Work Clothing Market Research Report

Work Clothing Market - Global Industry Size & Growth Analysis 2019-2030

Global Work Clothing Market is segmented by Application (Construction, Manufacturing, Healthcare, Hospitality, Retail), Type (Safety Gear, Uniforms, Protective Clothing, Corporate Workwear, Seasonal Workwear), and Geography (North America, LATAM, West Europe, Central & Eastern Europe, Northern Europe, Southern Europe, East Asia, Southeast Asia, South Asia, Central Asia, Oceania, MEA)

Pricing

Industry Overview

Global Work Clothing Market Size, Forecast, Segment Analysis, By Type Safety Gear, Uniforms, Protective Clothing, Corporate Workwear, Seasonal Workwear By Application Construction, Manufacturing, Healthcare, Hospitality, Retail, By Region North America, LATAM, West Europe, Central & Eastern Europe, Northern Europe, Southern Europe, East Asia, Southeast Asia, South Asia, Central Asia, Oceania, MEA (2023 to 2030)

The work clothing market includes garments and protective wear designed for workers in various industries. These garments are engineered to provide comfort, safety, and durability for employees exposed to hazardous conditions. The market is growing due to increasing safety standards, the expansion of industrial sectors, and the rising awareness of employee welfare. The demand for high-performance, comfortable, and functional clothing is particularly strong in sectors like construction, healthcare, and manufacturing.

The research study Work Clothing Market provides readers with details on strategic planning and tactical business decisions that influence and stabilize growth prognosis in Work Clothing Market. A few disruptive trends, however, will have opposing and strong influences on the development of the Global Biometric Lockers market and the distribution across players. To provide further guidance on why specific trends in Work Clothing market would have a high impact and precisely why these trends can be factored into the market trajectory and the strategic planning of industry players.

Market Dynamics Highlighted

Market Driver

The Work Clothing Market is experiencing significant growth due to various factors.

- • Opportunities in eco-friendly workwear

- • Expansion in emerging markets

Market Trend

The Work Clothing market is growing rapidly due to various factors.

- • Demand for breathable fabrics

- • Smart workwear integration

Opportunity

The Work Clothing has several opportunities, particularly in developing countries where industrialization is growing.

Challenge

The market for fluid power systems faces several obstacles despite its promising growth possibilities.

Work Clothing Market Segment Highlighted

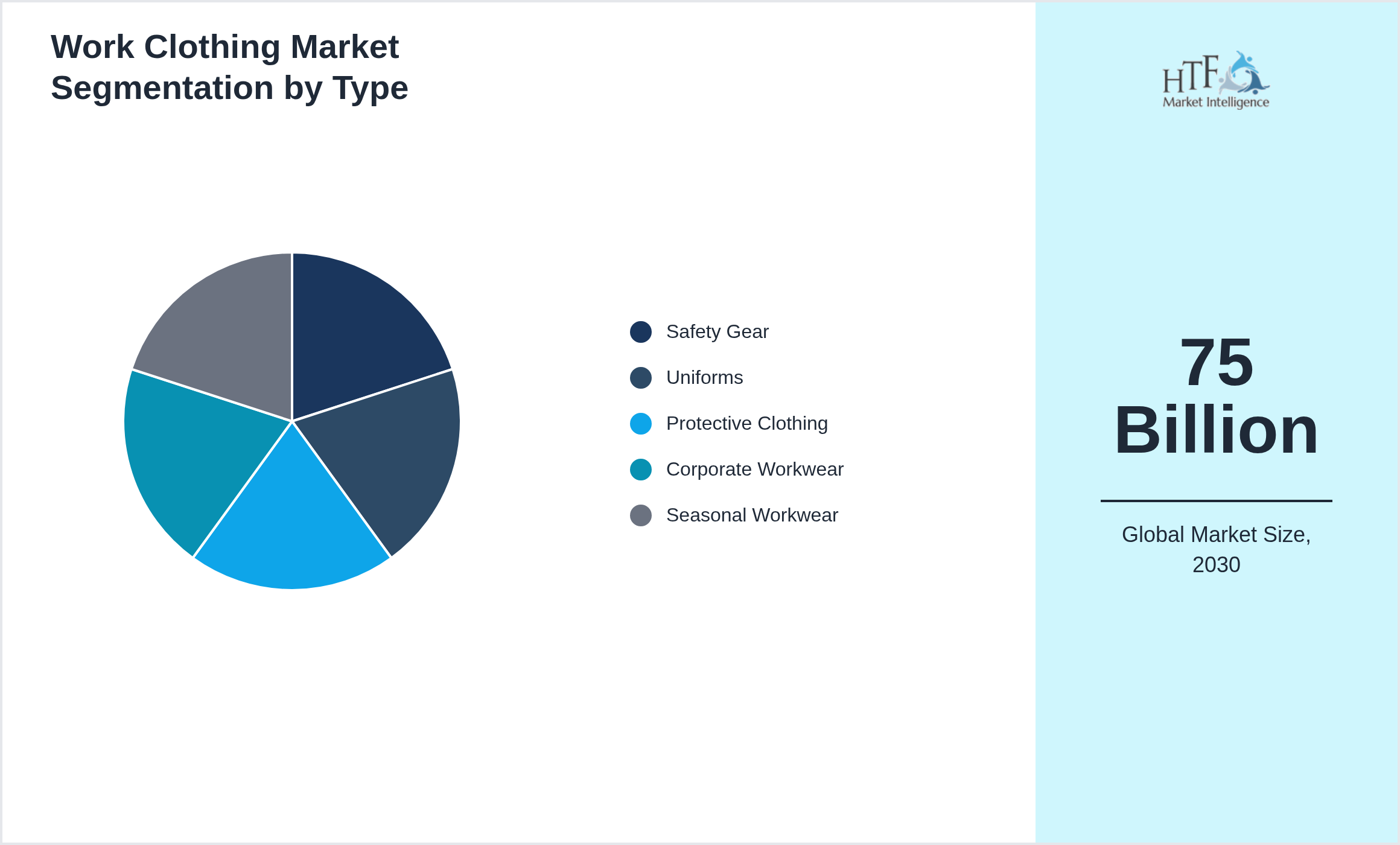

Segmentation by Type

- • Safety Gear

- • Uniforms

- • Protective Clothing

- • Corporate Workwear

- • Seasonal Workwear

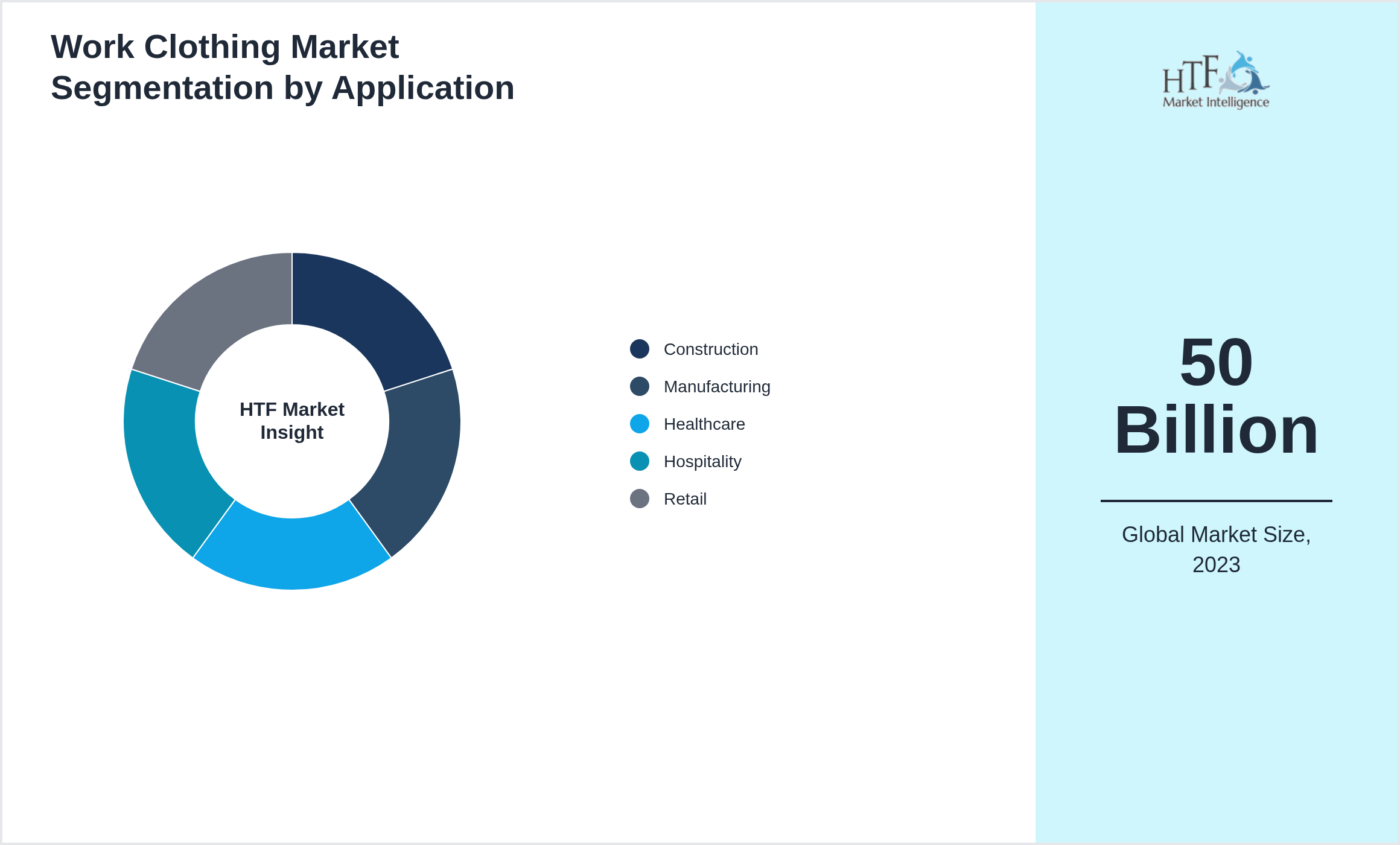

Segmentation by Application

- • Construction

- • Manufacturing

- • Healthcare

- • Hospitality

- • Retail

Key Players

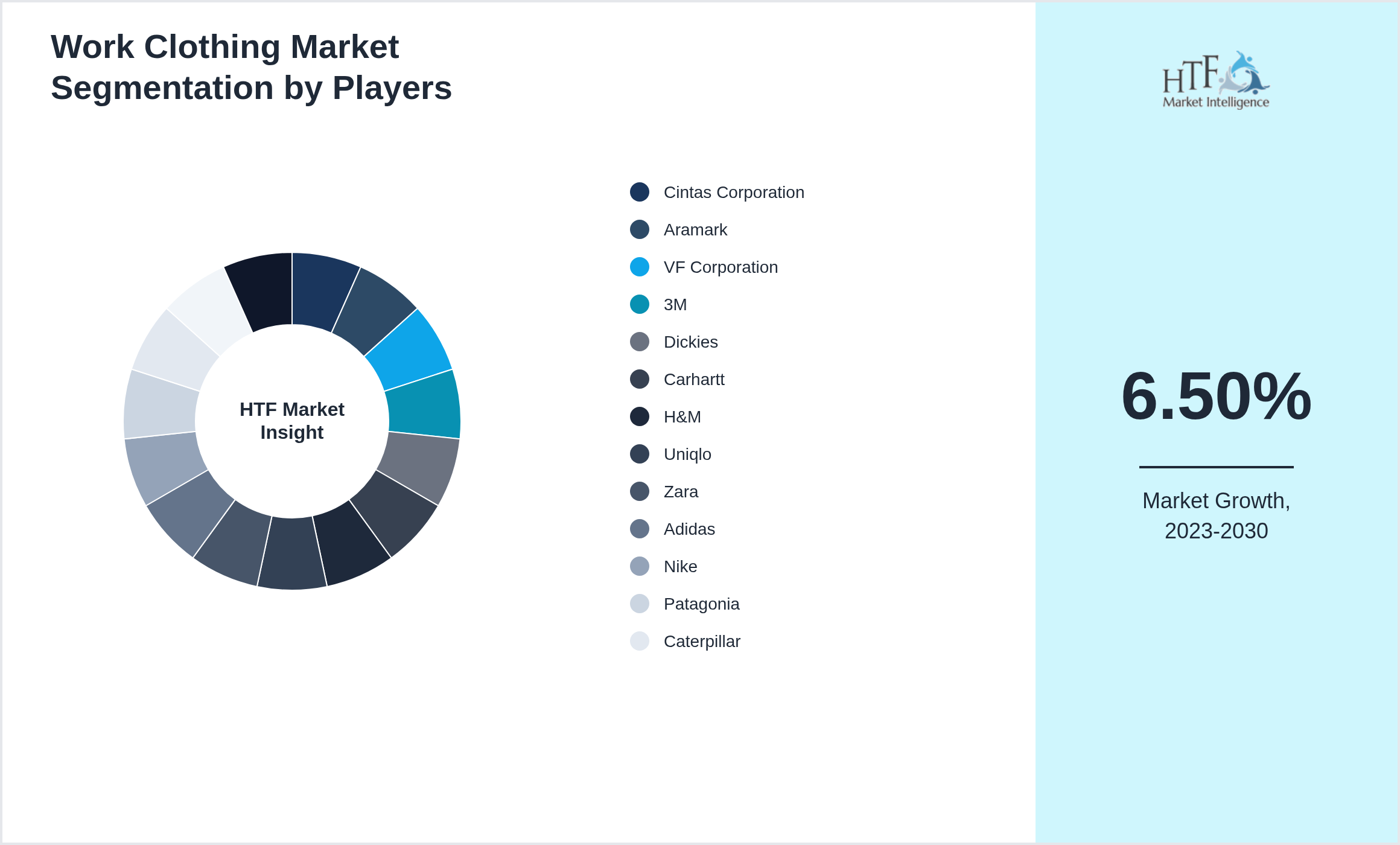

Several key players in the Work Clothing market is strategically focusing on expanding their operations in developing regions to capture a larger market share, particularly as the year-on-year growth rate for the market stands at 5%. The companies featured in this profile were selected based on insights from primary experts, evaluating their market penetration, product offerings, and geographical reach. By targeting emerging markets, these companies aim to leverage new opportunities, enhance their competitive advantage, and drive revenue growth. This approach not only aligns with their overall business objectives but also positions them to respond effectively to the evolving demands of consumers in these regions.

- • Cintas Corporation

- • Aramark

- • VF Corporation

- • 3M

- • Dickies

- • Carhartt

- • H&M

- • Uniqlo

- • Zara

- • Adidas

- • Nike

- • Patagonia

- • Caterpillar

- • Columbia Sportswear

- • Workwear Group

For the complete companies list, please ask for sample pages.

Merger & Acquisition

Key Highlights

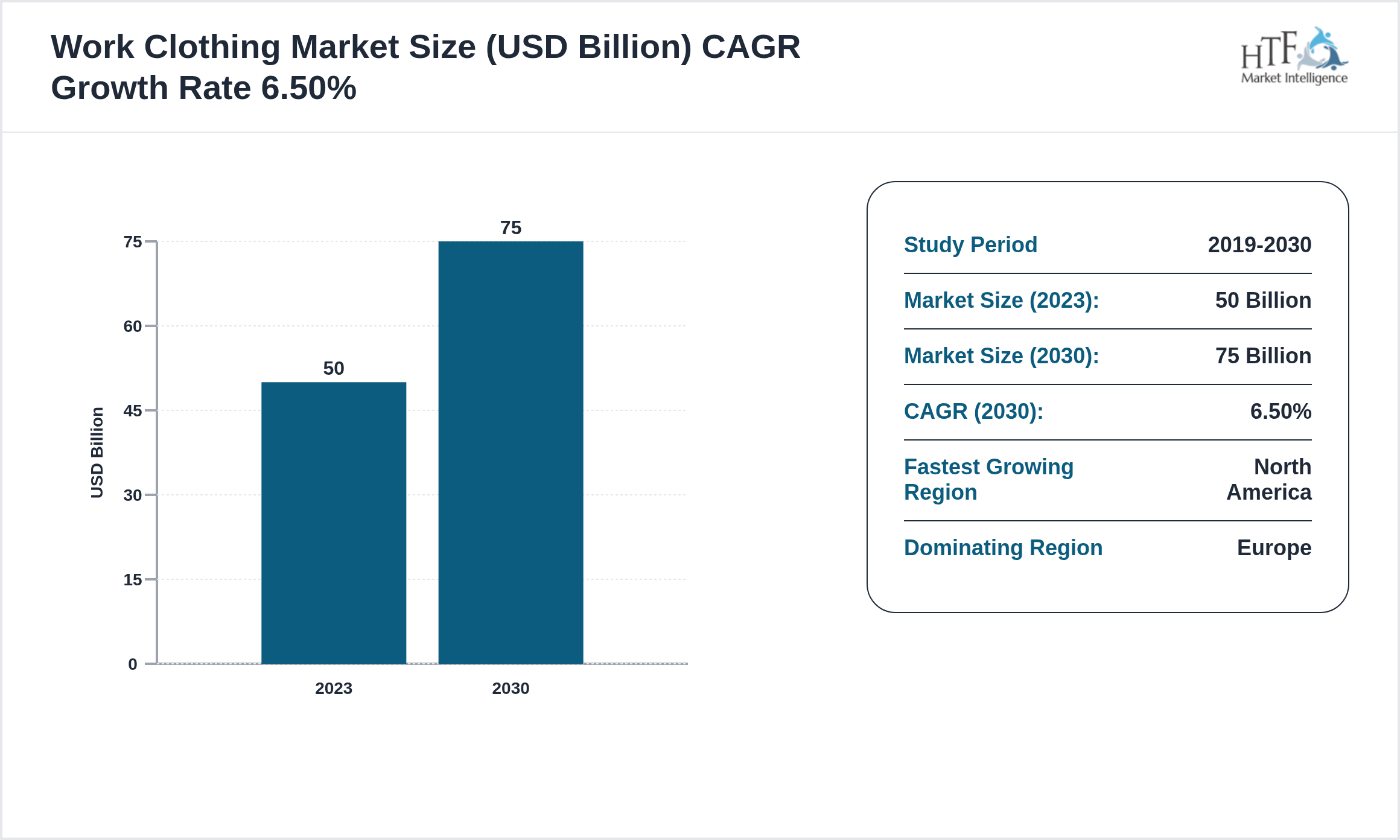

• The Work Clothing is growing at a CAGR of 6.50% during the forecasted period of 2023 to 2030

• Year on Year growth for the market is 5%

• North America dominated the market share of 50 Billion in 2023

• Based on type, the market is bifurcated into Safety Gear, Uniforms, Protective Clothing, Corporate Workwear, Seasonal Workwear segment, which dominated the market share during the forecasted period

• Based on application, the market is segmented into Application Construction, Manufacturing, Healthcare, Hospitality, Retail is the fastest-growing segment

• Global Import Export in terms of K Tons, K Units, and Metric Tons will be provided if Applicable based on industry best practice

Market Estimation & Data Collection Process

Problem Definition: Clarify research objectives and client needs & identify key questions and market scope.

Data Collection:

Primary Research: Conduct interviews, surveys, and focus groups.

Secondary Research: Analyzed industry reports, market publications, and financial records.

Data Analysis:

Quantitative Analysis: Use statistical tools to identify trends and quantify market size.

Qualitative Analysis: Interpret non-numerical data to understand market drivers and consumer behavior.

Market Segmentation:

Divide the market into distinct segments based on shared characteristics.

Validation and Triangulation:

Cross-verify findings from multiple sources to ensure accuracy and reliability.

Reporting and Recommendations:

Present insights and strategic recommendations in a tailored, actionable report.

Continuous Feedback Loop:

Engage with clients to refine research and ensure alignment with their goals.

Regional Insight

The Work Clothing varies widely by region, reflecting diverse economic conditions and consumer preferences. In North America, the focus is on convenience and premium products, driven by high disposable incomes and a strong e-commerce sector. Europe’s market is fragmented, with Western countries emphasizing luxury and organic goods, while Eastern Europe sees rapid growth. Asia-Pacific is a fast-growing region with high demand for high-tech and affordable products, driven by urbanization and rising middle-class incomes. Latin America prioritizes affordability amidst economic fluctuations, with Brazil and Mexico leading in market growth. In the Middle East and Africa, market trends are influenced by cultural preferences, with luxury goods prominent in the Gulf States and gradual growth in sub-Saharan Africa. Global trends like sustainability and digital transformation are impacting all regions.

The Europe dominant region currently dominates the market share, fueled by increasing consumption, population growth, and sustained economic progress which collectively enhance market demand. Conversely, the North America is growing rapidly, driven by significant infrastructure investments, industrial expansion, and rising consumer demand.

- North America

- LATAM

- West Europe

- Central & Eastern Europe

- Northern Europe

- Southern Europe

- East Asia

- Southeast Asia

- South Asia

- Central Asia

- Oceania

- MEA

The Top-Down and Bottom-Up Approaches

The top-down approach begins with a broad theory or hypothesis and breaks it down into specific components for testing. This structured, deductive process involves developing a theory, creating hypotheses, collecting and analyzing data, and drawing conclusions. It is particularly useful when there is substantial theoretical knowledge, but it can be rigid and may overlook new phenomena.

Conversely, the bottom-up approach starts with specific data or observations, from which broader generalizations and theories are developed. This inductive process involves collecting detailed data, analyzing it for patterns, developing hypotheses, formulating theories, and validating them with additional data. While this approach is flexible and encourages the discovery of new phenomena, it can be time-consuming and less structured.

Regulatory Framework

The healthcare sector is overseen by various regulatory bodies that ensure the safety, quality, and efficacy of health services and products. In the United States, the U.S. Department of Health and Human Services (HHS) plays a crucial role in protecting public health and providing essential human services. Within HHS, the Food and Drug Administration (FDA) regulates food, drugs, and medical devices, ensuring they meet safety and efficacy standards. The Centers for Disease Control and Prevention (CDC) focus on disease control and prevention, conducting research, and providing health information to protect public health.

In the United Kingdom, the General Medical Council (GMC) regulates doctors, ensuring they adhere to professional standards. Other important bodies include the General Pharmaceutical Council (GPhC), which oversees pharmacists, and the Nursing and Midwifery Council (NMC), which regulates nurses and midwives. These organizations work to maintain high standards of care and protect patients.

Internationally, the European Medicines Agency (EMA) regulates medicines within the European Union, while the World Health Organization (WHO) provides global leadership on public health issues. Each of these regulatory bodies plays a vital role in ensuring that health care systems operate effectively and safely, ultimately safeguarding public health across different regions.

Report Infographics

| Report Features | Details |

| Base Year | 2023 |

| Based Year Market Size (2023) | 50 Billion |

| Historical Period | 2019 to 2023 |

| CAGR (2023 to 2030) | 6.50% |

| Forecast Period | 2025 to 2030 |

| Forecasted Period Market Size ( 2030) | 75 Billion |

| Scope of the Report | Safety Gear, Uniforms, Protective Clothing, Corporate Workwear, Seasonal Workwear, Construction, Manufacturing, Healthcare, Hospitality, Retail |

| Regions Covered | North America, LATAM, West Europe, Central & Eastern Europe, Northern Europe, Southern Europe, East Asia, Southeast Asia, South Asia, Central Asia, Oceania, MEA |

| Companies Covered | Cintas Corporation, Aramark, VF Corporation, 3M, Dickies, Carhartt, H&M, Uniqlo, Zara, Adidas, Nike, Patagonia, Caterpillar, Columbia Sportswear, Workwear Group |

| Customization Scope | 15% Free Customization |

| Delivery Format | PDF and Excel through Email |

Work Clothing - Table of Contents

Chapter 1: Market Preface

Chapter 2: Strategic Overview

Chapter 3: Global Work Clothing Market Business Environment & Changing Dynamics

Chapter 4: Global Work Clothing Industry Factors Assessment

Chapter 5: Work Clothing : Competition Benchmarking & Performance Evaluation

Chapter 6: Global Work Clothing Market: Company Profiles

Chapter 7: Global Work Clothing by Type & Application (2019-2030)

Chapter 8: North America Work Clothing Market Breakdown by Country, Type & Application

Chapter 9: Europe Work Clothing Market Breakdown by Country, Type & Application

Chapter 10: Asia Pacific Work Clothing Market Breakdown by Country, Type & Application

Chapter 11: Latin America Work Clothing Market Breakdown by Country, Type & Application

Chapter 12: Middle East & Africa Work Clothing Market Breakdown by Country, Type & Application

Chapter 13: Research Finding and Conclusion

Frequently Asked Questions (FAQ):

The Compact Track Loaders market is expected to see value worth 5.3 Billion in 2025.

North America currently leads the market with approximately 45% market share, followed by Europe at 28% and Asia-Pacific at 22%. The remaining regions account for 5% of the global market.

Key growth drivers include increasing construction activities, rising demand for versatile equipment in agriculture, technological advancements in track loader design, and growing preference for compact equipment in urban construction projects.