Radiator Valves Market Research Report

Radiator Valves Market - Global Growth Opportunities 2019-2030

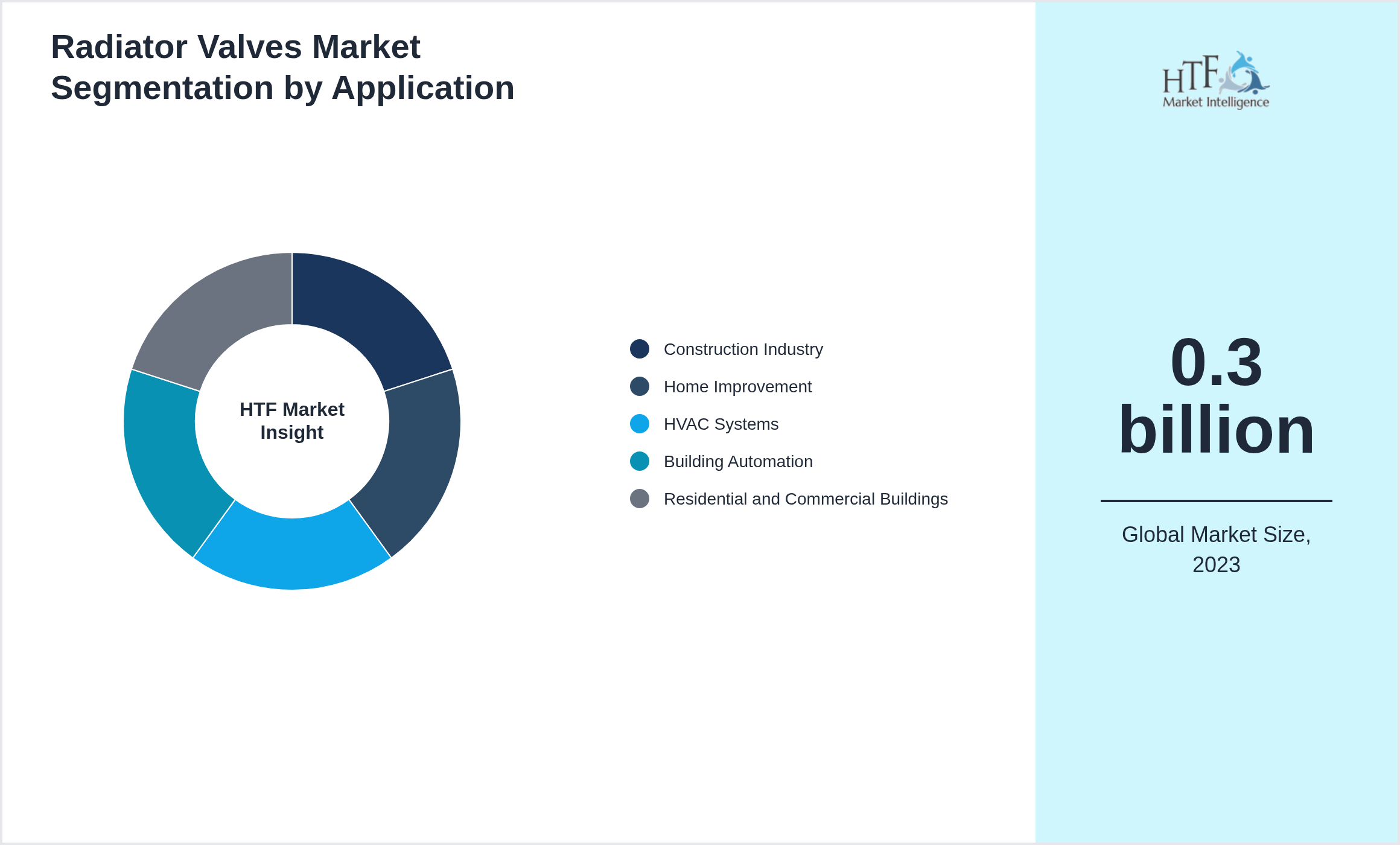

Global Radiator Valves Market is segmented by Application (Construction Industry, Home Improvement, HVAC Systems, Building Automation, Residential and Commercial Buildings), Type (HVAC Components, Plumbing Fixtures, Heating and Cooling, Building Automation, Home Automation), and Geography (North America, LATAM, West Europe, Central & Eastern Europe, Northern Europe, Southern Europe, East Asia, Southeast Asia, South Asia, Central Asia, Oceania, MEA)

Pricing

Industry Overview

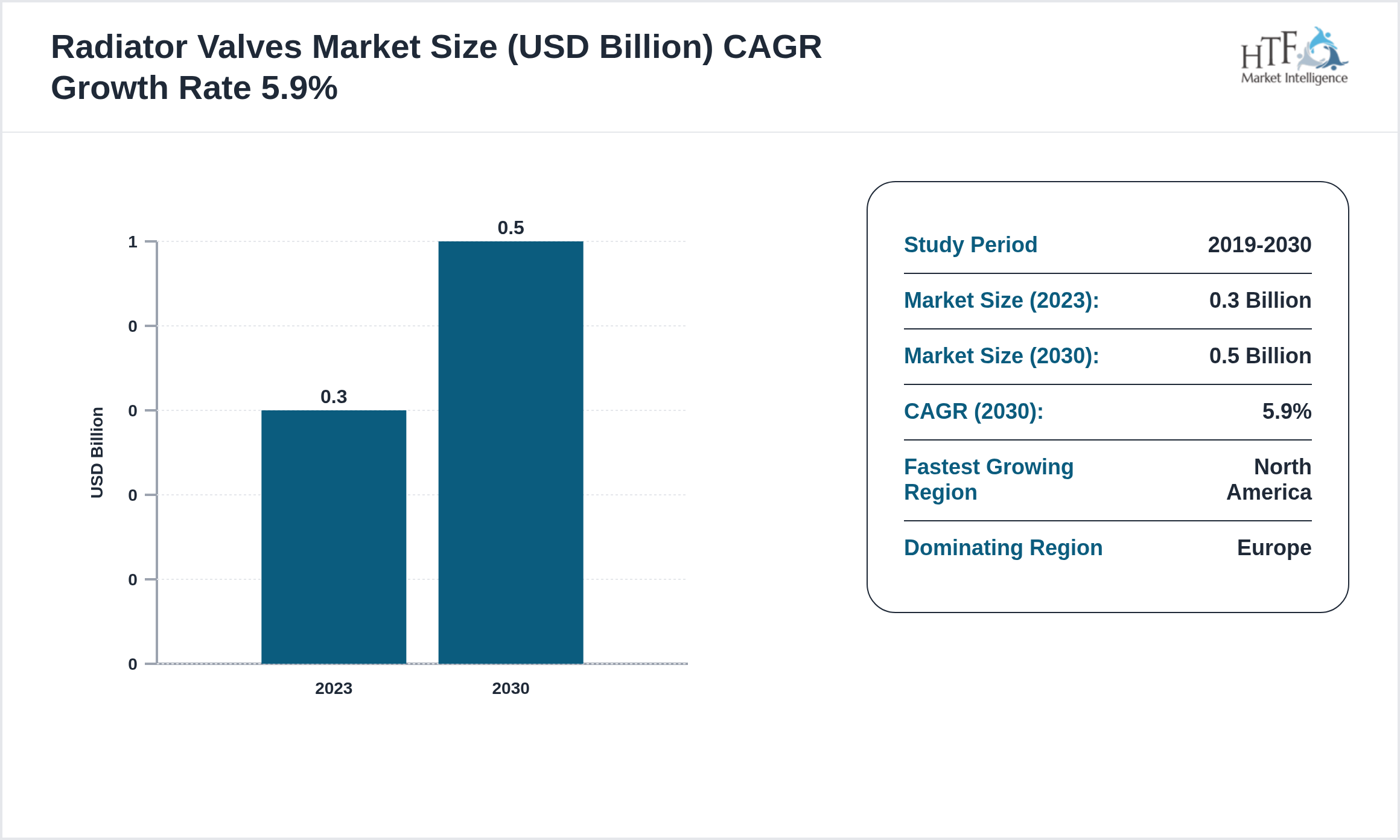

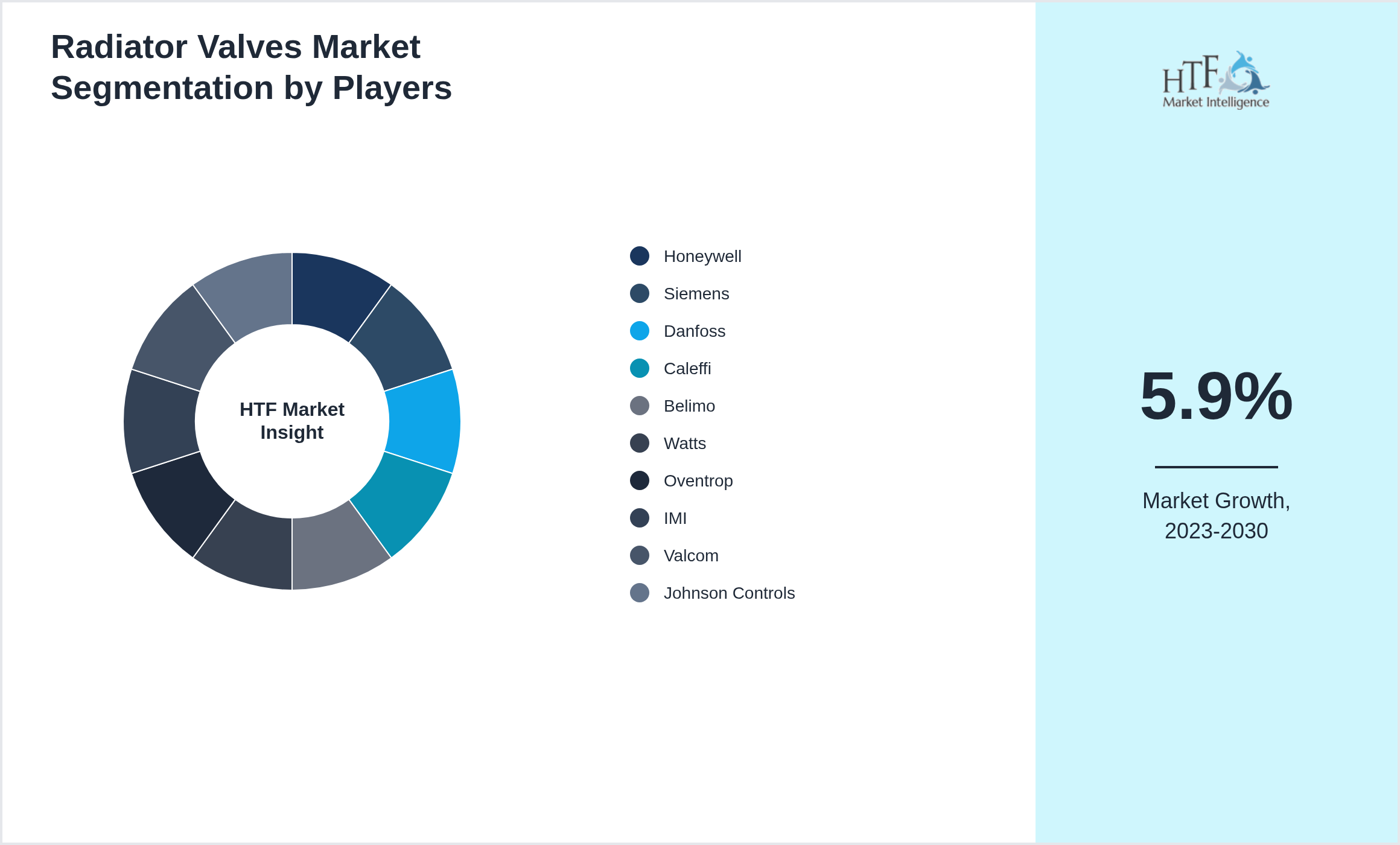

The Radiator Valves is at 0.3 billion in 2023 and is expected to reach 0.5 billion by 2030. The Radiator Valves is driven by factors such as increasing demand in end-use industries, technological advancements, research and development (R&D), economic growth, and increasing global trade. Honeywell, Siemens, Danfoss, Caleffi, Belimo, Watts, Oventrop, IMI, Valcom, Johnson Controls, and others are some of the key players in the market.

Radiator valves control the flow of hot water to radiators in heating systems. They are used in residential_ commercial_ and industrial buildings. The market is driven by the growth of the construction industry_ increasing demand for energy-efficient heating systems_ and advancements in HVAC technology.

Key Players

Several key players in the Radiator Valves market are strategically focusing on expanding their operations in developing regions to capture a larger market share, particularly as the year-on-year growth rate for the market stands at 5.10%. The companies featured in this profile were selected based on insights from primary experts, evaluating their market penetration, product offerings, and geographical reach. By targeting emerging markets, these companies aim to leverage new opportunities, enhance their competitive advantage, and drive revenue growth. This approach not only aligns with their overall business objectives but also positions them to respond effectively to the evolving demands of consumers in these regions.

- • Honeywell

- • Siemens

- • Danfoss

- • Caleffi

- • Belimo

- • Watts

- • Oventrop

- • IMI

- • Valcom

- • Johnson Controls

Market Dynamics

Market Driver

- • Emerging markets

- • Construction industry

- • Home improvement

- • Improved energy efficiency

- • Enhanced control

- • Durability

- • Emerging markets

- • Construction industry

- • Home improvement

- • Supply chain disruptions

- • Material cost volatility

- • Competition from low-cost manufacturers

Key Highlights

- The Radiator Valves is growing at a 5.9% during the forecasted period of 2019 to 2030

- Based on type, the market is bifurcated into HVAC Components, Plumbing Fixtures, Heating and Cooling, Building Automation, Home Automation

- Based on application, the market is segmented into Construction Industry, Home Improvement, HVAC Systems, Building Automation, Residential and Commercial Buildings

- Global Import Export in terms of K Tons, K Units, and Metric Tons will be provided if Applicable based on industry best practice

Market Segmentation Overview

- Type Segmentation: categorizes products by their specific variants, helping businesses identify demand drivers and innovate effectively.

- Application Segmentation: Divides the market based on product usage across industries, enabling targeted marketing and growth identification.

- Geographic Segmentation: Segments the market by location, allowing for tailored strategies based on regional preferences and economic factors.

- Customer Segmentation: Focuses on demographics like age, gender, and income, enabling personalized marketing and improved customer targeting.

- Distribution Channel Segmentation: categorizes by how products reach customers, optimizing supply chain and sales strategies.

Market Segmentation

Segmentation by Type

- • HVAC Components

- • Plumbing Fixtures

- • Heating and Cooling

- • Building Automation

- • Home Automation

Segmentation by Application

- • Construction Industry

- • Home Improvement

- • HVAC Systems

- • Building Automation

- • Residential and Commercial Buildings

This report also splits the market by region:

- North America

- LATAM

- West Europe

- Central & Eastern Europe

- Northern Europe

- Southern Europe

- East Asia

- Southeast Asia

- South Asia

- Central Asia

- Oceania

- MEA

Market Estimation Process

Primary & Secondary Approach

The Radiator Valves is analyzed by both primary and secondary research sources. There are numerous methodologies available to navigate and utilize these resources effectively:

Surveys and Questionnaires: Getting feedback from healthcare professionals, patients, or any other stakeholders on a particular topic. It is a great method to collect quantitative data on behaviors, preferences, and/or experiences.

One on Ones: Interviews with key stakeholders, including physicians, nurses, and administrators can yield rich qualitative data. The interviews can be divided into structured, semi-structured, or unstructured.

Focus Groups: Pull together small numbers of people who share a common characteristic, trait, or behavior to discuss particular topics. Focus Groups: This offers qualitative data and points of view that are often overlooked, such as attitudes, perceptions, or other statements relating to a specific platform.

Observational Studies: Understanding healthcare practices and patient interactions in the way we do it can say a lot more than what people formally report doing.

Field Studies: This method allows researchers to collect data firsthand from healthcare settings, including hospitals, clinics, and even home. It is a way to touch and feel the context that drives service delivery in healthcare.

Secondary Research in Radiator Valves

Secondary research is a kind of revising, restructuring, and rethinking what has already been collected by primary sources. Such research is beneficial as long as it comes at a low cost and gives an overarching view of the market. Some of the important methods include:

Literature Review: To go through the research papers, articles, and studies published in medical journals, industry reports, and academic publications. This is crucial for understanding the study landscape and identifying knowledge deficits.

Reports From the Industry: It aims in examining reports published by Market Research firms, Healthcare Associations, and Government bodies. This report can also be used by all stakeholders including service providers and delivery chains across the world to identify market opportunities in an undetermined depth.

Public Health Records: Data collected by governments and public health authorities in different countries of the world from organizations with global reach like CDC, WHO, or national departments. These are important because they provide us with epidemiological data and numbers.

Company Reports: Read the annual reports, financial statements, and press releases of healthcare companies. It includes company performance reports, market strategies, and competitive positioning for this domain.

Online Databases: You understand the access to databases like PubMed, MEDLINE, and even Google Scholar for scientific articles and study materials. Some of these databases are treasure troves for peer-reviewed data.

Media Sources: Analyzing news articles, press releases, and media coverage related to the healthcare industry. This helps in staying updated on recent developments and emerging trends.

A blended approach of primary and secondary research methods allows researchers to collect well-rounded, solid data that informs the best decisions and strategies.

Research Methodology

At HTF Market Intelligence, we pride ourselves on delivering comprehensive market research that combines both secondary and primary methodologies. Our secondary research involves rigorous analysis of existing data sources, such as industry reports, market databases, and competitive landscapes, to provide a robust foundation of market knowledge. This is complemented by our primary research services, where we gather firsthand data through surveys, interviews, and focus groups tailored specifically to your business needs. By integrating these approaches, we offer a thorough understanding of market trends, consumer behavior, and competitive dynamics, enabling you to make well-informed strategic decisions. We would welcome the opportunity to discuss how our research expertise can support your business objectives.

Report Infographics:

| Report Features | Details |

| Base Year | 2023 |

| Based Year Market Size (2023) | 0.3 billion |

| Historical Period Market Size (2019) | USD Million ZZ |

| CAGR (2023 to 2030) | 5.9% |

| Forecast Period | 2025 to 2030 |

| Forecasted Period Market Size (2030) | 0.5 billion |

| Scope of the Report | HVAC Components, Plumbing Fixtures, Heating and Cooling, Building Automation, Home Automation, Construction Industry, Home Improvement, HVAC Systems, Building Automation, Residential and Commercial Buildings |

| Regions Covered | North America, LATAM, West Europe, Central & Eastern Europe, Northern Europe, Southern Europe, East Asia, Southeast Asia, South Asia, Central Asia, Oceania, MEA |

| Year on Year Growth | 5.10% |

| Companies Covered | Honeywell, Siemens, Danfoss, Caleffi, Belimo, Watts, Oventrop, IMI, Valcom, Johnson Controls |

| Customization Scope | 15% Free Customization (For EG) |

| Delivery Format | PDF and Excel through Email |

Radiator Valves - Table of Contents

Chapter 1: Market Preface

Chapter 2: Strategic Overview

Chapter 3: Global Radiator Valves Market Business Environment & Changing Dynamics

Chapter 4: Global Radiator Valves Industry Factors Assessment

Chapter 5: Radiator Valves : Competition Benchmarking & Performance Evaluation

Chapter 6: Global Radiator Valves Market: Company Profiles

Chapter 7: Global Radiator Valves by Type & Application (2019-2030)

Chapter 8: North America Radiator Valves Market Breakdown by Country, Type & Application

Chapter 9: Europe Radiator Valves Market Breakdown by Country, Type & Application

Chapter 10: Asia Pacific Radiator Valves Market Breakdown by Country, Type & Application

Chapter 11: Latin America Radiator Valves Market Breakdown by Country, Type & Application

Chapter 12: Middle East & Africa Radiator Valves Market Breakdown by Country, Type & Application

Chapter 13: Research Finding and Conclusion

Frequently Asked Questions (FAQ):

The Compact Track Loaders market is projected to grow at a CAGR of 6.8% from 2025 to 2030, driven by increasing demand in construction and agricultural sectors.

North America currently leads the market with approximately 45% market share, followed by Europe at 28% and Asia-Pacific at 22%. The remaining regions account for 5% of the global market.

Key growth drivers include increasing construction activities, rising demand for versatile equipment in agriculture, technological advancements in track loader design, and growing preference for compact equipment in urban construction projects.