Carbon And Graphite Felt Market Research Report

Global Carbon And Graphite Felt Market Roadmap to 2033

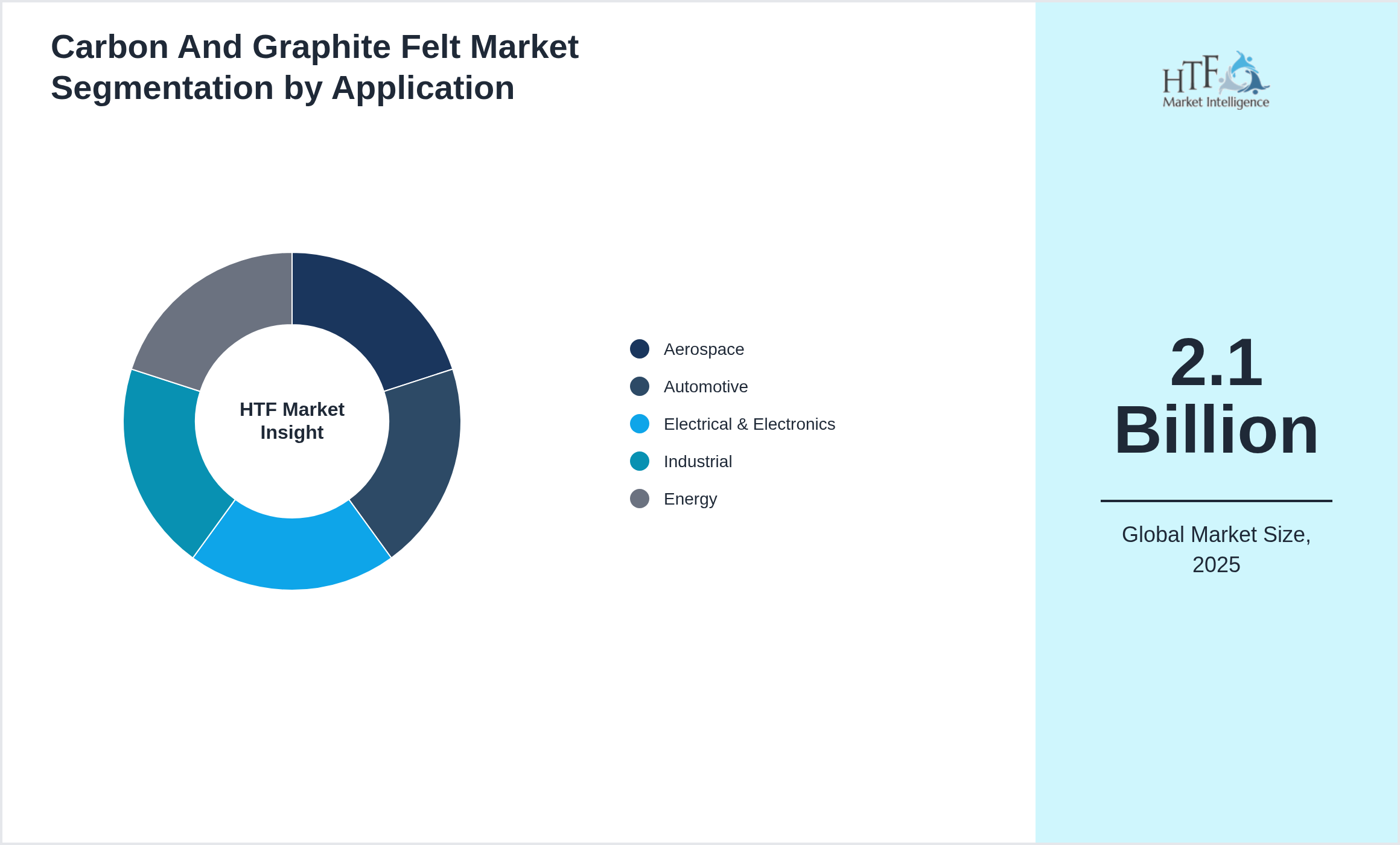

Global Carbon And Graphite Felt Market is segmented by Application (Aerospace, Automotive, Electrical & Electronics, Industrial, Energy), Type (Needle-Punched Felt, Woven Felt, Carbon-Carbon Composites, Graphite Felt, High-Temperature Resistant Felt), and Geography (North America, LATAM, West Europe, Central & Eastern Europe, Northern Europe, Southern Europe, East Asia, Southeast Asia, South Asia, Central Asia, Oceania, MEA)

Pricing

Industry Overview

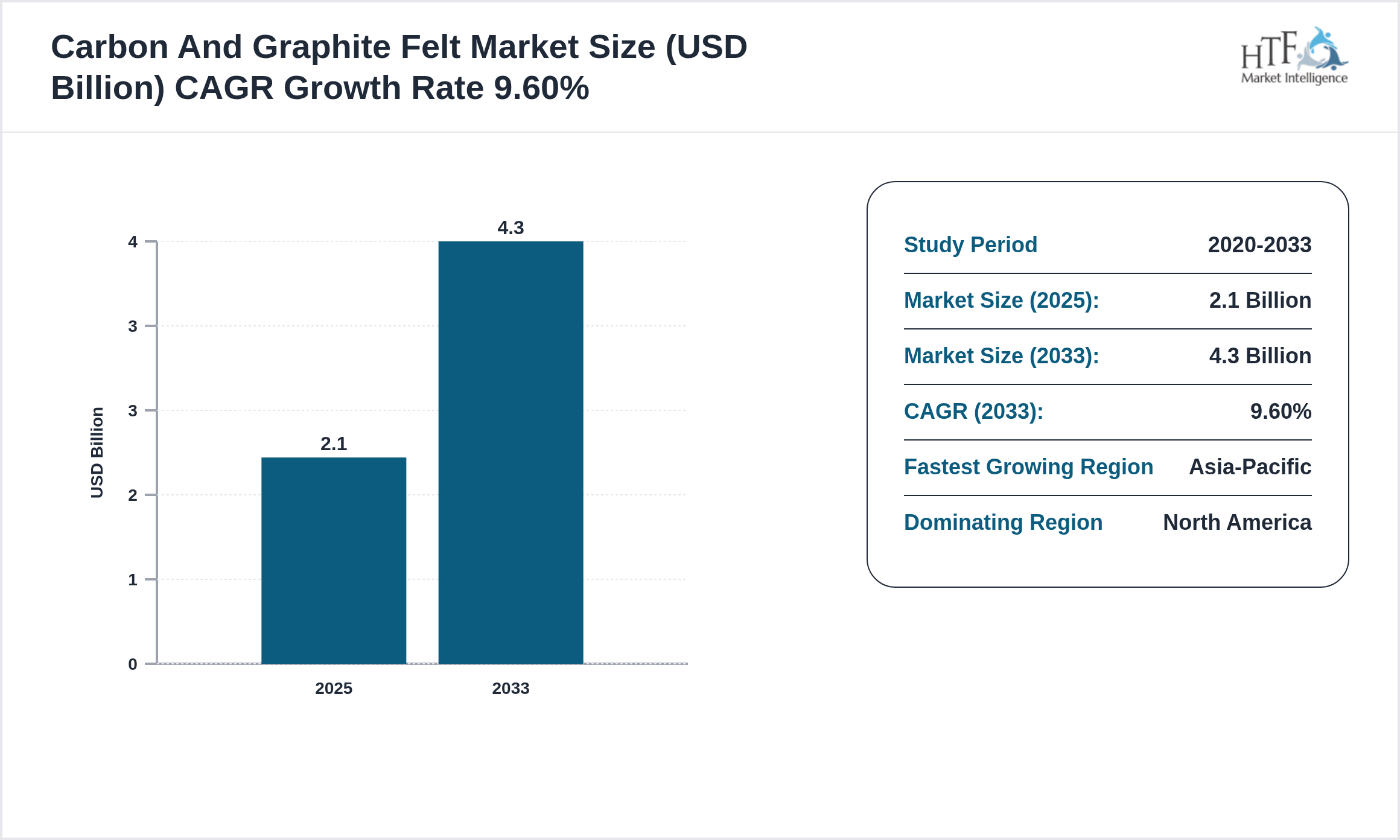

The Carbon And Graphite Felt is at USD 2.1 Billion in 2025 and is expected to reach 4.3 Billion by 2033. The Carbon And Graphite Felt is driven by increasing demand in end-use industries, technological advancements, research and development (R&D), economic growth, and global trade.

Carbon and graphite felts are materials used in various high-temperature applications, particularly for insulation, batteries, and energy storage devices. The market is growing due to the increasing demand for lightweight, high-performance materials, especially in industries like automotive, aerospace, and renewable energy.

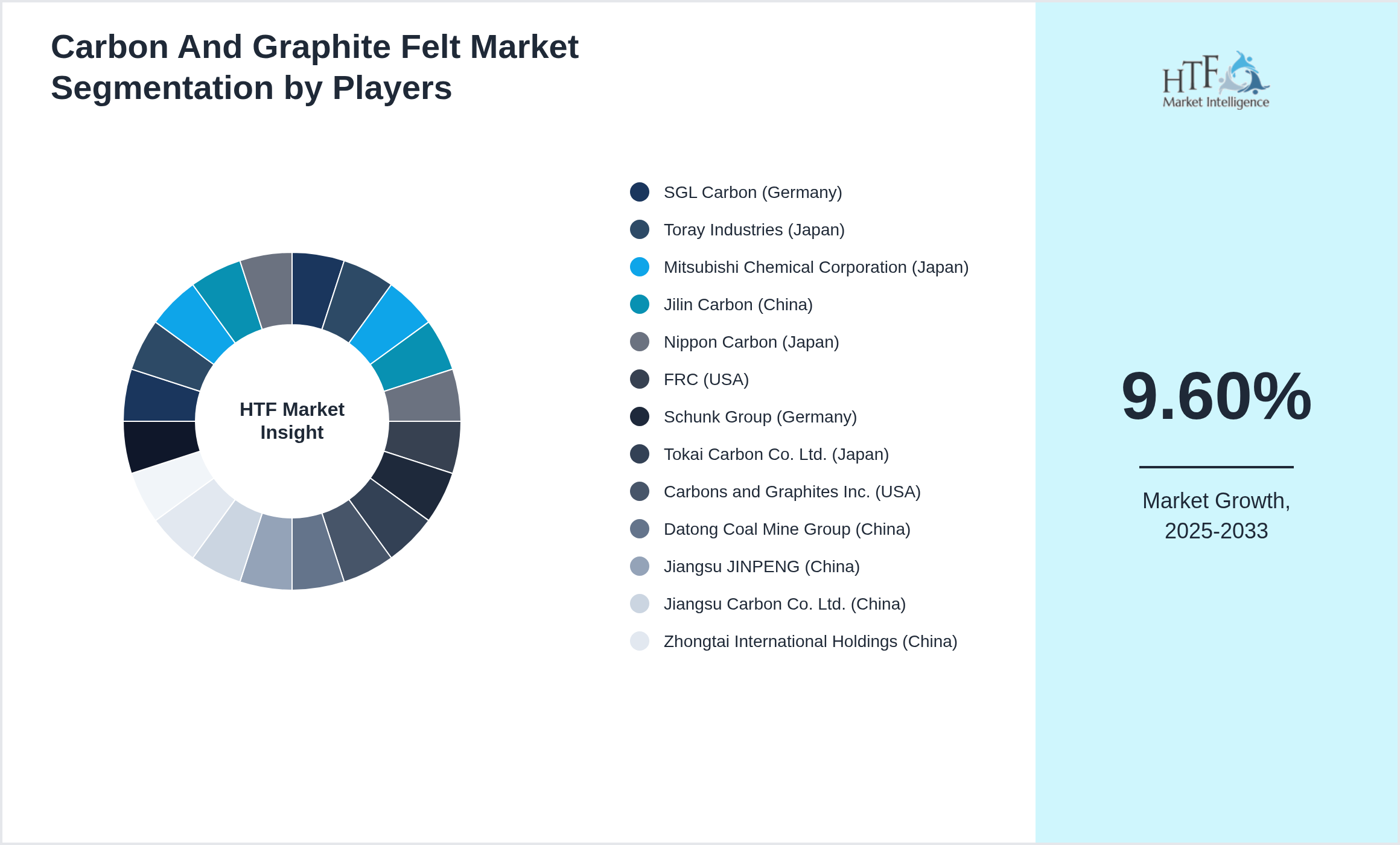

Competitive landscape

The key players in the Carbon And Graphite Felt are intensifying their focus on research and development (R&D) activities to innovate and stay competitive. Major companies, such as SGL Carbon (Germany), Toray Industries (Japan), Mitsubishi Chemical Corporation (Japan), Jilin Carbon (China), Nippon Carbon (Japan), FRC (USA), Schunk Group (Germany), Tokai Carbon Co. Ltd. (Japan), Carbons and Graphites Inc. (USA), Datong Coal Mine Group (China), Jiangsu JINPENG (China), Jiangsu Carbon Co. Ltd. (China), Zhongtai International Holdings (China), Beijing United Carbon (China), Spheretex (Germany), Saint-Gobain (France), Henkel AG (Germany), Haydale (UK), Graphene Nanochem (Malaysia), Cabot Corporation (USA), are heavily investing in R&D to develop new products and improve existing ones. This strategic emphasis on innovation is driving significant advancements in chemical manufacturing processes and the introduction of sustainable and eco-friendly products.

Moreover, these established industry leaders are actively pursuing acquisitions of smaller companies to expand their regional presence and enhance their market share. These acquisitions not only help in diversifying their product portfolios but also provide access to new technologies and markets. This consolidation trend is a critical factor in the growth of the Carbon And Graphite Felt, as it enables larger companies to streamline operations, reduce costs, and increase their competitive edge.

In addition to R&D and acquisitions, there is a notable shift towards green investments among key players in the Carbon And Graphite Felt. Companies are increasingly committing resources to sustainable practices and the development of environmentally friendly products. This green investment is in response to growing consumer demand for sustainable solutions and stringent environmental regulations. By prioritizing sustainability, these companies are not only contributing to environmental protection but also positioning themselves as leaders in the green chemistry movement, thereby fueling market growth.

Key Players

The companies highlighted in this profile were selected based on insights from primary experts and an evaluation of their market penetration, product offerings, and geographical reach:

- • SGL Carbon (Germany)

- • Toray Industries (Japan)

- • Mitsubishi Chemical Corporation (Japan)

- • Jilin Carbon (China)

- • Nippon Carbon (Japan)

- • FRC (USA)

- • Schunk Group (Germany)

- • Tokai Carbon Co. Ltd. (Japan)

- • Carbons and Graphites Inc. (USA)

- • Datong Coal Mine Group (China)

- • Jiangsu JINPENG (China)

- • Jiangsu Carbon Co. Ltd. (China)

- • Zhongtai International Holdings (China)

- • Beijing United Carbon (China)

- • Spheretex (Germany)

- • Saint-Gobain (France)

- • Henkel AG (Germany)

- • Haydale (UK)

- • Graphene Nanochem (Malaysia)

- • Cabot Corporation (USA)

Carbon And Graphite Felt Dynamics

Driving Factor

The Carbon And Graphite Felt is propelled by several key drivers, including the demand from diverse industrial sectors such as automotive, construction, and pharmaceuticals. Technological advancements and continuous innovation in chemical processes enhance efficiency and open new market opportunities. Economic growth, particularly in emerging markets, along with rapid urbanization and population growth, increases the need for chemicals in infrastructure and consumer goods. Additionally, stricter environmental regulations and the push for sustainable products drive the development of green chemicals. Global trade, raw material availability, and investments in research and development further shape the industry's growth, while supportive government policies and evolving consumer trends also play crucial roles.

Challenge Factor

The Carbon And Graphite Felt faces several challenges and restraining factors, including stringent environmental regulations that increase operational costs and complexity. Fluctuating raw material prices and availability can impact production expenses while growing health and safety concerns necessitate significant investments in compliance measures. Additionally, the push for sustainability requires costly reforms and green technologies. Economic uncertainty, supply chain disruptions, and rapid technological advancements further complicate market dynamics. Geopolitical instability and intellectual property risks also pose significant threats, while market saturation in mature regions pressures profit margins and limits growth opportunities.

Opportunities

The Carbon And Graphite Felt presents numerous opportunities for growth and innovation. Emerging trends in sustainability offer significant prospects for developing green and eco-friendly products, which are increasingly demanded by consumers and regulated by governments. Advancements in technology, such as digitalization and automation, provide opportunities for improving efficiency and reducing costs in chemical production. Expansion into emerging markets and developing regions presents a chance for companies to tap into new customer bases and increase their market share. Additionally, ongoing investments in research and development pave the way for innovations in specialty chemicals and advanced materials. Collaborations and partnerships within the industry can also drive growth by leveraging complementary strengths and accessing new technologies and markets.

Important Trend

Key trends in the Carbon And Graphite Felt include a focus on sustainability and green chemistry, driven by environmental regulations and consumer demand. Digital transformation is enhancing efficiency through AI and automation, while advanced materials are being developed for various industries. The shift towards a circular economy promotes recycling and reuse, and personalized medicine is increasing demand for specialty chemicals. Investments in renewable energy create new opportunities, and emerging markets offer growth potential. Evolving regulations and consumer preferences for sustainable products are influencing innovation, and supply chain advancements are improving efficiency. These trends are reshaping the chemical industry and driving its growth.

Regulatory Framework

Several regulatory bodies oversee the chemical industry globally to ensure safety, environmental protection, and compliance with standards. Notable among these are the Environmental Protection Agency (EPA) in the United States, the European Chemicals Agency (ECHA) in the European Union, and the Occupational Safety and Health Administration (OSHA) in the United States. Other significant entities include the Health and Safety Executive (HSE) in the United Kingdom, the National Institute of Chemical Safety (NICS) in South Korea, and the Ministry of Environmental Protection (MEP) in China.

Additionally, the National Industrial Chemicals Notification and Assessment Scheme (NICNAS) in Australia, the Japan Chemical Industry Association (JCIA), the Canadian Environmental Protection Act (CEPA), and the Central Pollution Control Board (CPCB) in India play crucial roles. These organizations establish regulations, conduct inspections, and enforce compliance to ensure the safe production, handling, and disposal of chemicals.

Regional Insight

The North America leads the market share, largely due to rising consumption, a growing population, and strong economic momentum that boosts demand. In contrast, the Asia-Pacific is emerging as the fastest-growing area, driven by rapid infrastructure development, the expansion of industrial sectors, and heightened consumer demand, making it a critical factor for future market growth. The regions covered in the report are:

- North America

- LATAM

- West Europe

- Central & Eastern Europe

- Northern Europe

- Southern Europe

- East Asia

- Southeast Asia

- South Asia

- Central Asia

- Oceania

- MEA

Market Segmentation

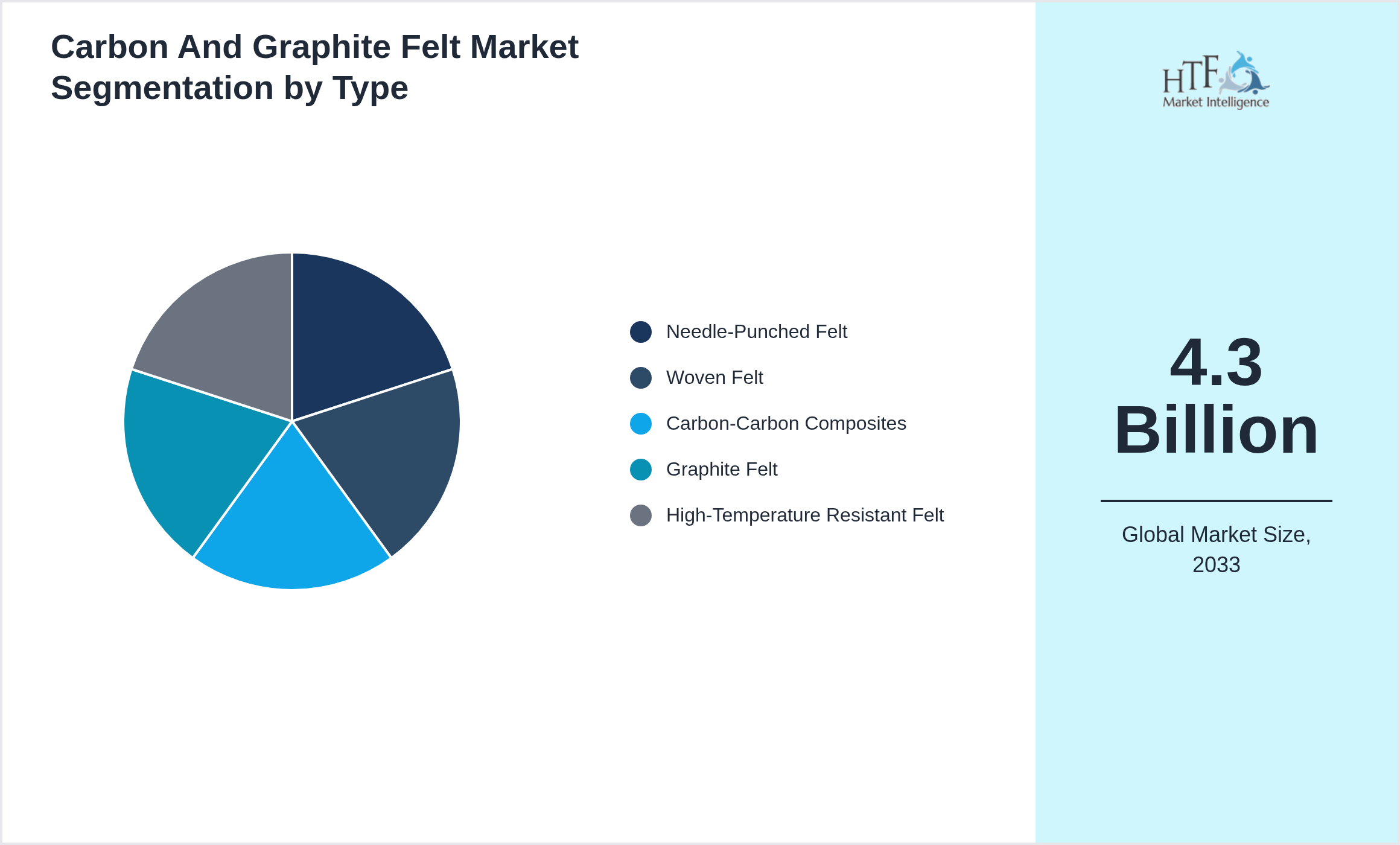

Segmentation by Type

- • Needle-Punched Felt

- • Woven Felt

- • Carbon-Carbon Composites

- • Graphite Felt

- • High-Temperature Resistant Felt

Segmentation by Application

- • Aerospace

- • Automotive

- • Electrical & Electronics

- • Industrial

- • Energy

Regional Analysis

- • North America and Europe are major markets for carbon and graphite felts

- • May 2024 – SGL Carbon and Tokai Carbon introduced new carbon and graphite felts with enhanced thermal stability

- • June

- • Regulations focus on ensuring the safety and environmental impact of carbon and graphite products. There is also growing pressure to use more sustainable materials in the production of these high-performance materials.

- • Patents focus on innovations in the production and processing of carbon and graphite felts

- • Investment is increasing in the carbon and graphite felt market as industries continue to expand their use of high-performance materials. Companies are investing in R&D to create more cost-effective and efficient solutions.

Research Methodology

The research methodology involves several key steps to ensure comprehensive and accurate insights. First, the objectives of the research are clearly defined, focusing on aspects such as market size, growth trends, and competitive dynamics. Data collection is conducted through both primary and secondary methods. Primary research includes interviews with industry experts, surveys, and focus groups to gather first-hand information, while secondary research involves analyzing existing reports, government publications, and company filings.

The collected data is then subjected to rigorous analysis, with quantitative methods used to evaluate market size and trends, and qualitative methods applied to understand industry dynamics and consumer behavior. Findings are compiled into a detailed report featuring key insights, data visualizations, and strategic recommendations. Validation is achieved through data verification and peer reviews to ensure accuracy.

Finally, the research concludes with actionable insights and recommendations, along with suggestions for future studies to address emerging trends and gaps. This methodology provides a structured approach to understanding the {keywords} and guiding strategic decisions.

Report Details

| Report Features | Details |

| Base Year | 2025 |

| Based Year Market Size (2025) | 2.1 Billion |

| Historical Period | 2020 to 2025 |

| CAGR (2025 to 2033) | 9.60% |

| Forecast Period | 2025 to 2033 |

| Forecasted Period Market Size (2033) | 4.3 Billion |

| Scope of the Report | Needle-Punched Felt, Woven Felt, Carbon-Carbon Composites, Graphite Felt, High-Temperature Resistant Felt, Aerospace, Automotive, Electrical & Electronics, Industrial, Energy |

| Regions Covered | North America, LATAM, West Europe, Central & Eastern Europe, Northern Europe, Southern Europe, East Asia, Southeast Asia, South Asia, Central Asia, Oceania, MEA |

| Companies Covered | SGL Carbon (Germany), Toray Industries (Japan), Mitsubishi Chemical Corporation (Japan), Jilin Carbon (China), Nippon Carbon (Japan), FRC (USA), Schunk Group (Germany), Tokai Carbon Co. Ltd. (Japan), Carbons and Graphites Inc. (USA), Datong Coal Mine Group (China), Jiangsu JINPENG (China), Jiangsu Carbon Co. Ltd. (China), Zhongtai International Holdings (China), Beijing United Carbon (China), Spheretex (Germany), Saint-Gobain (France), Henkel AG (Germany), Haydale (UK), Graphene Nanochem (Malaysia), Cabot Corporation (USA) |

| Customization Scope | 15% Free Customization |

| Delivery Format | PDF and Excel through Email |

Carbon And Graphite Felt - Table of Contents

Chapter 1: Market Preface

Chapter 2: Strategic Overview

Chapter 3: Global Carbon And Graphite Felt Market Business Environment & Changing Dynamics

Chapter 4: Global Carbon And Graphite Felt Industry Factors Assessment

Chapter 5: Carbon And Graphite Felt : Competition Benchmarking & Performance Evaluation

Chapter 6: Global Carbon And Graphite Felt Market: Company Profiles

Chapter 7: Global Carbon And Graphite Felt by Type & Application (2020-2033)

Chapter 8: North America Carbon And Graphite Felt Market Breakdown by Country, Type & Application

Chapter 9: Europe Carbon And Graphite Felt Market Breakdown by Country, Type & Application

Chapter 10: Asia Pacific Carbon And Graphite Felt Market Breakdown by Country, Type & Application

Chapter 11: Latin America Carbon And Graphite Felt Market Breakdown by Country, Type & Application

Chapter 12: Middle East & Africa Carbon And Graphite Felt Market Breakdown by Country, Type & Application

Chapter 13: Research Finding and Conclusion

Frequently Asked Questions (FAQ):

The Compact Track Loaders market is projected to grow at a CAGR of 6.8% from 2025 to 2030, driven by increasing demand in construction and agricultural sectors.

North America currently leads the market with approximately 45% market share, followed by Europe at 28% and Asia-Pacific at 22%. The remaining regions account for 5% of the global market.

Key growth drivers include increasing construction activities, rising demand for versatile equipment in agriculture, technological advancements in track loader design, and growing preference for compact equipment in urban construction projects.