initiatives to promote clean energy sources, are expected to contribute to the growth of the gasifier BOP components market.

Key Highlights of the Gasifier Balance of Plant Components

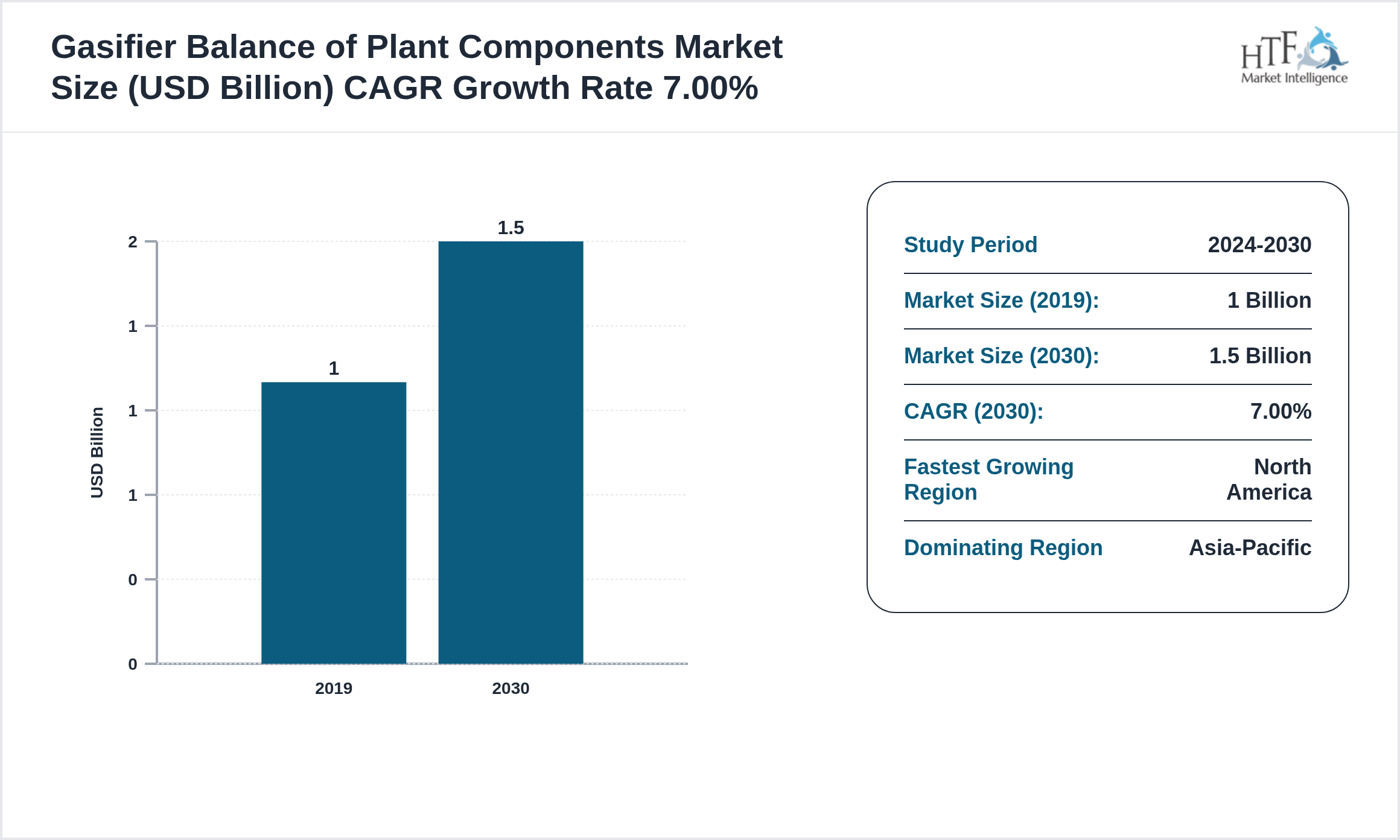

• The Gasifier Balance of Plant Components is growing at a CAGR of 7.00% during the forecasted period of 2019 to 2030

• Year on Year growth for the market is 6.50%

• North America dominated the market share of 1.0 billion % in 2019

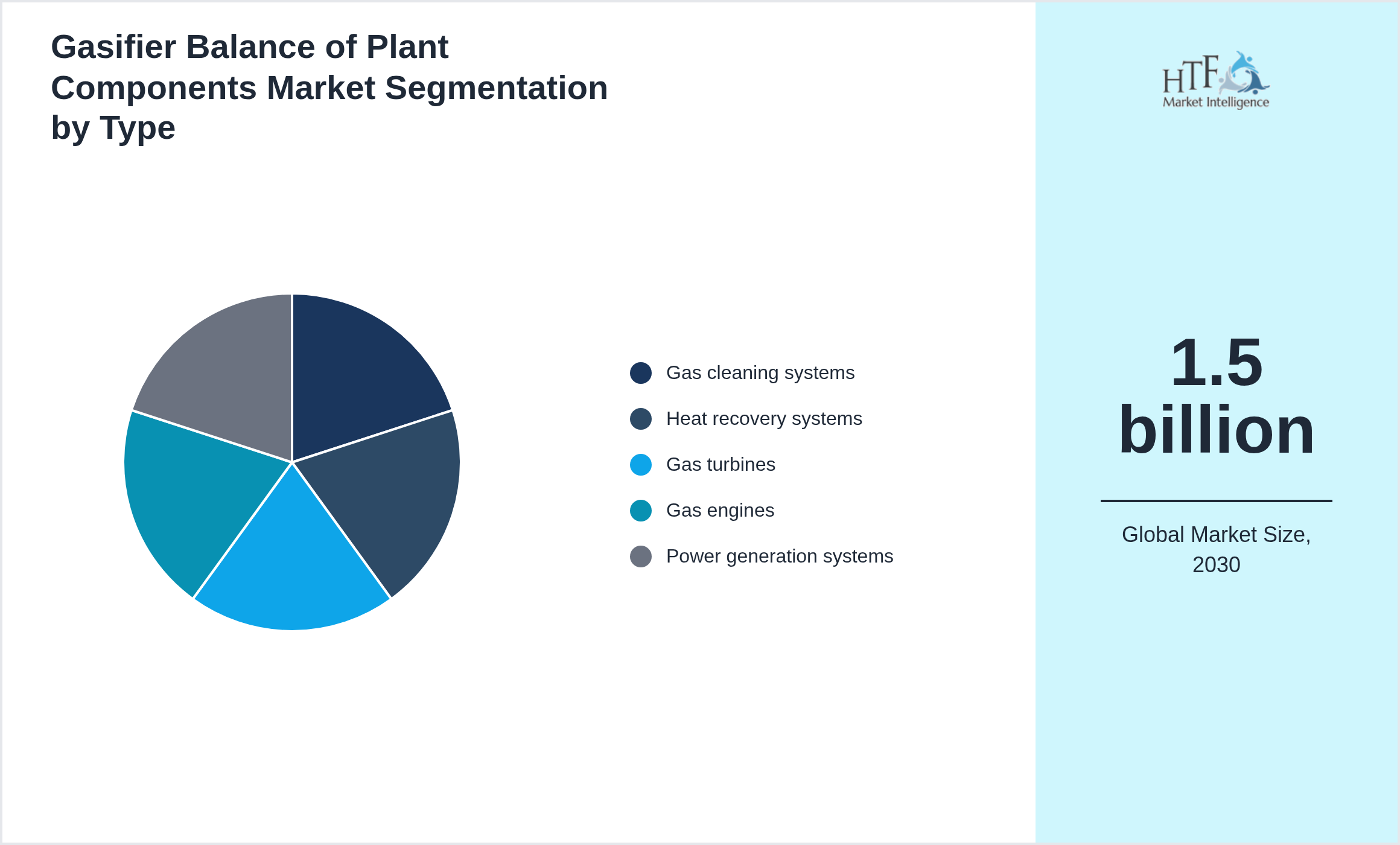

• Based on type, the market is bifurcated into Gas cleaning systems, Heat recovery systems, Gas turbines, Gas engines, Power generation systems segment dominated the market share during the forecasted period

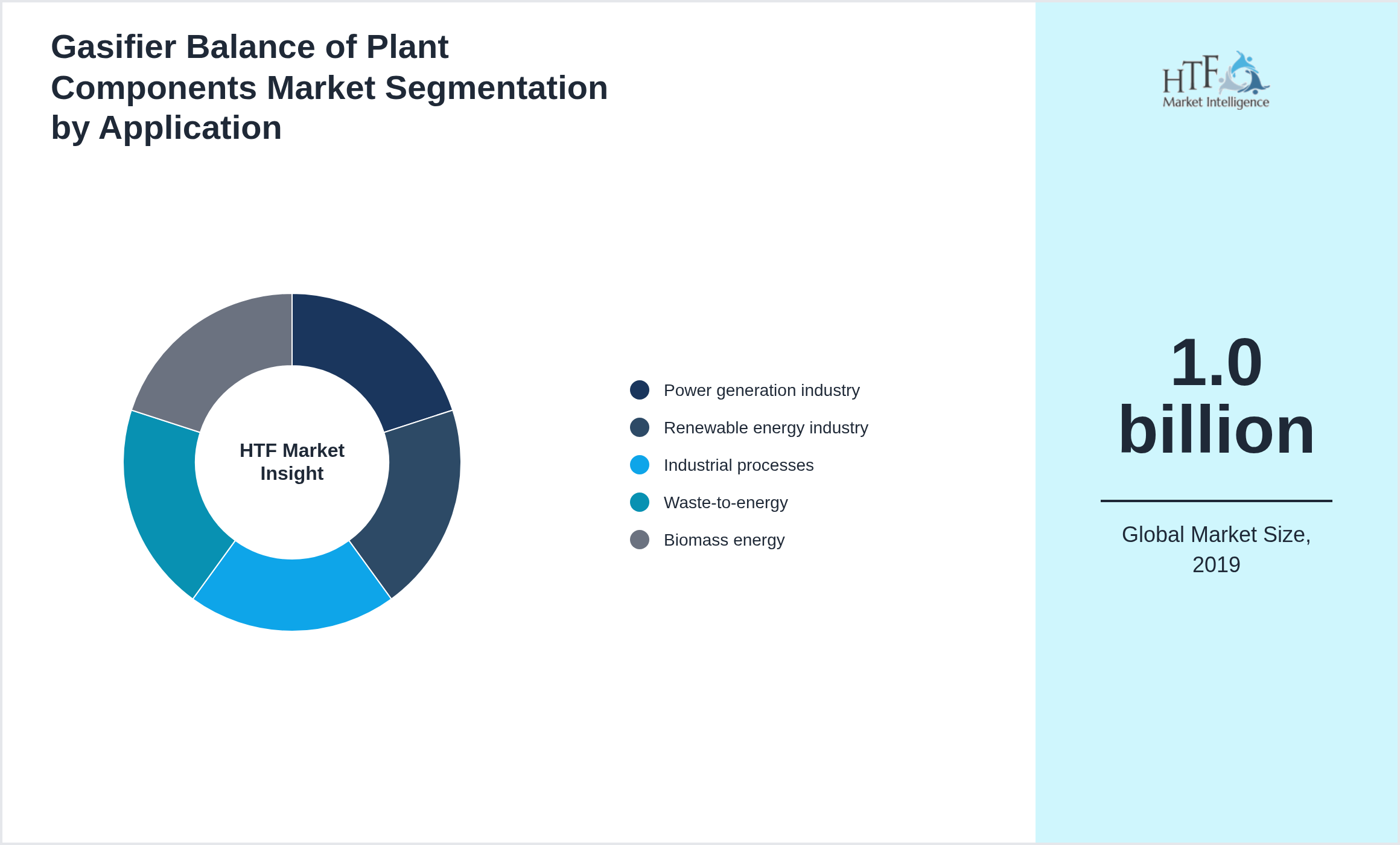

• Based on application the market is segmented into Application Power generation industry, Renewable energy industry, Industrial processes, Waste-to-energy, Biomass energy is the fastest-growing segment

• Global Import Export in terms of K Tons, K Units, and Metric Tons will be provided if Applicable based on industry best practice

Dynamics Overview

The market dynamics are influenced by a complex interplay of factors that drive and shape industry behavior. Key elements include supply and demand dynamics, were shifts in consumer preferences or production capabilities impact pricing and market stability. Competitive forces play a crucial role, with companies adjusting their strategies based on competitor actions, pricing, and innovation. Economic conditions like inflation rates, currency fluctuations, and overall economic growth also affect market performance and consumer purchasing power.

Additionally, technological advancements introduce new products and services, disrupting existing market structures and creating growth opportunities. Regulatory changes and policies can alter market dynamics by influencing operational practices and market entry. Understanding these market dynamics requires continuous monitoring and analysis to anticipate trends, identify opportunities, and develop strategies that align with evolving market conditions. Effective management of these dynamics is essential for maintaining competitive advantage and achieving business success.

Influencing Trend:

- • Higher efficiency

- • Lower emissions

- • Improved reliability

- • Modular design

- • Integration with renewable energy sources

- • Development of advanced BOP technologies

- • Expansion into emerging markets

- • Integration with energy systems

- • Customization options

- • Sustainable materials

- • High initial investment costs

- • Complex engineering and construction

- • Environmental impact

- • Regulatory compliance

- • Development of advanced BOP technologies

- • Expansion into emerging markets

- • Integration with energy systems

- • Customization options

- • Sustainable materials

Import and Export Data

The data is collected, imported, and exported through a comprehensive approach that ensures accuracy and depth. We source information from government databases, which provide official trade statistics and customs data, as well as industry reports and trade journals for detailed market insights. Company filings and financial disclosures also contribute valuable data on import and export activities. To aggregate and normalize this data to maintain consistency and accuracy. To ensure reliability, and cross-verify information across multiple sources and analyze trends to understand market dynamics. The key findings are compiled into detailed reports that offer insights into trade volumes, key markets, and emerging trends, accompanied by actionable recommendations. This thorough process allows to deliver of precise and valuable trade data that supports strategic decision-making for the clients.

Key Players

Several key players in the Gasifier Balance of Plant Components market are strategically focusing on expanding their operations in developing regions to capture a larger market share, particularly as the year-on-year growth rate for the market stands at 6.50%. The companies featured in this profile were selected based on insights from primary experts, evaluating their market penetration, product offerings, and geographical reach. By targeting emerging markets, these companies aim to leverage new opportunities, enhance their competitive advantage, and drive revenue growth. This approach not only aligns with their overall business objectives but also positions them to respond effectively to the evolving demands of consumers in these regions.

Regional Insight

The North America is the fastest-growing region, fuelled by a rapidly increasing population and expanding economic sectors. Factors such as urbanization, improved infrastructure, and government support for industrial development are key drivers. Additionally, the region's young workforce and rising consumer demand are accelerating growth. In contrast, Asia-Pacific remains the dominant region, leading the market with well-established industries, technological advancements, and a strong global foothold.

- North America

- LATAM

- West Europe

- Central & Eastern Europe

- Northern Europe

- Southern Europe

- East Asia

- Southeast Asia

- South Asia

- Central Asia

- Oceania

- MEA

Market Segmentation Overview

• Type segmentation categorizes products by their specific variants, helping businesses identify demand drivers and innovate effectively.

• Application Segmentation: Divides the market based on product usage across industries, enabling targeted marketing and growth identification.

• Geographic Segmentation: Segments the market by location, allowing for tailored strategies based on regional preferences and economic factors.

• Customer Segmentation: Focuses on demographics like age, gender, and income, enabling personalized marketing and improved customer targeting.

• Distribution Channel Segmentation: categorizes by how products reach customers, optimizing supply chain and sales strategies.

Market Segmentation

Segmentation by Type

- • Gas cleaning systems

- • Heat recovery systems

- • Gas turbines

- • Gas engines

- • Power generation systems

Segmentation by Application

- • Power generation industry

- • Renewable energy industry

- • Industrial processes

- • Waste-to-energy

- • Biomass energy

This report also splits the market by players:

{PLAYER_LIST}

{COMPANY_DONUGHT_GRAPH}

Consumer Behavior Analysis

conduct consumer behavior analysis by examining the factors that influence purchasing decisions. The data starts by collecting data from surveys, focus groups, social media, and transactional records to understand consumer preferences and buying patterns. Then segment consumers based on behaviors such as purchase frequency and brand loyalty, allowing us to tailor strategies for different groups.

The psychographic analysis delves into consumers' attitudes, values, and lifestyles to gain deeper insights into their motivations. Also, tracks emerging trends to anticipate shifts in consumer behavior and uses predictive modeling to forecast future preferences. This comprehensive approach enables to provide actionable insights that help businesses better understand their customers, optimize marketing efforts, and enhance product development.

Research Methodology

The research delivers comprehensive market insights that combine both secondary and primary methodologies. The secondary research involves rigorous analysis of existing data sources, such as industry reports, market databases, and competitive landscapes, to provide a robust foundation of market knowledge. This is complemented by our primary research services, where we gather firsthand data through surveys, interviews, and focus groups tailored specifically to your business needs. Integrating these approaches, offers a thorough understanding of market trends, consumer behavior, and competitive dynamics, enabling you to make well-informed strategic decisions.

Market Highlights

Report Features

|

Details

|

Base Year

|

2019

|

Based Year Market Size

|

1.0 billion

|

Historical Period

|

2024

|

CAGR (2019to FORECAST_YEAR})

|

7.00%

|

Forecast Period

|

2030

|

Forecasted Period Market Size (FORECAST_YEAR})

|

1.5 billion

|

Scope of the Report

|

Gas cleaning systems, Heat recovery systems, Gas turbines, Gas engines, Power generation systems, Power generation industry, Renewable energy industry, Industrial processes, Waste-to-energy, Biomass energy, Sales Channel

|

Regions Covered

|

North America, LATAM, West Europe, Central & Eastern Europe, Northern Europe, Southern Europe, East Asia, Southeast Asia, South Asia, Central Asia, Oceania, MEA

|

Companies Covered

|

GE, Siemens, Air Products, DLR, Linde, Mitsubishi Heavy Industries, Thyssenkrupp, Black & Veatch, Bechtel, Babcock & Wilcox

|

Customization Scope

|

15% Free Customization (For EG)

|

Delivery Format

|

PDF and Excel through Email

|

Gasifier Balance of Plant Components - Table of Contents

Chapter 1: Market Preface

Chapter 2: Strategic Overview

Chapter 3: Global Gasifier Balance of Plant Components Market Business Environment & Changing Dynamics

Chapter 4: Global Gasifier Balance of Plant Components Industry Factors Assessment

Chapter 5: Gasifier Balance of Plant Components : Competition Benchmarking & Performance Evaluation

Chapter 6: Global Gasifier Balance of Plant Components Market: Company Profiles

Chapter 7: Global Gasifier Balance of Plant Components by Type & Application (2024-2030)

Chapter 8: North America Gasifier Balance of Plant Components Market Breakdown by Country, Type & Application

Chapter 9: Europe Gasifier Balance of Plant Components Market Breakdown by Country, Type & Application

Chapter 10: Asia Pacific Gasifier Balance of Plant Components Market Breakdown by Country, Type & Application

Chapter 11: Latin America Gasifier Balance of Plant Components Market Breakdown by Country, Type & Application

Chapter 12: Middle East & Africa Gasifier Balance of Plant Components Market Breakdown by Country, Type & Application

Chapter 13: Research Finding and Conclusion

Frequently Asked Questions (FAQ):

The Compact Track Loaders market is projected to grow at a CAGR of 6.8% from 2025 to 2030, driven by increasing demand in construction and agricultural sectors.

North America currently leads the market with approximately 45% market share, followed by Europe at 28% and Asia-Pacific at 22%. The remaining regions account for 5% of the global market.

Key growth drivers include increasing construction activities, rising demand for versatile equipment in agriculture, technological advancements in track loader design, and growing preference for compact equipment in urban construction projects.