Still Wine Market Research Report

Still Wine Market - Global Share, Size & Changing Dynamics 2024-2030

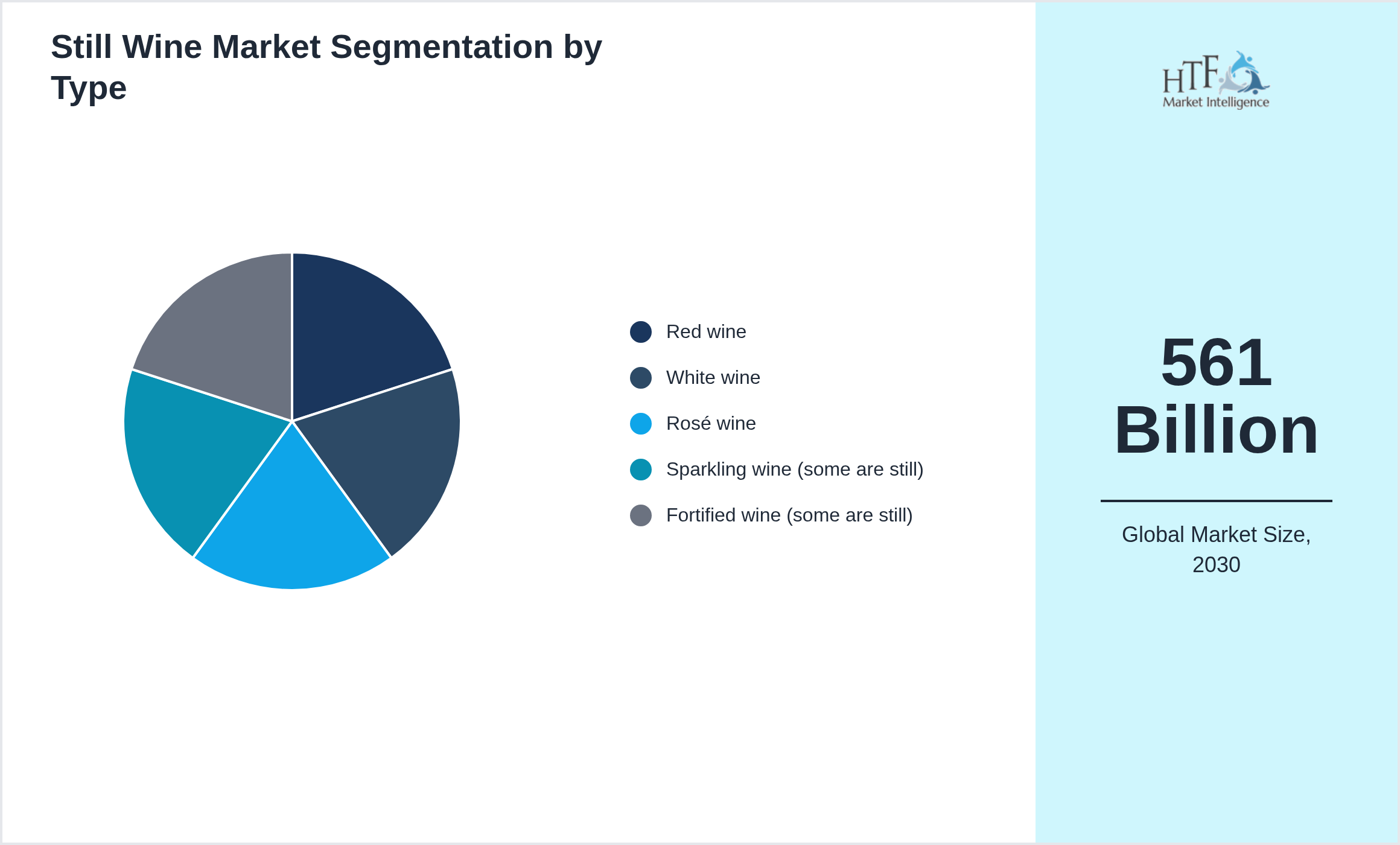

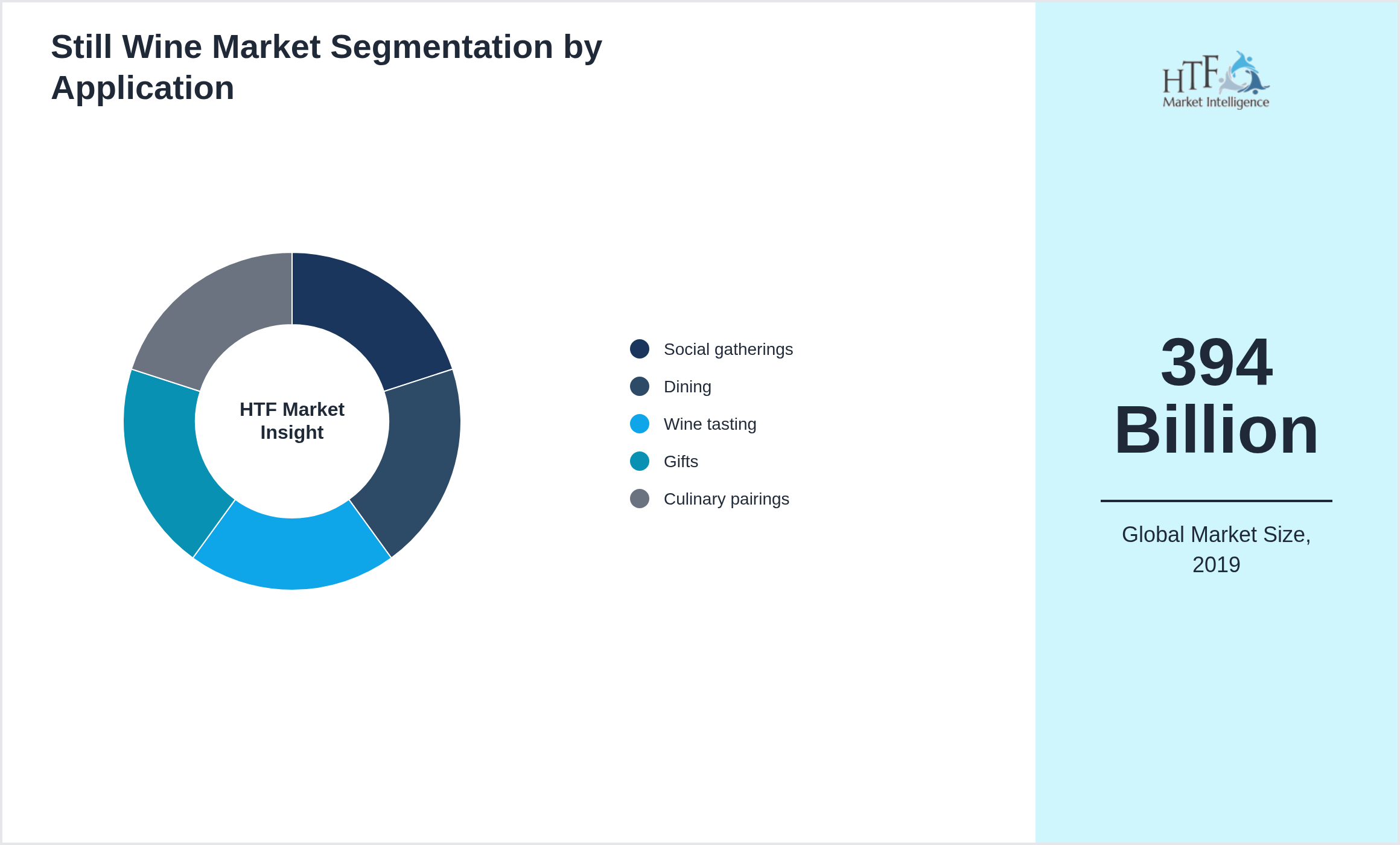

Global Still Wine Market is segmented by Application (Social gatherings, Dining, Wine tasting, Gifts, Culinary pairings), Type (Red wine, White wine, Rosé wine, Sparkling wine (some are still), Fortified wine (some are still)), and Geography (North America, LATAM, West Europe, Central & Eastern Europe, Northern Europe, Southern Europe, East Asia, Southeast Asia, South Asia, Central Asia, Oceania, MEA)

Pricing

Industry Overview

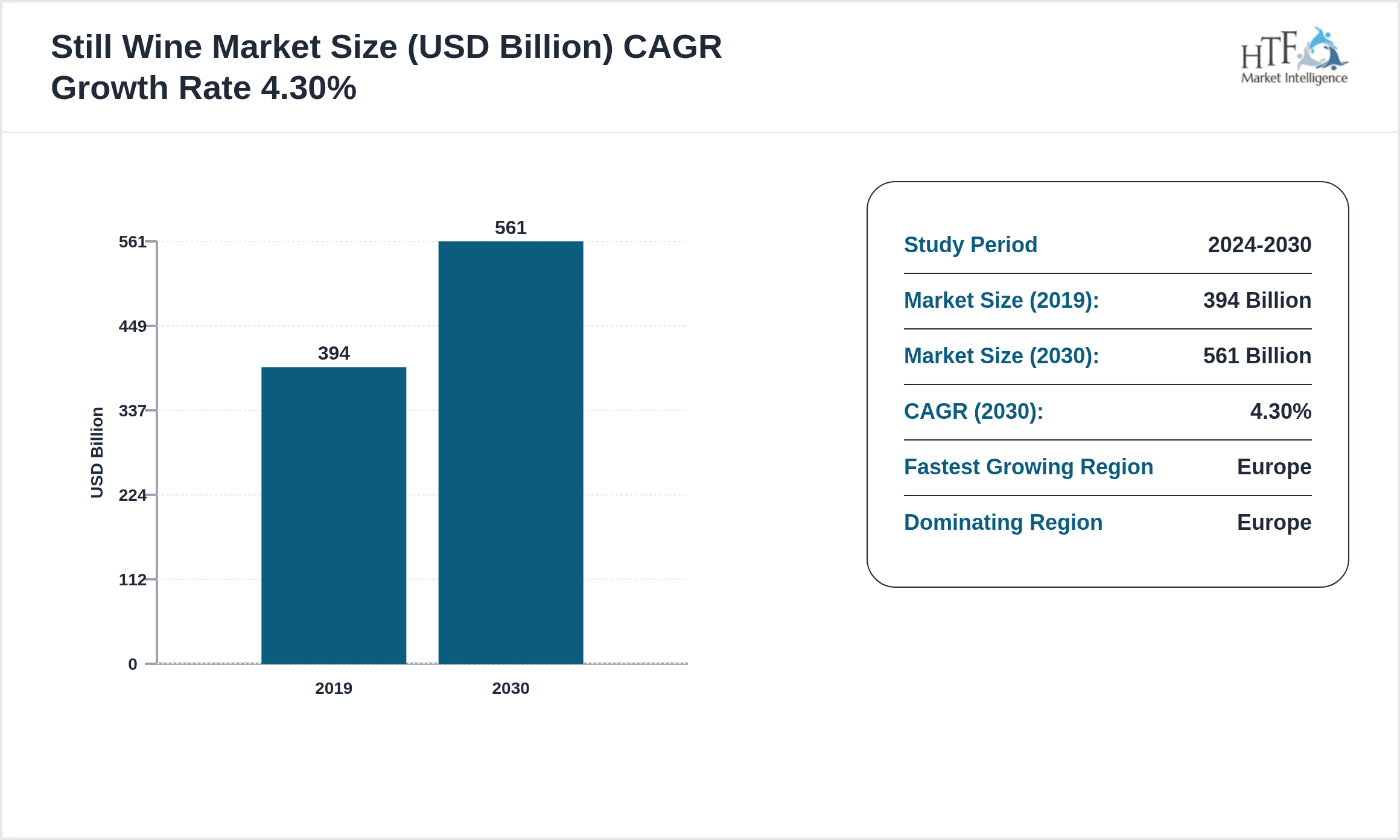

The Still Wine market is experiencing robust growth, projected to achieve a compound annual growth rate CAGR of 4.30% during the forecast period. Valued at 394 Billion, the market is expected to reach 561 Billion by 2030, with a year-on-year growth rate of 4.30%

The Still Wine Market focuses on the demand for wine that is not carbonated and undergoes a fermentation process to retain its natural flavors and aromas. This market includes red, white, and rosé wines, which are the most commonly consumed types of wine globally. The market is driven by the increasing global consumption of wine, particularly in regions such as Europe, North America, and emerging markets in Asia and Latin America. Consumers are becoming more knowledgeable about different wine varieties, flavors, and production processes, leading to a growing preference for quality wines. Additionally, the rise of wine tourism, where visitors explore wine regions and wineries, is boosting the market. Wine festivals, improved distribution channels, and innovations in wine packaging are also contributing to market growth. The trend towards organic, biodynamic, and sustainable winemaking practices is further shaping the future of the still wine market.

Data Collection Method

Data triangulation is a method used to analyze markets by gathering and comparing information from multiple sources or utilizing different research approaches to examine the same topic. This technique involves integrating data from various sources, such as surveys, interviews, and industry reports, or combining both qualitative and quantitative methods. By employing data triangulation, researchers can cross-verify information, reduce biases, and achieve a more accurate and comprehensive understanding of market dynamics.

Key Highlights of the Still Wine

• The Still Wine is growing at a CAGR of 4.30% during the forecasted period of 2019 to 2030

• Year-on-year growth for the market is 4.30%

• North America dominated the market share of 394 Billion in 2019

• Based on type, the market is bifurcated into Red wine, White wine, Rosé wine, Sparkling wine (some are still), Fortified wine (some are still) segments, which dominated the market share during the forecasted period

Market Segmentation

Segmentation by Type

- • Red wine

- • White wine

- • Rosé wine

- • Sparkling wine (some are still)

- • Fortified wine (some are still)

Segmentation by Application

- • Social gatherings

- • Dining

- • Wine tasting

- • Gifts

- • Culinary pairings

This report also splits the market by region

- North America

- LATAM

- West Europe

- Central & Eastern Europe

- Northern Europe

- Southern Europe

- East Asia

- Southeast Asia

- South Asia

- Central Asia

- Oceania

- MEA

Regional Insights

The Still Wine market exhibits significant regional variation, shaped by different economic conditions and consumer behaviors.

- North America: High disposable incomes and a robust e-commerce sector are driving demand for premium and convenient products.

- Europe: A fragmented market where Western Europe emphasizes luxury and organic products, while Eastern Europe experiences rapid growth.

- Asia-Pacific: Urbanization and a growing middle class drive demand for both high-tech and affordable products, positioning the region as a fast-growing market.

- Latin America: Economic fluctuations make affordability a key factor, with Brazil and Mexico leading the way in market expansion.

- Middle East & Africa: Luxury products are prominent in the Gulf States, while Sub-Saharan Africa sees gradual market growth, influenced by local preferences.

Currently, Europe dominates the market due to high consumption, population growth, and sustained economic progress. Meanwhile, Europe is experiencing the fastest growth, driven by large-scale infrastructure investments, industrial development, and rising consumer demand.

Key Players

The companies highlighted in this profile were selected based on insights from primary experts and an evaluation of their market penetration, product offerings, and geographical reach:

- • Concha y Toro

- • Pernod Ricard

- • Treasury Wine Estates

- • E&J Gallo Winery

- • The Wine Group

- • Diageo

- • Castel Group

- • Carlsberg

- • Moet Hennessy

- • Accolade Wines

- • Jackson Family Wines

- • Sogrape

- • Brown-Forman

Companies within the industry are increasingly concentrating on broadening their market presence through a variety of strategic initiatives. These include mergers and acquisitions, as well as green investments, particularly in underdeveloped regions. Such strategies are proving instrumental in enabling these companies to capture a larger share of the market. By consolidating resources and expanding their geographical footprint, they not only enhance their competitive edge but also contribute to sustainable development in emerging markets. This approach not only fosters growth but also aligns with global trends toward environmental responsibility and corporate sustainability.

Competitive Landscape

The competitive landscape is shaped by a mix of global leaders and regional players, with large companies like Concha y Toro, Pernod Ricard, Treasury Wine Estates, E&J Gallo Winery, The Wine Group, Diageo, Castel Group, Carlsberg, Moet Hennessy, Accolade Wines, Jackson Family Wines, Sogrape, Brown-Forman dominating the market through their extensive resources, innovation, and established brand presence. However, emerging players are disrupting the market with niche products and innovative technologies, challenging the incumbents. Pricing strategies vary, with larger firms benefiting from economies of scale while smaller players offer value-added services or customization. Geographical reach is key as global companies expand across regions, while regional firms focus on local markets. Strategic partnerships and mergers continue to reshape the landscape, and barriers to entry remain high due to capital requirements and regulatory hurdles.

Get the full report to explore critical industry dynamics.

Price Trend Analysis

Price trend analysis is the study of historical pricing data to identify patterns and predict future price movements. It provides businesses with insights into how prices for goods or services change over time due to factors like market demand, supply levels, economic conditions, and external influences such as inflation or raw material costs.

This analysis is critical for businesses, as it helps in developing effective pricing strategies. By understanding pricing trends, companies can adjust their prices to remain competitive while safeguarding their profit margins. For example, if a business anticipates a rise in material costs, it can adjust its pricing or production plan to mitigate the impact.

Price trend analysis is also essential for forecasting. It allows companies to predict future price fluctuations and plan accordingly, whether for purchasing, production, or sales strategies. This is particularly important for industries where price volatility is common, such as commodities or seasonal products.

Furthermore, analyzing price trends offers valuable market insights. Businesses can gain a clearer view of consumer behavior, competitor pricing tactics, and overall market health. This helps in making informed decisions about product positioning, promotions, and inventory management.

In short, price trend analysis is a crucial tool that enables businesses to remain agile, mitigate risks, and drive profitability.

Dynamics

Market dynamics refer to the forces that influence the supply and demand of products and services within a market. These forces include factors such as consumer preferences, technological advancements, regulatory changes, economic conditions, and competitive actions. Understanding market dynamics is crucial for businesses, as it helps them anticipate changes, identify opportunities, and mitigate risks.

By analyzing market dynamics, companies can better understand market trends, predict potential shifts, and develop strategic responses. This analysis enables businesses to align their product offerings, pricing strategies, and marketing efforts with evolving market conditions, ultimately leading to more informed decision-making and a stronger competitive position in the marketplace.

Market Driver

- • Flavor

- • Aroma

- • Social & cultural significance

- • Health benefits (moderate consumption)

Market Trend

- • Premiumization

- • Growing interest in wine culture

- • Online wine sales

Opportunity

- • Wine tourism

- • Wine education

- • Online retail & delivery

Challenges

- • Competition from other beverages

- • Changing consumer preferences

- • Grape quality & vintage variation

- • Regulatory & taxation issues

Merger & Acquisition

Research Process

The research process is a systematic approach to gathering and analyzing information in order to address specific questions or hypotheses. It typically begins with identifying a problem or research question that needs exploration. Once the question is defined, researchers review existing literature to gain a deeper understanding of the subject and identify gaps that need addressing.

Next, researchers develop a research plan or methodology, outlining how data will be collected and analyzed. This may involve choosing between qualitative, quantitative, or mixed methods depending on the nature of the research. Data collection methods can include surveys, experiments, observations, or secondary data analysis.

Once data is collected, the next step is analyzing the information using appropriate tools or techniques, such as statistical software for quantitative data or thematic analysis for qualitative data. This analysis helps draw conclusions and identify patterns relevant to the research question.

Finally, the findings are interpreted and communicated through reports, presentations, or publications. The results are often compared against the initial hypotheses, and limitations or further areas of study are highlighted. This structured process ensures that research is rigorous, transparent, and reliable, contributing valuable insights to the field of study.

|

Report Features |

Details |

|

Base Year |

2025 |

|

Based Year Market Size (2019) |

394 Billion |

|

Historical Period Market Size (2024) |

USD Million ZZ |

|

CAGR (2025 to 2030) |

4.30% |

|

Forecast Period |

2025 to 2030 |

|

Forecasted Period Market Size (2030) |

561 Billion |

|

Scope of the Report |

Red wine, White wine, Rosé wine, Sparkling wine (some are still), Fortified wine (some are still), Social gatherings, Dining, Wine tasting, Gifts, Culinary pairings |

|

Regions Covered |

North America, Europe, Asia Pacific, South America, and MEA |

|

Year-on-Year Growth |

4.30% |

|

Companies Covered |

Concha y Toro, Pernod Ricard, Treasury Wine Estates, E&J Gallo Winery, The Wine Group, Diageo, Castel Group, Carlsberg, Moet Hennessy, Accolade Wines, Jackson Family Wines, Sogrape, Brown-Forman |

|

Customization Scope |

15% Free Customization (For EG) |

|

Delivery Format |

PDF and Excel through Email |

Still Wine - Table of Contents

Chapter 1: Market Preface

Chapter 2: Strategic Overview

Chapter 3: Global Still Wine Market Business Environment & Changing Dynamics

Chapter 4: Global Still Wine Industry Factors Assessment

Chapter 5: Still Wine : Competition Benchmarking & Performance Evaluation

Chapter 6: Global Still Wine Market: Company Profiles

Chapter 7: Global Still Wine by Type & Application (2024-2030)

Chapter 8: North America Still Wine Market Breakdown by Country, Type & Application

Chapter 9: Europe Still Wine Market Breakdown by Country, Type & Application

Chapter 10: Asia Pacific Still Wine Market Breakdown by Country, Type & Application

Chapter 11: Latin America Still Wine Market Breakdown by Country, Type & Application

Chapter 12: Middle East & Africa Still Wine Market Breakdown by Country, Type & Application

Chapter 13: Research Finding and Conclusion

Frequently Asked Questions (FAQ):

The Compact Track Loaders market is expected to see value worth 5.3 Billion in 2025.

North America currently leads the market with approximately 45% market share, followed by Europe at 28% and Asia-Pacific at 22%. The remaining regions account for 5% of the global market.

Key growth drivers include increasing construction activities, rising demand for versatile equipment in agriculture, technological advancements in track loader design, and growing preference for compact equipment in urban construction projects.