Power Sector Market Research Report

Power Sector Market - India Industry Size & Growth Analysis 2024-2030

India Power Sector Market is segmented by Application (Utilities, Governments, Businesses), Type (Energy, Electricity, Utilities), and Geography ()

Pricing

Report Overview

The Power Sector Market involves the generation, transmission, and distribution of electricity. It includes a wide range of activities, from power plant operations (coal, natural gas, renewable energy sources) to grid management and electrical distribution. The market is shaped by global energy demands, government regulations, and the growing transition toward renewable energy sources. The power sector is undergoing significant transformation with the increasing adoption of clean energy technologies such as wind, solar, and hydroelectric power, which are driving sustainable development. The shift from fossil fuels to renewables, along with technological advancements in smart grids, energy storage systems, and energy efficiency solutions, is reshaping the power sector. The market is also influenced by energy policies, environmental concerns, and the demand for reliable and affordable electricity. The power sector market is expected to continue evolving with innovations in energy generation, distribution, and consumption.

The Power Sector market research study is a vital tool for companies looking to make well-informed strategic decisions since it offers a thorough examination of consumer behavior, industry trends, and competition dynamics. The Power Sector report synthesizes data using a variety of research approaches to find practical insights that assist businesses in determining market prospects and evaluating the profitability of their products. The Power Sector report’s structure, which includes sections on methodology, results, and suggestions, prioritizes accessibility and clarity to make sure that stakeholders can understand the findings with ease. In the end, this Power Sector study gives companies the information they need to improve their market presence and spur expansion in a constantly changing environment.

Market Segmentation

Segmentation in market research involves dividing a large market into smaller groups of consumers with similar characteristics, such as demographics, location, behavior, or lifestyle. This allows businesses to target their products and marketing efforts more effectively, focusing on the specific needs and preferences of each segment. By doing so, companies can allocate resources efficiently, enhance customer satisfaction, and improve sales outcomes, ultimately gaining a competitive edge in the market. Segmentation helps businesses to understand their audience better, create tailored strategies, and optimize their overall market performance.

By Type Analysis:

- • Energy

- • Electricity

- • Utilities

- • Utilities

- • Governments

- • Businesses

Key Report Aspects

Power Sector Market Dynamics

Influencing Trend:

Market Growth Drivers:

Challenges:

Opportunities:

For the complete companies list, please ask for sample pages.Need More Details on Market Players and Competitors?

Key Highlights

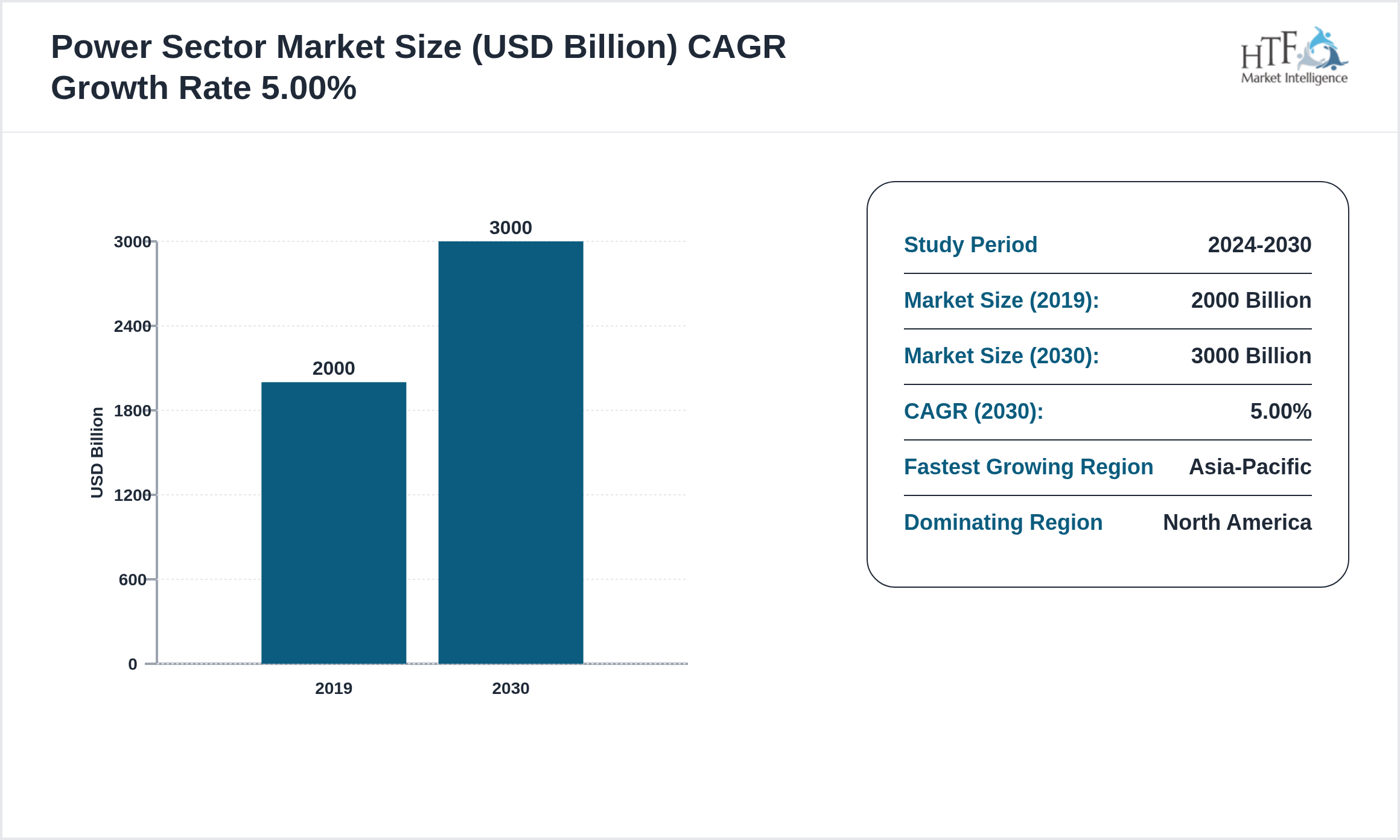

• The Power Sector is growing at a CAGR of 5.00% during the forecasted period of 2019 to 2030

• Year on Year growth for the market is 6%

• North America dominated the market share of 2 trillion % in 2019

• Based on type, the market is bifurcated into Energy, Electricity, Utilities segment dominated the market share during the forecasted period

• Based on application the market is segmented into Application Utilities, Governments, Businesses is the fastest-growing segment

• Global Import Export in terms of K Tons, K Units, and Metric Tons will be provided if Applicable based on industry best practice

Regional Insight

Regional market research begins with defining clear objectives and the scope of the study, focusing on specific geographic areas and market segments. Data collection involves both secondary research, where existing industry reports and government statistics are analyzed, and primary research, which includes surveys and interviews with local stakeholders. The analysis then evaluates the market size, growth trends, competitive landscape, and consumer behavior specific to the region. Additionally, it examines regulatory and economic factors that impact the market, such as local regulations and economic conditions. A SWOT analysis identifies regional strengths, weaknesses, opportunities, and threats. The research culminates in a detailed report with key findings and strategic recommendations, which are updated regularly to reflect market changes and ensure ongoing relevance.

Competitive Landscape

The competitive landscape of the market is driven by a diverse array of participants, from established industry leaders to emerging innovators. Dominant players, such as known for their extensive product portfolio and strong distribution network, maintain a significant market share through advanced technology and strategic partnerships. Meanwhile, it distinguishes itself with innovative solutions and a focus on niche segments, positioning itself as a major disruptor.

A global player leverages cost leadership and operational efficiency to capture market share across various regions. Key competitive strategies include product differentiation, aggressive market penetration through mergers and acquisitions, and adaptive pricing models. Current market trends highlight a strong emphasis on technological advancements and sustainability, driving companies to invest in digital transformation and eco-friendly practices. However, challenges such as regulatory compliance and economic fluctuations continue to impact the market. As the landscape evolves, companies that innovate and adapt to these dynamics will be best positioned for continued success.

SWOT Analysis

Incorporating a SWOT analysis into a market report is essential for providing a comprehensive evaluation of internal and external factors impacting a business or market. The analysis begins by identifying strengths, such as robust brand recognition or advanced technology, which give the company or market a competitive edge. It then addresses weaknesses, including operational inefficiencies or limited market presence, which need improvement.

The analysis explores opportunities arising from emerging trends, regulatory changes, or market gaps, enabling businesses to capitalize on potential growth areas. Finally, it examines threats, such as increasing competition or economic downturns, helping companies develop strategies to mitigate risks. This structured approach supports strategic planning, informed decision-making, and effective risk management, ultimately aiding in the identification of growth opportunities and enhancing competitive positioning.

Key Players

Key market players are concentrating on enhancing their market presence through the acquisition of new and emerging companies. Established firms are also investing significantly in research and development, aiming to launch innovative products and expand their market share. Additionally, some companies are pursuing mergers to combine their strengths and deliver superior products to the market. Based on all the criteria some of the players included in our study are:

- • General Electric (USA)

- • Siemens (Germany)

- • Schneider Electric (France)

- • ABB (Switzerland)

- • Mitsubishi Electric (Japan)

- • Hitachi (Japan)

- • Honeywell (USA)

- • E.ON (Germany)

- • Duke Energy (USA)

- • Southern Company (USA)

- • NextEra Energy (USA)

- • Enel (Italy)

- • Vattenfall (Sweden)

- • Iberdrola (Spain)

- • Dominion Energy (USA)

Report Infographics:

Report Features

|

Details

|

Base Year

|

2019

|

Based Year Market Size

|

2 trillion

|

Historical Period

|

2024

|

CAGR (2019 to 2030)

|

5.00%

|

Forecast Period

|

2030

|

Forecasted Period Market Size (2030)

|

3 trillion

|

Scope of the Report

|

Energy, Electricity, Utilities, Utilities, Governments, Businesses

|

Regions Covered

|

North America, Europe, Asia Pacific, Latin America, and MEA

|

Companies Covered

|

General Electric (USA), Siemens (Germany), Schneider Electric (France), ABB (Switzerland), Mitsubishi Electric (Japan), Hitachi (Japan), Honeywell (USA), E.ON (Germany), Duke Energy (USA), Southern Company (USA), NextEra Energy (USA), Enel (Italy), Vattenfall (Sweden), Iberdrola (Spain), Dominion Energy (USA)

|

Customization Scope

|

15% Free Customization (For EG)

|

Delivery Format

|

PDF and Excel through Email

|

Power Sector - Table of Contents

Chapter 1: Market Preface

Chapter 2: Strategic Overview

Chapter 3: India Power Sector Market Business Environment & Changing Dynamics

Chapter 4: India Power Sector Industry Factors Assessment

Chapter 5: Power Sector : Competition Benchmarking & Performance Evaluation

Chapter 6: India Power Sector Market: Company Profiles

Chapter 7: India Power Sector by Type & Application (2024-2030)

Chapter 8: India Power Sector Market Breakdown by Type & Application

Chapter 9: Research Finding and Conclusion

Frequently Asked Questions (FAQ):

The Compact Track Loaders market is expected to see value worth 5.3 Billion in 2025.

North America currently leads the market with approximately 45% market share, followed by Europe at 28% and Asia-Pacific at 22%. The remaining regions account for 5% of the global market.

Key growth drivers include increasing construction activities, rising demand for versatile equipment in agriculture, technological advancements in track loader design, and growing preference for compact equipment in urban construction projects.