Hydraulic Fracturing Market Research Report

Hydraulic Fracturing Market Size, Share Growth & Forecast

Global Hydraulic Fracturing Market is segmented by Application (Oil & Gas, Energy, Mining), Type (Horizontal, Vertical, Shale, Conventional, Unconventional), and Geography (North America, LATAM, West Europe, Central & Eastern Europe, Northern Europe, Southern Europe, East Asia, Southeast Asia, South Asia, Central Asia, Oceania, MEA)

Pricing

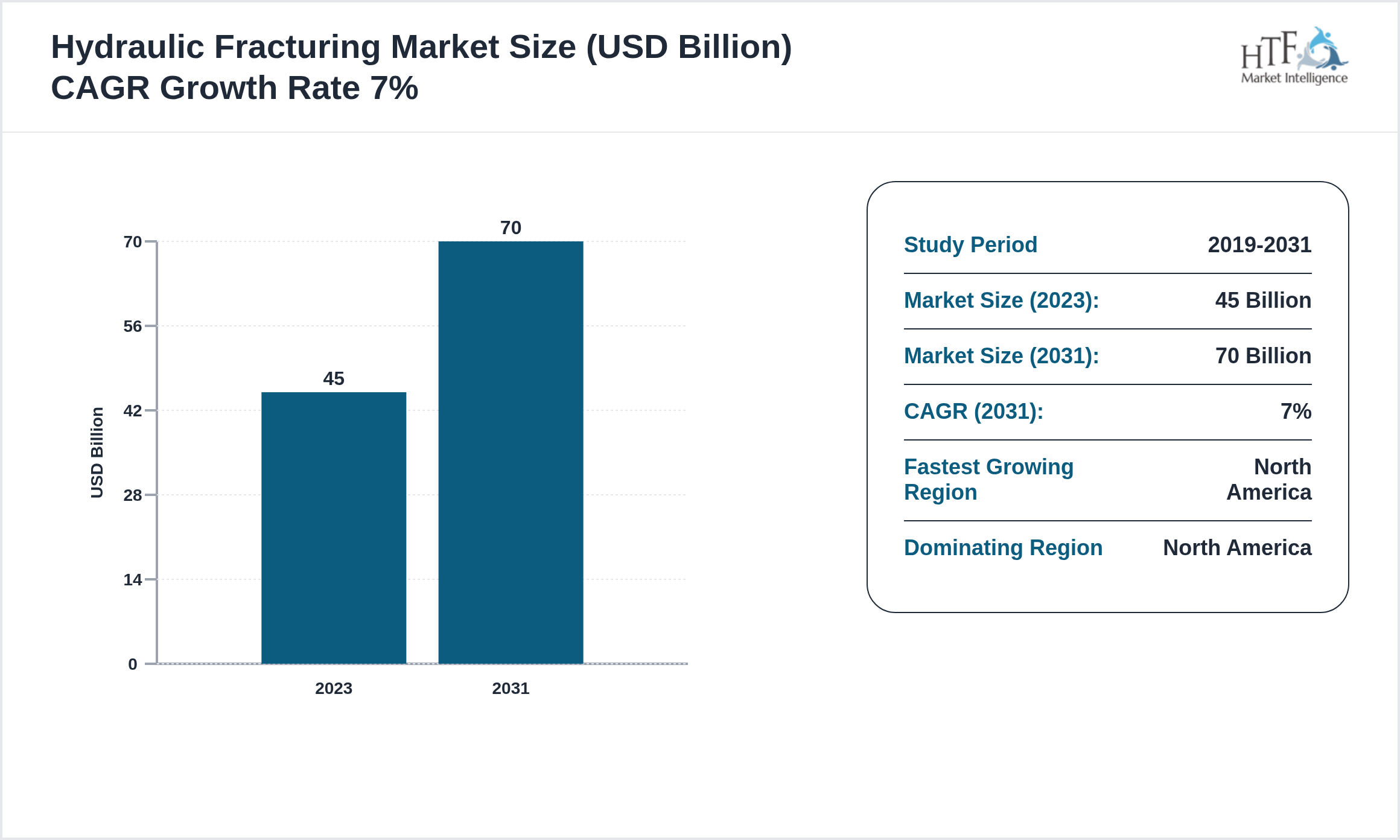

The Hydraulic Fracturing is growing at 7% and is expected to reach 70Billion by 2031. Below are some of the dynamics shaping the Hydraulic Fracturing.

Hydraulic fracturing is used to maximizing well and field value. It is versatile, customized system which meets the requirement of the deep water, extended-reach unconventional completion. It fulfil unique deepwater requirements. Hydraulic fracturing also named as ‘fraccing’ or ‘fracking’. It is a technique which stimulate a reservoir after drilling of any well to enhance the production of oil and gas from that particular reservoir. Hydraulic fracturing, is a form of well stimulation which is a part of completing the well. It is a process of making the well which is ready for the production in oil and gas industry. It consider the drilling and installation of casing procedure in the well, holes are created along selected intervals of the well with the help of small explosive charges to perforate the casing.

Key Highlights

· The Hydraulic Fracturing is growing at a CAGR of 7% during the forecasted period of 2019 to 2031

· Year on Year growth for the market is {YOY_GROWTH}

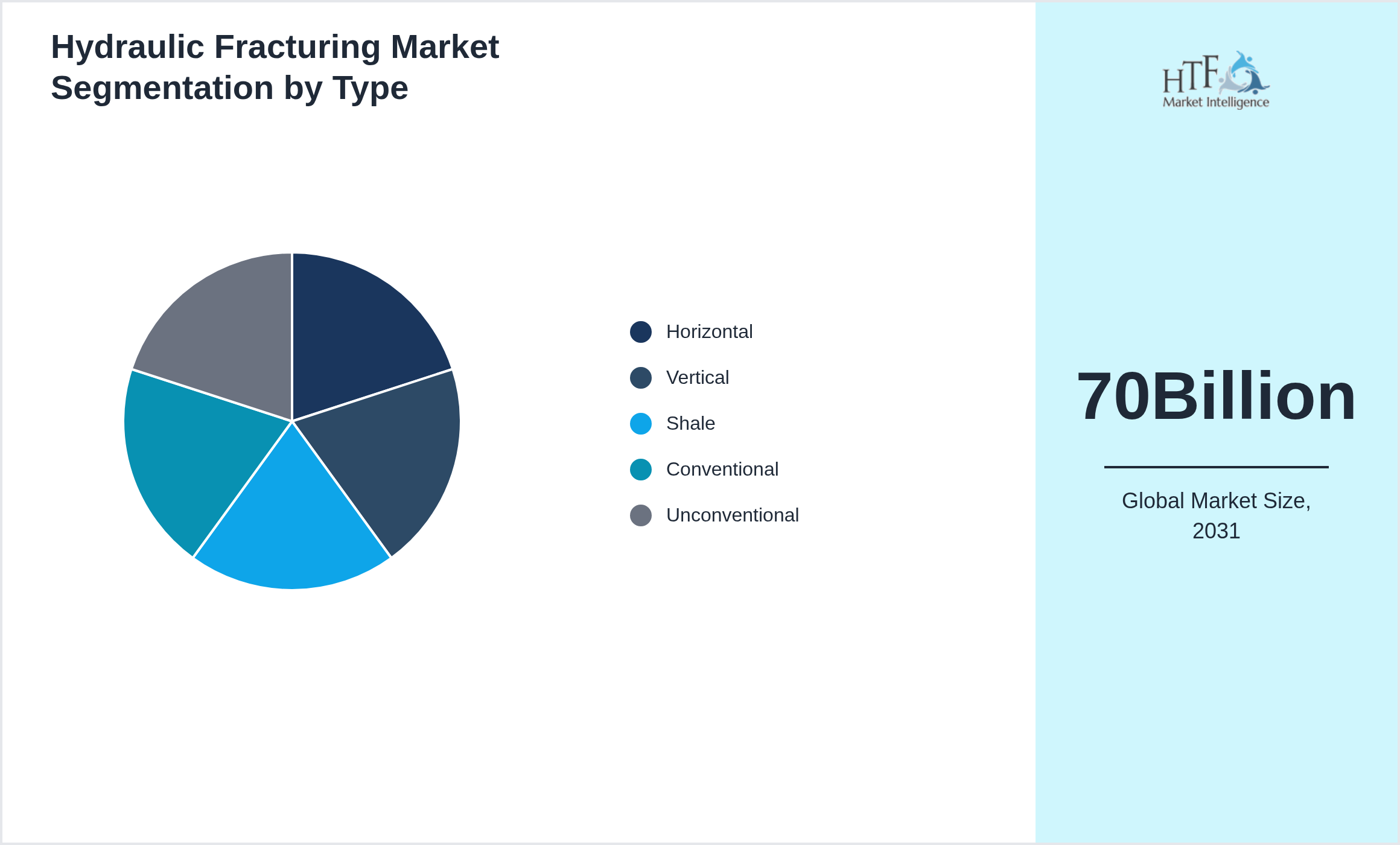

· Based on type, the market is bifurcated into Horizontal, Vertical, Shale, Conventional, Unconventionalsegment dominated the market share during the forecasted period

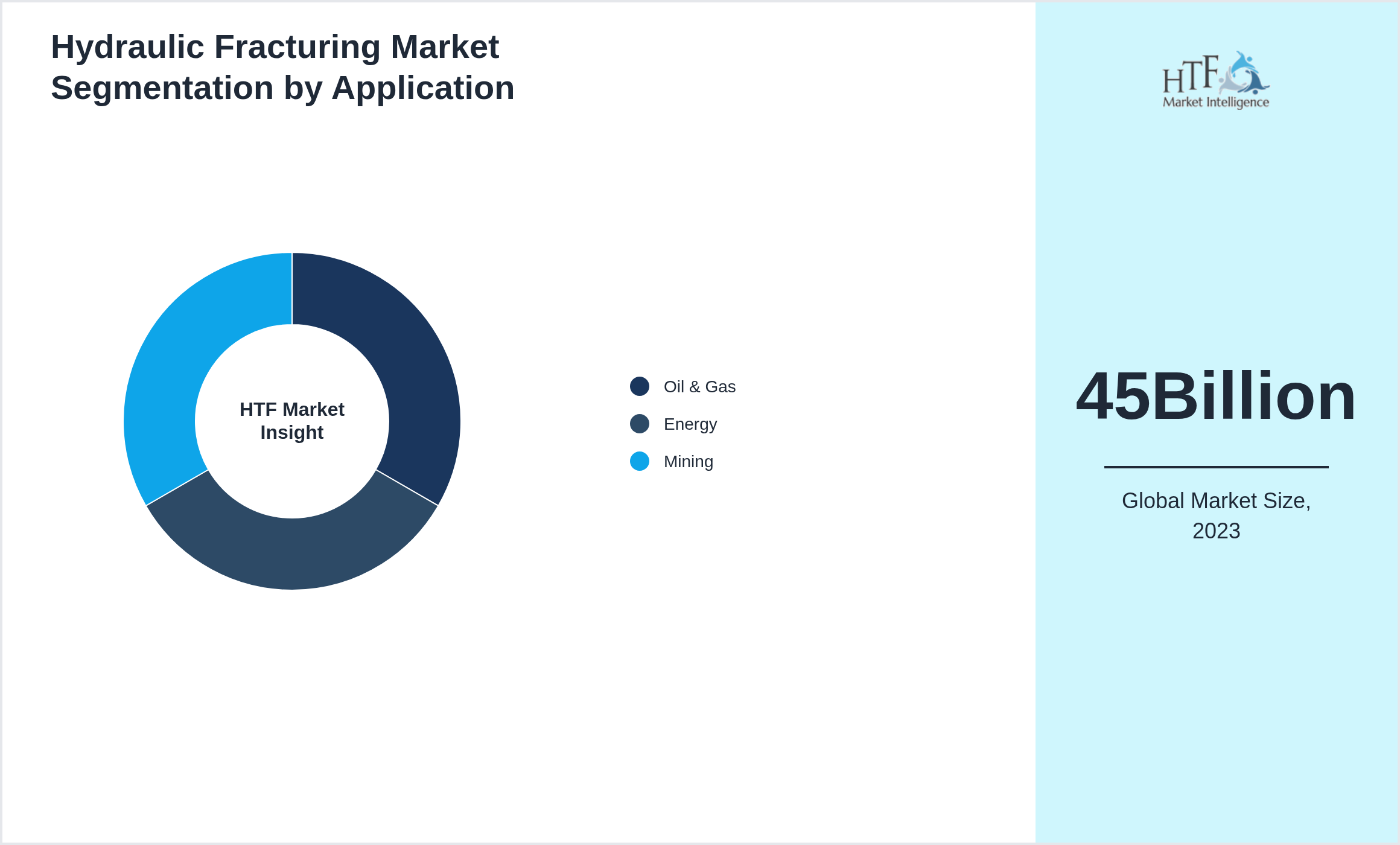

· Based on application, the market is segmented into Oil & Gas, Energy, Mining

· North America, LATAM, West Europe, Central & Eastern Europe, Northern Europe, Southern Europe, East Asia, Southeast Asia, South Asia, Central Asia, Oceania, MEA Import Export in terms of K Tons, K Units, and Metric Tons will be provided if Applicable based on industry best practice

The Hydraulic Fracturing industry study provides important insights in several important ways. To help stakeholders quickly understand key information, it starts with an executive summary that briefly summarizes the results, conclusions, and practical suggestions. The purpose and questions being addressed are guaranteed to be understood when the study objectives are clearly stated. To build credibility, the methodology section explains the research techniques used, such as surveys and focus groups, and why they were chosen. The Hydraulic Fracturing industry landscape, including market size, growth trends, and major drivers, is presented in a market overview.

The segmentation research also examines different market categories to determine client wants. The competitive analysis highlights the advantages and disadvantages of the main rivals. Key facts and insights are presented at the end of the study, followed by conclusions and suggestions that offer doable tactics to direct future company choices.

Schedule a personalized consultation with our industry analysts

Regional Coverage

The North America leads the market share, largely due to rising consumption, a growing population, and strong economic momentum that boosts demand. In contrast, the North America is emerging as the fastest-growing area, driven by rapid infrastructure development, the expansion of industrial sectors, and heightened consumer demand, making it a critical factor for future market growth. The regions covered in our report are

This report also splits the market by region:

- North America

- LATAM

- West Europe

- Central & Eastern Europe

- Northern Europe

- Southern Europe

- East Asia

- Southeast Asia

- South Asia

- Central Asia

- Oceania

- MEA

Hydraulic Fracturing Dynamics

GROWTH DRIVERS: The Hydraulic Fracturing is propelled by several key drivers, including the demand from diverse industrial sectors such as automotive, construction, and pharmaceuticals. Technological advancements and continuous innovation in chemical processes enhance efficiency and open new market opportunities. Economic growth, particularly in emerging markets, along with rapid urbanization and population growth, increases the need for chemicals in infrastructure and consumer goods. Additionally, stricter environmental regulations and the push for sustainable products drive the development of green chemicals. Global trade, raw material availability, and investments in research and development further shape the industry's growth, while supportive government policies and evolving consumer trends also play crucial roles.

- • The Growth of the Water Treatment Market Is Closely Linked To the Growth of Operators’ Recycling Efforts

- • Environmental concerns

- • The Growth of the Water Treatment Market Is Closely Linked To the Growth of Operators’ Recycling Efforts

- • Technological advancements

Regulatory Framework

Several regulatory bodies oversee the chemical industry globally to ensure safety, environmental protection, and compliance with standards. Notable among these are the Environmental Protection Agency (EPA) in the United States, the European Chemicals Agency (ECHA) in the European Union, and the Occupational Safety and Health Administration (OSHA) in the United States. Other significant entities include the Health and Safety Executive (HSE) in the United Kingdom, the National Institute of Chemical Safety (NICS) in South Korea, and the Ministry of Environmental Protection (MEP) in China.

Additionally, the National Industrial Chemicals Notification and Assessment Scheme (NICNAS) in Australia, the Japan Chemical Industry Association (JCIA), the Canadian Environmental Protection Act (CEPA), and the Central Pollution Control Board (CPCB) in India play crucial roles. These organizations establish regulations, conduct inspections, and enforce compliance to ensure the safe production, handling, and disposal of chemicals.

Market Segmentation Analysis

Segmentation by Type

- • Horizontal

- • Vertical

- • Shale

- • Conventional

- • Unconventional

Segmentation by Application

- • Oil & Gas

- • Energy

- • Mining

Competitive landscape

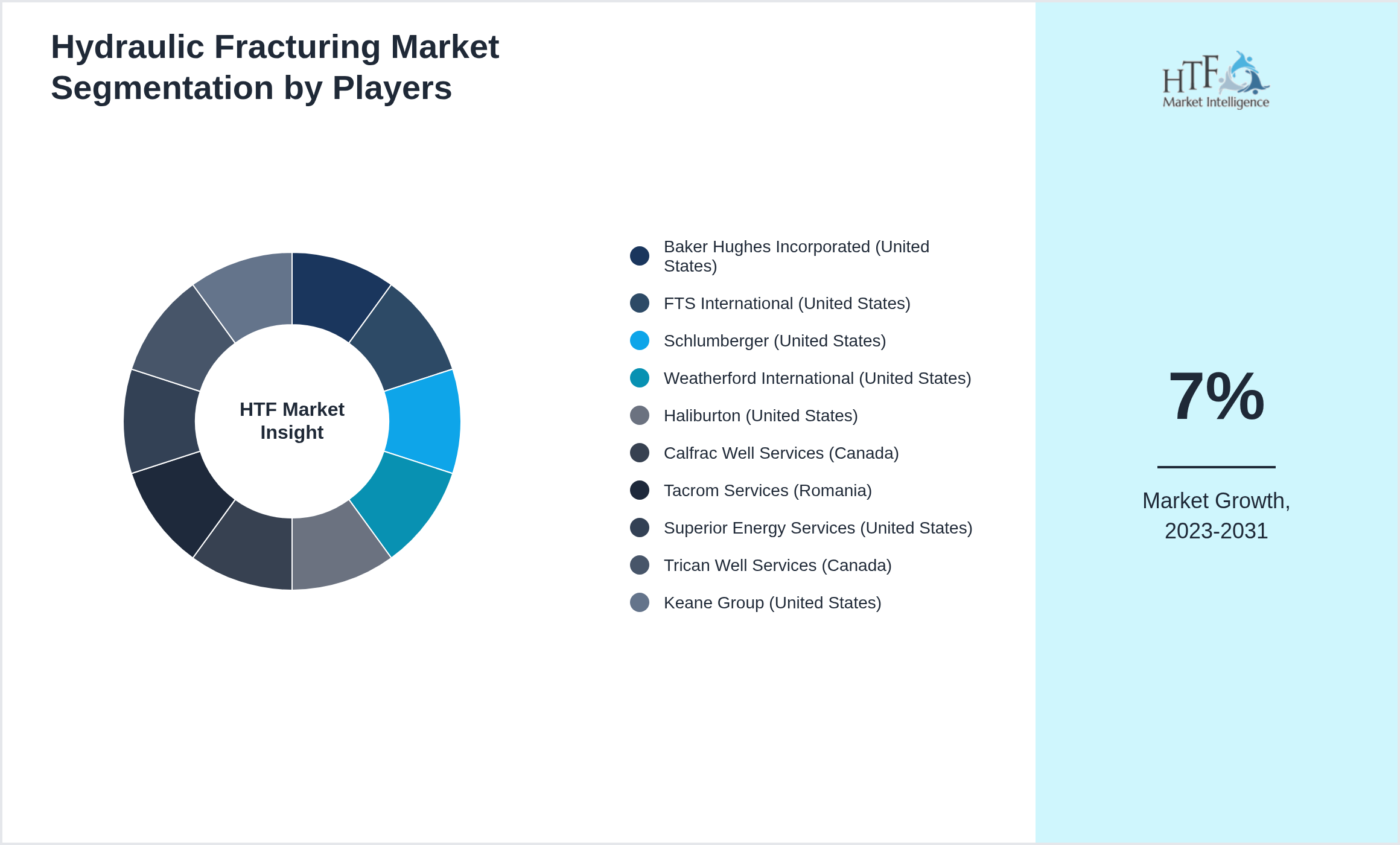

The key players in the Hydraulic Fracturing are intensifying their focus on research and development (R&D) activities to innovate and stay competitive. Major companies, such as Baker Hughes Incorporated (United States), FTS International (United States), Schlumberger (United States), Weatherford International (United States), Haliburton (United States), Calfrac Well Services (Canada), Tacrom Services (Romania), Superior Energy Services (United States), Trican Well Services (Canada), Keane Group (United States), are heavily investing in R&D to develop new products and improve existing ones. This strategic emphasis on innovation is driving significant advancements in chemical manufacturing processes and the introduction of sustainable and eco-friendly products.

Moreover, these established industry leaders are actively pursuing acquisitions of smaller companies to expand their regional presence and enhance their market share. These acquisitions not only help in diversifying their product portfolios but also provide access to new technologies and markets. This consolidation trend is a critical factor in the growth of the Hydraulic Fracturing, as it enables larger companies to streamline operations, reduce costs, and increase their competitive edge.

For the complete companies list, please ask for sample pages

In addition to R&D and acquisitions, there is a notable shift towards green investments among key players in the Hydraulic Fracturing. Companies are increasingly committing resources to sustainable practices and the development of environmentally friendly products. This green investment is in response to growing consumer demand for sustainable solutions and stringent environmental regulations. By prioritizing sustainability, these companies are not only contributing to environmental protection but also positioning themselves as leaders in the green chemistry movement, thereby fueling market growth.

The companies highlighted in this profile were selected based on insights from primary experts and an evaluation of their market penetration, product offerings, and geographical reach.

- • Baker Hughes Incorporated (United States)

- • FTS International (United States)

- • Schlumberger (United States)

- • Weatherford International (United States)

- • Haliburton (United States)

- • Calfrac Well Services (Canada)

- • Tacrom Services (Romania)

- • Superior Energy Services (United States)

- • Trican Well Services (Canada)

- • Keane Group (United States)

Merger & Acquisition

Report Infographics

| Report Features | Details |

| Base Year | 2023 |

| Based Year Market Size 2023 | 45Billion |

| Historical Period | 2019 to 2023 |

| CAGR 2023 to 2031 | 7% |

| Forecast Period | 2025 to 2031 |

| Forecasted Period Market Size 2031 | 70Billion |

| Scope of the Report | Horizontal, Vertical, Shale, Conventional, Unconventional, Oil & Gas, Energy, Mining |

| Regions Covered | North America, LATAM, West Europe, Central & Eastern Europe, Northern Europe, Southern Europe, East Asia, Southeast Asia, South Asia, Central Asia, Oceania, MEA |

| Companies Covered | Baker Hughes Incorporated (United States), FTS International (United States), Schlumberger (United States), Weatherford International (United States), Haliburton (United States), Calfrac Well Services (Canada), Tacrom Services (Romania), Superior Energy Services (United States), Trican Well Services (Canada), Keane Group (United States) |

| Customization Scope | 15% Free Customization |

| Delivery Format | PDF and Excel through Email |

Hydraulic Fracturing - Table of Contents

Chapter 1: Market Preface

Chapter 2: Strategic Overview

Chapter 3: Global Hydraulic Fracturing Market Business Environment & Changing Dynamics

Chapter 4: Global Hydraulic Fracturing Industry Factors Assessment

Chapter 5: Hydraulic Fracturing : Competition Benchmarking & Performance Evaluation

Chapter 6: Global Hydraulic Fracturing Market: Company Profiles

Chapter 7: Global Hydraulic Fracturing by Type & Application (2019-2031)

Chapter 8: North America Hydraulic Fracturing Market Breakdown by Country, Type & Application

Chapter 9: Europe Hydraulic Fracturing Market Breakdown by Country, Type & Application

Chapter 10: Asia Pacific Hydraulic Fracturing Market Breakdown by Country, Type & Application

Chapter 11: Latin America Hydraulic Fracturing Market Breakdown by Country, Type & Application

Chapter 12: Middle East & Africa Hydraulic Fracturing Market Breakdown by Country, Type & Application

Chapter 13: Research Finding and Conclusion

Frequently Asked Questions (FAQ):

The Compact Track Loaders market is projected to grow at a CAGR of 6.8% from 2025 to 2030, driven by increasing demand in construction and agricultural sectors.

North America currently leads the market with approximately 45% market share, followed by Europe at 28% and Asia-Pacific at 22%. The remaining regions account for 5% of the global market.

Key growth drivers include increasing construction activities, rising demand for versatile equipment in agriculture, technological advancements in track loader design, and growing preference for compact equipment in urban construction projects.