Asset-Backed Securities (ABS) Market Research Report

Asset-Backed Securities (ABS) Market - Global Industry Size & Growth Analysis 2020-2033

Global Asset-Backed Securities (ABS) Market is segmented by Application (Real Estate, Banking, Consumer Credit, Asset Management, Securitization), Type (Mortgage-Backed Securities (MBS), Auto Loan ABS, Credit Card ABS, Student Loan ABS, Commercial ABS), and Geography (North America, LATAM, West Europe, Central & Eastern Europe, Northern Europe, Southern Europe, East Asia, Southeast Asia, South Asia, Central Asia, Oceania, MEA)

Pricing

Industry Overview

Growing demand for investment products with high yield_Regulatory changes encouraging ABS issuance_Increased credit availability_Need for liquidity solutions_Enhanced risk management tools

The global insurance industry is a cornerstone of economic stability, offering risk management solutions across various sectors, including life, health, property, and casualty. The industry is undergoing a transformative phase, driven by technological advancements such as artificial intelligence, automation, and digital platforms. These innovations are reshaping customer expectations, pushing insurers to enhance user experiences through personalized policies and faster claims processing.

In terms of market size, the industry continues to grow steadily, fueled by rising awareness of risk management and increasing regulatory requirements. North America remains a key market, while Asia-Pacific is emerging as a high-growth region due to expanding middle-class populations and growing insurance penetration.

As competition intensifies, companies are focusing on digital transformation and strategic partnerships to remain agile and customer-centric. The industry is expected to see continued growth, especially in regions with increasing demand for health and life insurance products.

Asset-Backed Securities (ABS) Market Dynamics

Influencing Trend:

- • Credit risk

- • Liquidity risk

- • Regulatory scrutiny

- • Volatility in interest rates

- • Reputational risks

- • Growth in asset-backed securities

- • More innovative ABS structures

- • Expansion of auto loan-backed securities

- • Rise of consumer finance-backed ABS

- • Increased institutional participation in ABS market

- • Asset-backed securities (ABS) are financial instruments backed by a pool of underlying assets

- • Increased demand in emerging markets

- • Innovation in structured products

- • Development of green ABS

- • Rising interest in student loan-backed securities

- • Growing market for auto loan ABS

Regulatory Framework

The insurance industry is heavily regulated to ensure market stability, protect consumers, and maintain solvency. Regulations differ by country but share common goals of promoting transparency, fair competition, and risk management. In the United States, insurance is primarily regulated at the state level, with each state's department responsible for licensing insurers, setting premium rates, and enforcing consumer protections. The National Association of Insurance Commissioners (NAIC) helps align state regulations by providing guidelines and model laws.

In the European Union, the Solvency II directive sets the regulatory framework, focusing on capital requirements, risk management, and disclosure. Insurers must maintain sufficient capital to mitigate insolvency risks and comply with strict reporting and governance standards. This framework is aimed at protecting policyholders while ensuring the industry’s financial stability.

In many emerging markets, regulatory bodies are evolving, with a focus on increasing insurance penetration, protecting consumers, and promoting innovation. Governments are encouraging the adoption of digital tools and insurtech solutions, while regulators emphasize compliance with risk management standards.

Globally, there is growing attention to environmental, social, and governance (ESG) issues, requiring insurers to consider sustainability in their operations and policies. Adhering to these regulatory demands is vital for insurers to remain competitive and compliant.

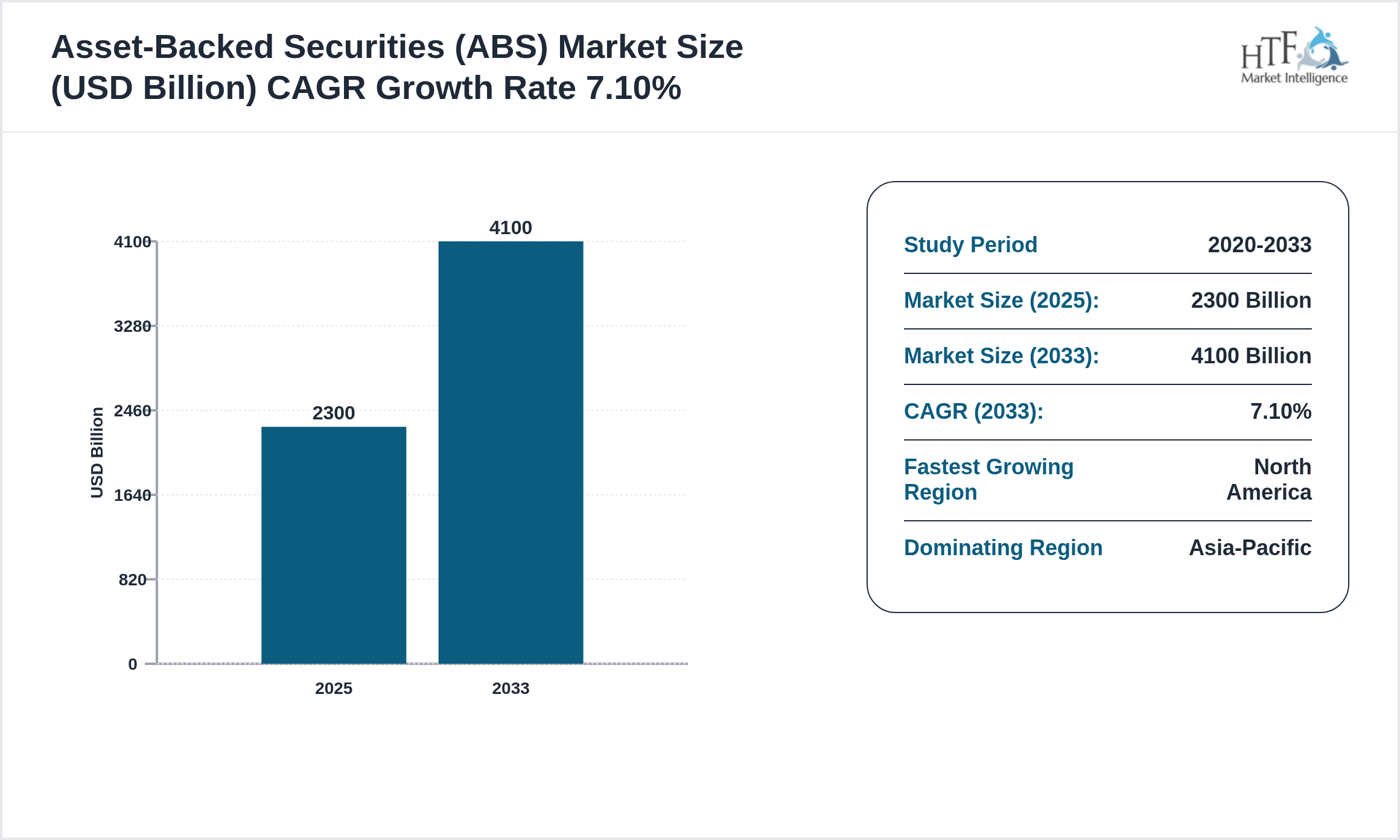

Regional Insight

The Asia-Pacific currently holds a significant share of the market, primarily due to several key factors: increasing consumption rates, a burgeoning population, and robust economic momentum. These elements collectively drive demand, positioning this region as a leader in the market. On the other hand, North America is rapidly emerging as the fastest-growing area within the industry. This remarkable growth can be attributed to swift infrastructure development, the expansion of various industrial sectors, and a marked increase in consumer demand. These dynamics make this region a crucial player in shaping future market growth. In our report, we cover a comprehensive analysis of the regions and countries, including

North America, LATAM, West Europe, Central & Eastern Europe, Northern Europe, Southern Europe, East Asia, Southeast Asia, South Asia, Central Asia, Oceania, MEA

tag

Market Segmentation

Segmentation by Type

- • Mortgage-Backed Securities (MBS)

- • Auto Loan ABS

- • Credit Card ABS

- • Student Loan ABS

- • Commercial ABS

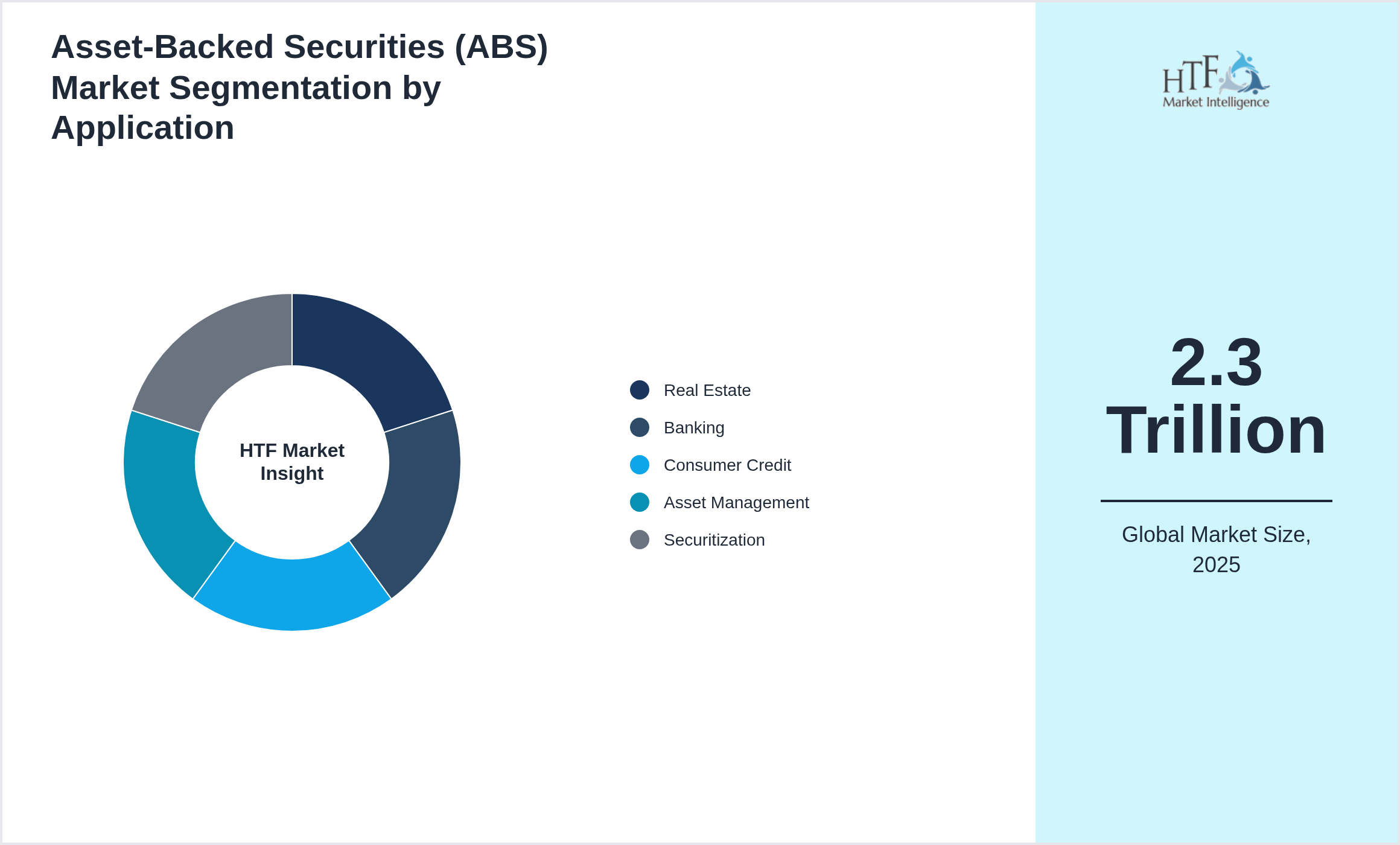

Segmentation by Application

Segmentation by Application

- • Real Estate

- • Banking

- • Consumer Credit

- • Asset Management

- • Securitization

Key Players

The companies highlighted in this profile were selected based on insights from primary experts and an evaluation of their market penetration, product offerings, and geographical reach.

- • JPMorgan Chase (USA)

- • Bank of America (USA)

- • Citigroup (USA)

- • Goldman Sachs (USA)

- • Morgan Stanley (USA)

- • Wells Fargo (USA)

- • Deutsche Bank (Germany)

- • Barclays (UK)

- • HSBC (UK)

- • Crédit Agricole (France)

- • BNP Paribas (France)

- • RBS (UK)

- • Standard Chartered (UK)

- • UBS (Switzerland)

- • ING (Netherlands)

Report Insights

1. Informed Decision-Making: Our reports provide clients with comprehensive insights and data that enable them to make well-informed strategic decisions. This includes understanding market trends, customer preferences, and competitive dynamics.

2. Risk Mitigation: By analyzing market conditions and potential challenges, our reports help clients identify risks early on. This allows them to develop strategies to mitigate these risks effectively.

3. Opportunity Identification: Our research identifies emerging opportunities within the market, such as new customer segments, product innovations, or geographical expansions, empowering clients to seize growth potential.

4. Benchmarking Performance: We provide comparative analyses against industry benchmarks, allowing clients to evaluate their performance relative to competitors and identify areas for improvement.

5. Tailored Recommendations: Each report is customized to address specific client needs, offering actionable recommendations that align with their business goals and challenges.

6. Regulatory Insights: Our reports often include an overview of regulatory environments, helping clients navigate compliance and understand the implications of regulatory changes.

Why HTF Market Research

Choosing our market research company offers distinct advantages that set us apart from the competition. We specialize in delivering tailored solutions that address the specific needs and objectives of each client, ensuring that our insights are both relevant and actionable. Our team comprises industry experts with extensive knowledge across various sectors, providing in-depth analyses and nuanced perspectives to drive strategic decision-making. We employ a comprehensive research methodology that combines qualitative and quantitative techniques, giving clients a holistic view of market dynamics. Timeliness is a priority; we deliver reports within agreed timelines, ensuring access to the latest data when it matters most.

Our proven track record of successful projects and satisfied clients underscores our reliability and effectiveness. Additionally, we leverage innovative tools and technologies to gather and analyze data efficiently, enhancing the accuracy of our findings. Our commitment extends beyond delivering reports; we offer ongoing support and consultation to help clients implement findings and adjust strategies as needed. By choosing our company, clients gain a dedicated partner equipped with the expertise and resources to navigate market complexities effectively and achieve their business goals.

Research Methodology

The research methodology for studying the insurance industry combines both qualitative and quantitative approaches. It begins with secondary research, gathering data from industry reports, government publications, and regulatory filings to understand market trends and dynamics. This is followed by primary research, involving interviews and surveys with industry stakeholders, such as insurers and regulators, to capture insights on market challenges and customer behavior. Quantitative analysis includes examining market size, growth rates, and segmentation by product type and geography. Competitive analysis and trend evaluation are conducted to assess key players and emerging industry shifts, culminating in forecasts and actionable insights for strategic planning.

Market Entropy

Merger & Acquisition

Patent Analysis

Investment and Funding Scenario

Market Estimation Process

Market Highlights

|

Report Features |

Details |

|

Base Year |

2025 |

|

Based Year Market Size |

2.3 Trillion |

|

Historical Period |

2020 |

|

CAGR (2025to 2033) |

7.10% |

|

Forecast Period |

2033 |

|

Forecasted Period Market Size (2033) |

4.1 Trillion |

|

Scope of the Report |

|

|

Regions Covered |

North America, LATAM, West Europe, Central & Eastern Europe, Northern Europe, Southern Europe, East Asia, Southeast Asia, South Asia, Central Asia, Oceania, MEA |

|

Companies Covered |

JPMorgan Chase (USA), Bank of America (USA), Citigroup (USA), Goldman Sachs (USA), Morgan Stanley (USA), Wells Fargo (USA), Deutsche Bank (Germany), Barclays (UK), HSBC (UK), Crédit Agricole (France), BNP Paribas (France), RBS (UK), Standard Chartered (UK), UBS (Switzerland), ING (Netherlands) |

|

Customization Scope |

15% Free Customization (For EG) |

|

Delivery Format |

PDF and Excel through Email |

Asset-Backed Securities (ABS) - Table of Contents

Chapter 1: Market Preface

Chapter 2: Strategic Overview

Chapter 3: Global Asset-Backed Securities (ABS) Market Business Environment & Changing Dynamics

Chapter 4: Global Asset-Backed Securities (ABS) Industry Factors Assessment

Chapter 5: Asset-Backed Securities (ABS) : Competition Benchmarking & Performance Evaluation

Chapter 6: Global Asset-Backed Securities (ABS) Market: Company Profiles

Chapter 7: Global Asset-Backed Securities (ABS) by Type & Application (2020-2033)

Chapter 8: North America Asset-Backed Securities (ABS) Market Breakdown by Country, Type & Application

Chapter 9: Europe Asset-Backed Securities (ABS) Market Breakdown by Country, Type & Application

Chapter 10: Asia Pacific Asset-Backed Securities (ABS) Market Breakdown by Country, Type & Application

Chapter 11: Latin America Asset-Backed Securities (ABS) Market Breakdown by Country, Type & Application

Chapter 12: Middle East & Africa Asset-Backed Securities (ABS) Market Breakdown by Country, Type & Application

Chapter 13: Research Finding and Conclusion

Frequently Asked Questions (FAQ):

The Compact Track Loaders market is projected to grow at a CAGR of 6.8% from 2025 to 2030, driven by increasing demand in construction and agricultural sectors.

North America currently leads the market with approximately 45% market share, followed by Europe at 28% and Asia-Pacific at 22%. The remaining regions account for 5% of the global market.

Key growth drivers include increasing construction activities, rising demand for versatile equipment in agriculture, technological advancements in track loader design, and growing preference for compact equipment in urban construction projects.