Cloud-native Banking Systems Market Research Report

Global Cloud-native Banking Systems Market Scope & Changing Dynamics 2025-2033

Global Cloud-native Banking Systems Market is segmented by Application (Retail Banking, Commercial Banking, Investment Banking, Digital-Only Banks, Payment Services), Type (Core Banking Systems, API-Driven Platforms, Cloud-Based Payment Solutions, Digital Banking Platforms, Cloud Financial Services), and Geography (North America, LATAM, West Europe, Central & Eastern Europe, Northern Europe, Southern Europe, East Asia, Southeast Asia, South Asia, Central Asia, Oceania, MEA)

Pricing

INDUSTRY OVERVIEW

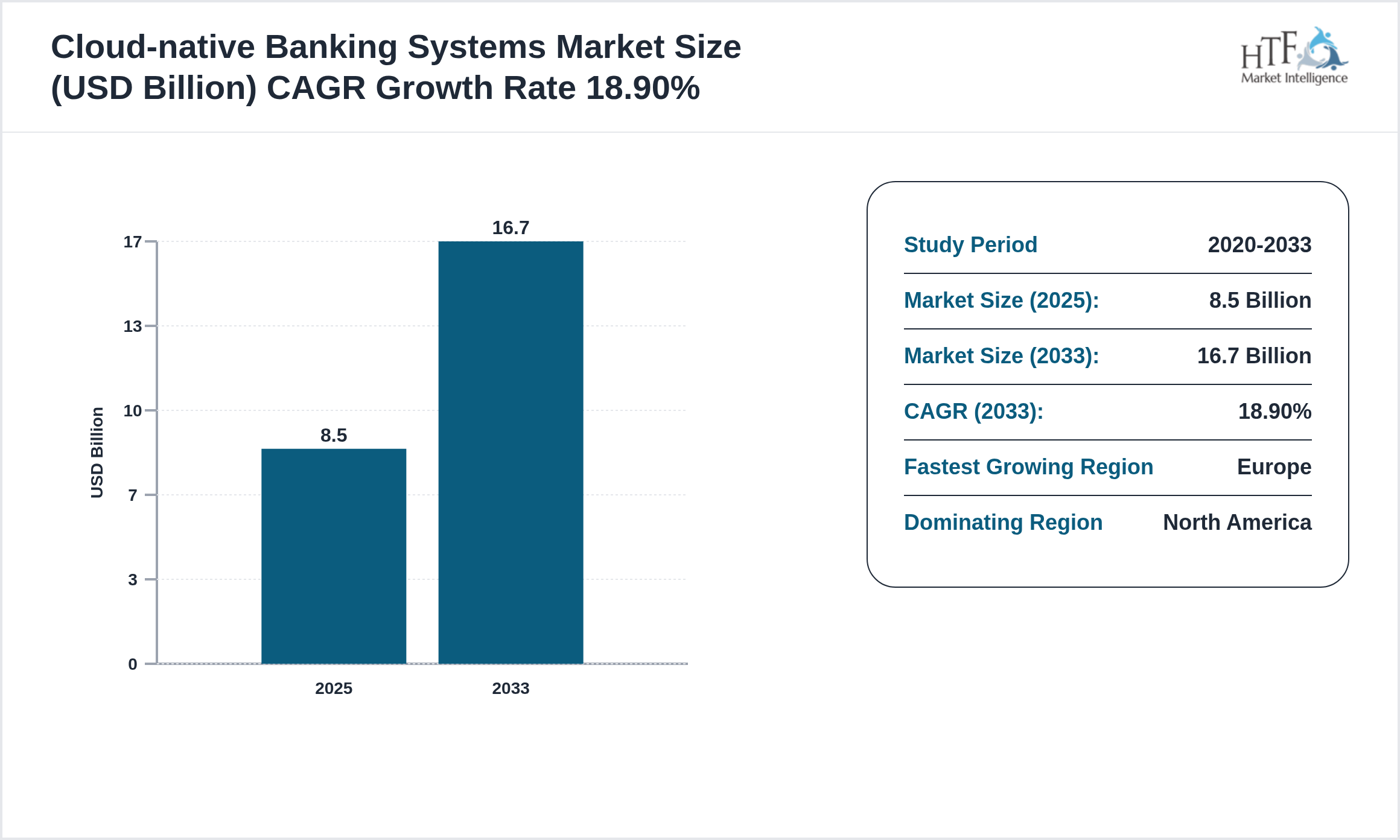

The Cloud-native Banking Systems market is experiencing robust growth, projected to achieve a compound annual growth rate CAGR of 18.90% during the forecast period. Valued at 8.5 Billion, the market is expected to reach 16.7 Billion by 2033, with a year-on-year growth rate of 16.30%. This upward trajectory is driven by factors such as evolving consumer preferences, technological advancements, and increased investment in innovation, positioning the market for significant expansion in the coming years. Companies should strategically focus on enhancing their offerings and exploring new market opportunities to capitalize on this growth potential.

The cloud-native banking systems market focuses on the migration of banking infrastructure and services to the cloud. Cloud-native systems allow banks to scale operations, reduce costs, and offer more personalized and agile services. With the rise of digital banking, banks are increasingly adopting cloud technologies to enhance customer experience, support regulatory compliance, and streamline operations, making the market grow rapidly.

Regulatory Landscape

- • Regulations focus on data security

Regulatory Framework

The Information and Communications Technology (ICT) industry is primarily regulated by the Federal Communications Commission (FCC) in the United States, along with other national and international regulatory bodies. The FCC oversees the allocation of spectrum, ensures compliance with telecommunications laws, and fosters fair competition within the sector. It also establishes guidelines for data privacy, cybersecurity, and service accessibility, which are crucial for maintaining industry standards and protecting consumer interests.

Globally, various regulatory agencies, such as the European Telecommunications Standards Institute (ETSI) and the International Telecommunication Union (ITU), play significant roles in standardizing practices and facilitating international cooperation. These bodies work together to create a cohesive regulatory framework that addresses emerging technologies, cross-border data flow, and infrastructure development. Their regulations aim to ensure the ICT industry's growth is both innovative and compliant with global standards, promoting a secure and competitive market environment.

Key Highlights

• The Cloud-native Banking Systems is growing at a CAGR of 18.90% during the forecasted period of 2020 to 2033

• Year on Year growth for the market is 16.30%

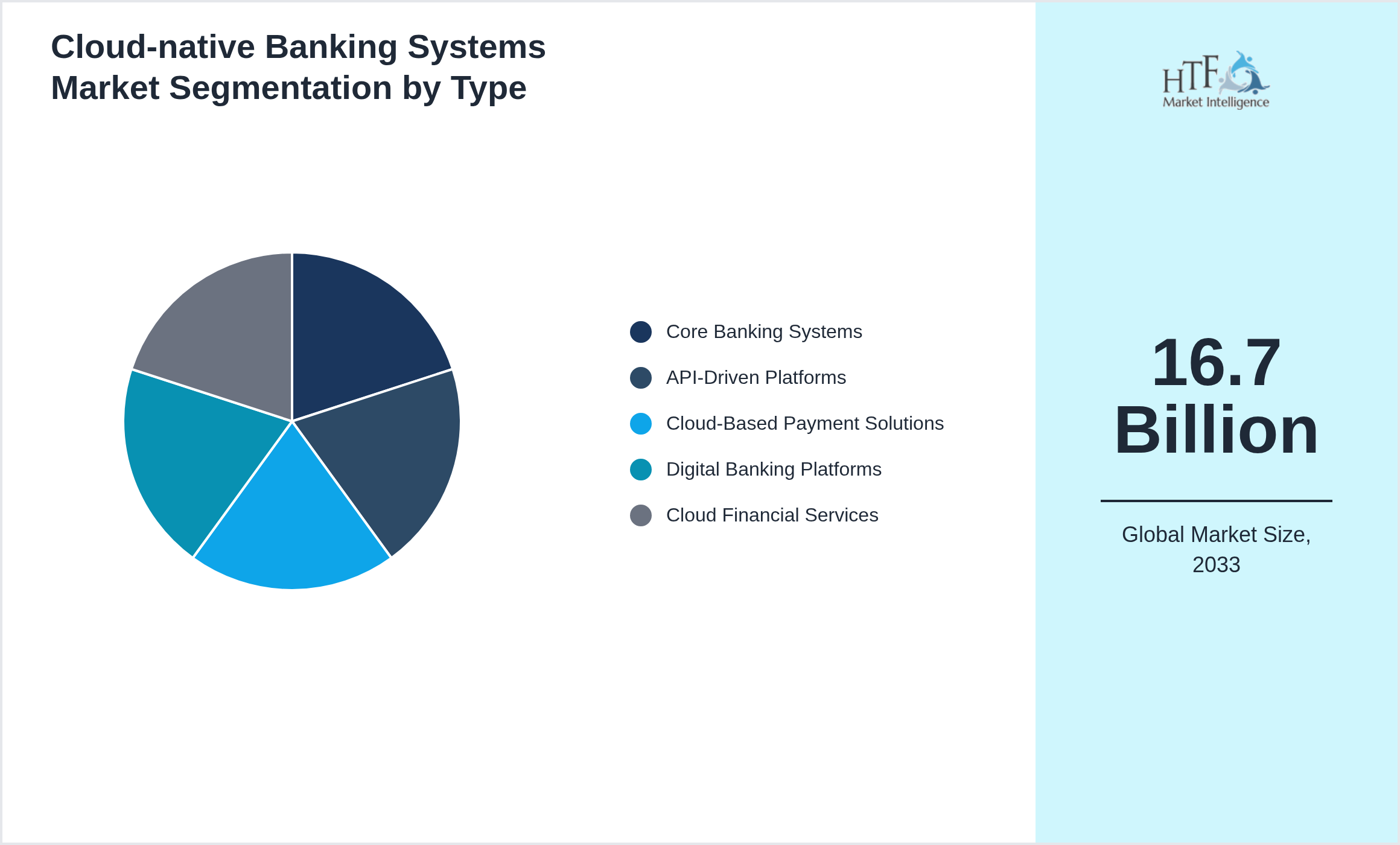

• Based on type, the market is bifurcated into Core Banking Systems, API-Driven Platforms, Cloud-Based Payment Solutions, Digital Banking Platforms, Cloud Financial Services

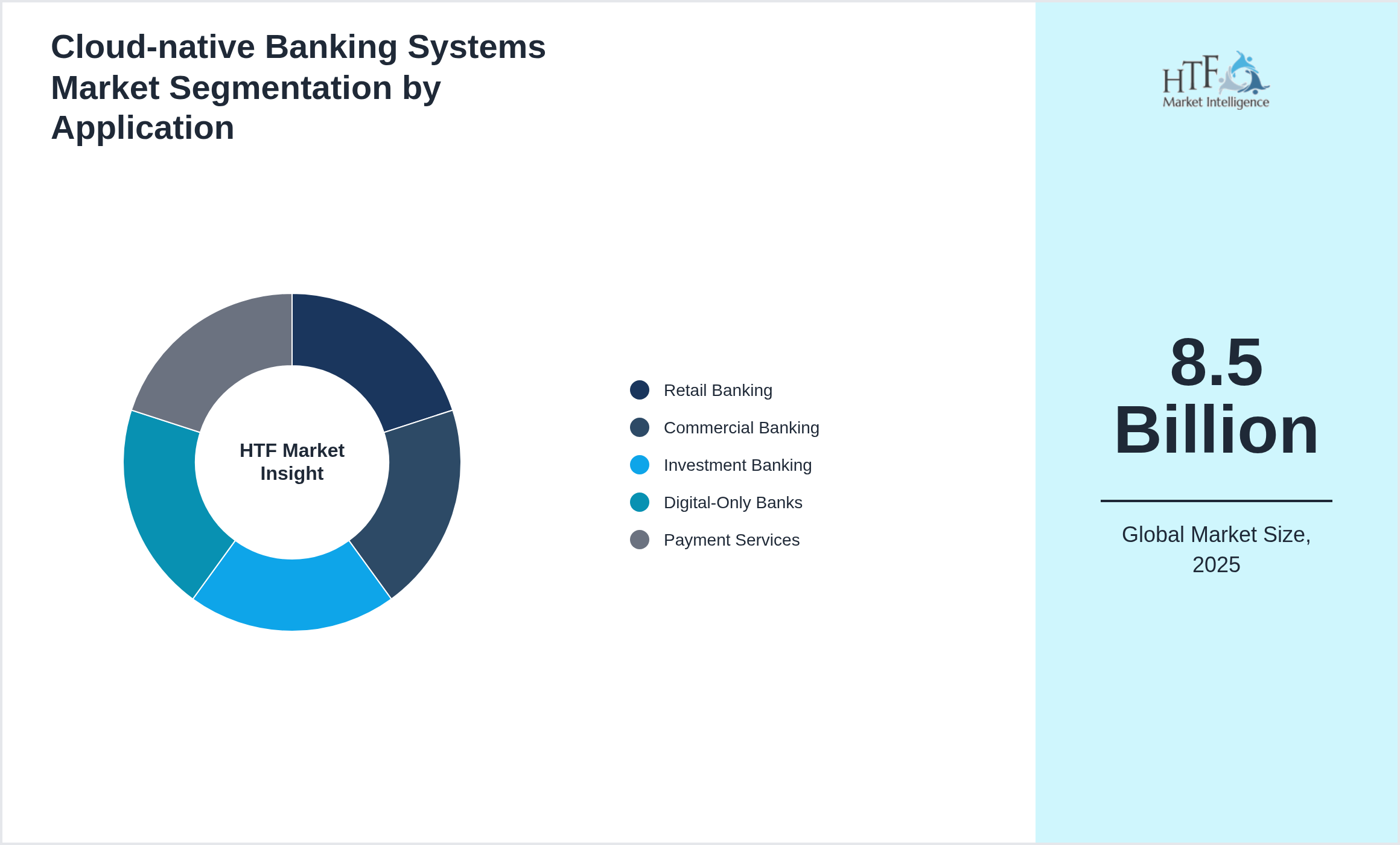

• Based on application, the market is segmented into Retail Banking, Commercial Banking, Investment Banking, Digital-Only Banks, Payment Services

• Global Import Export in terms of K Tons, K Units, and Metric Tons will be provided if Applicable based on industry best practice

Market Segmentation Analysis

Segmentation by Type

- • Core Banking Systems

- • API-Driven Platforms

- • Cloud-Based Payment Solutions

- • Digital Banking Platforms

- • Cloud Financial Services

Segmentation by Application

- • Retail Banking

- • Commercial Banking

- • Investment Banking

- • Digital-Only Banks

- • Payment Services

Key Players

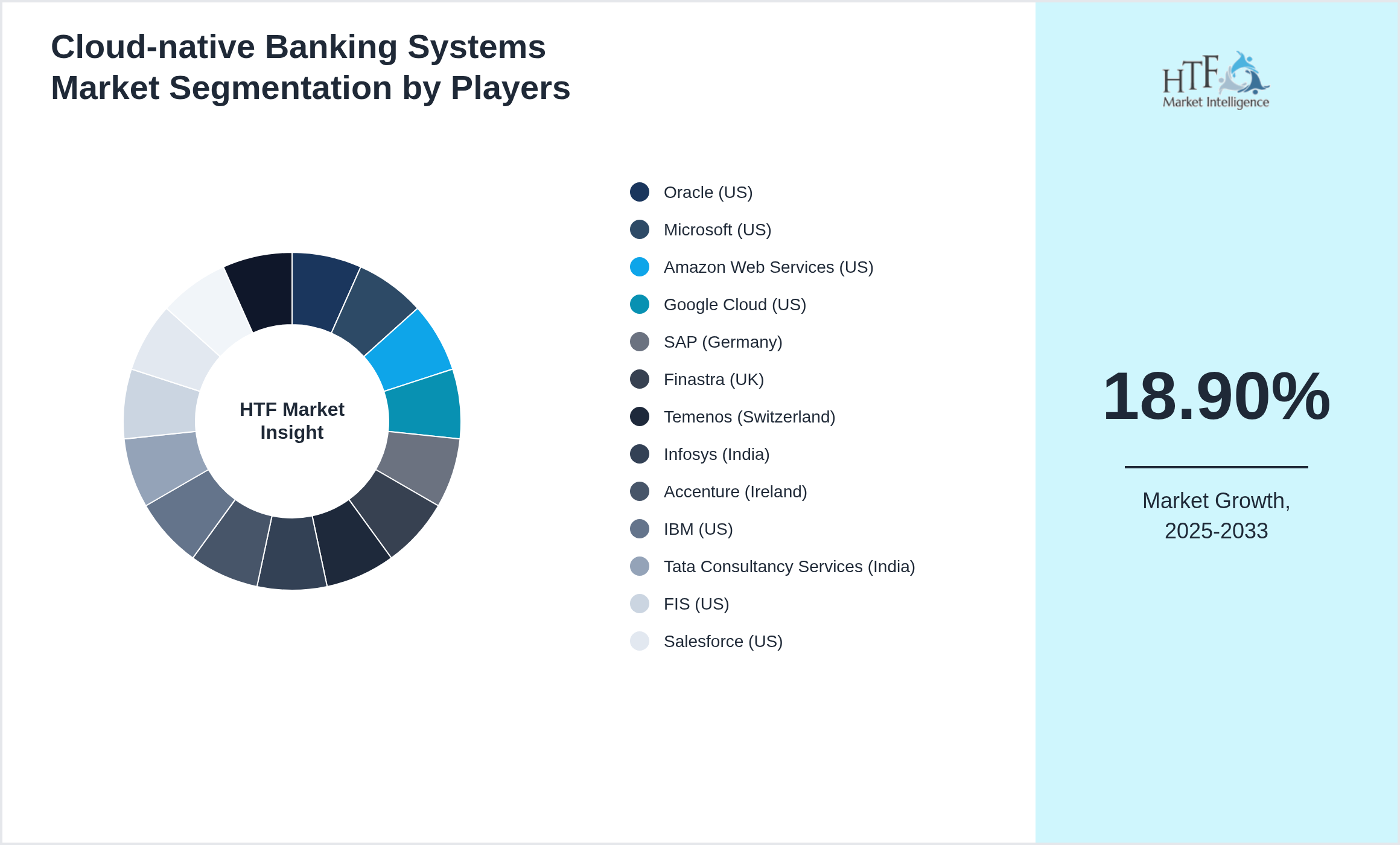

Several key players in the Cloud-native Banking Systems market are strategically focusing on expanding their operations in developing regions to capture a larger market share, particularly as the year-on-year growth rate for the market stands at 16.30%. The companies featured in this profile were selected based on insights from primary experts, evaluating their market penetration, product offerings, and geographical reach. By targeting emerging markets, these companies aim to leverage new opportunities, enhance their competitive advantage, and drive revenue growth. This approach not only aligns with their overall business objectives but also positions them to respond effectively to the evolving demands of consumers in these regions.

- • Oracle (US)

- • Microsoft (US)

- • Amazon Web Services (US)

- • Google Cloud (US)

- • SAP (Germany)

- • Finastra (UK)

- • Temenos (Switzerland)

- • Infosys (India)

- • Accenture (Ireland)

- • IBM (US)

- • Tata Consultancy Services (India)

- • FIS (US)

- • Salesforce (US)

- • CoreLogic (US)

- • Veeva Systems (US)

Research Methodology

At HTF Market Intelligence, we pride ourselves on delivering comprehensive market research that combines both secondary and primary methodologies. Our secondary research involves rigorous analysis of existing data sources, such as industry reports, market databases, and competitive landscapes, to provide a robust foundation of market knowledge. This is complemented by our primary research services, where we gather firsthand data through surveys, interviews, and focus groups tailored specifically to your business needs. By integrating these approaches, we offer a thorough understanding of market trends, consumer behavior, and competitive dynamics, enabling you to make well-informed strategic decisions. We would welcome the opportunity to discuss how our research expertise can support your business objectives.

Market Dynamics

Market dynamics refer to the forces that influence the supply and demand of products and services within a market. These forces include factors such as consumer preferences, technological advancements, regulatory changes, economic conditions, and competitive actions. Understanding market dynamics is crucial for businesses as it helps them anticipate changes, identify opportunities, and mitigate risks.

By analyzing market dynamics, companies can better understand market trends, predict potential shifts, and develop strategic responses. This analysis enables businesses to align their product offerings, pricing strategies, and marketing efforts with evolving market conditions, ultimately leading to more informed decision-making and a stronger competitive position in the marketplace.

Market Driver

- • Rising Demand For Scalable Banking Solutions

- • Need For Cost-Effective Banking Operations

- • Growth Of Digital Banking

- • Increased Adoption Of Cloud Technology

- • Consumer Demand For Seamless Digital Services

Market Trend

- • Focus On Cloud Security Solutions

- • Integration With Artificial Intelligence

- • Increased Adoption Of API-Driven Banking

- • Growth Of Open Banking Platforms

- • Expansion Of Banking-as-a-Service Solutions

- • Expansion In Cloud-Based Mobile Banking

- • Rise Of Digital-Only Banks

- • Growth Of Open Banking Solutions

- • Demand For Real-Time Payment Solutions

- • Integration With Fintech Companies

Challenge

- • High Migration Costs

- • Data Security Concerns

- • Integration Challenges

- • Regulatory Barriers

- • Limited Industry Awareness

Regional Analysis

- • Growing demand globally

- • May 2024 – DBS Bank and HSBC launched cloud-native banking systems to improve scalability

- • April

- • Regulations focus on data security

- • Patents focus on cloud architecture

- • Investment in cloud-native banking systems is increasing as financial institutions look for scalable and flexible solutions to improve operational efficiency. Companies are focusing on enhancing cloud integration and automation.

Regional Outlook

The North America Region holds the largest market share in 2025 and is expected to grow at a good CAGR. The Europe Region is the fastest-growing region due to increasing development and disposable income.

North America remains a leader, driven by innovation hubs like Silicon Valley and a strong demand for advanced technologies such as AI and cloud computing. Europe is characterized by robust regulatory frameworks and significant investments in digital transformation across sectors. Asia-Pacific is experiencing rapid growth, led by major markets like China and India, where increasing digital adoption and governmental initiatives are propelling ICT advancements.

The Middle East and Africa are witnessing steady expansion, driven by infrastructure development and growing internet penetration. Latin America and South America present emerging opportunities, with rising investments in digital infrastructure, though challenges like economic instability can impact growth. These regional differences highlight the need for tailored strategies in the global ICT market.

- North America

- LATAM

- West Europe

- Central & Eastern Europe

- Northern Europe

- Southern Europe

- East Asia

- Southeast Asia

- South Asia

- Central Asia

- Oceania

- MEA

|

Report Features |

Details |

|

Base Year |

2025 |

|

Based Year Market Size (2025) |

8.5 Billion |

|

Historical Period Market Size (2020) |

USD Million ZZ |

|

CAGR (2025 to 2033) |

18.90% |

|

Forecast Period |

2025 to 2033 |

|

Forecasted Period Market Size (2033) |

16.7 Billion |

|

Scope of the Report |

Core Banking Systems, API-Driven Platforms, Cloud-Based Payment Solutions, Digital Banking Platforms, Cloud Financial Services, Retail Banking, Commercial Banking, Investment Banking, Digital-Only Banks, Payment Services |

|

Regions Covered |

North America, Europe, Asia Pacific, South America, and MEA |

|

Year on Year Growth |

16.30% |

|

Companies Covered |

Oracle (US), Microsoft (US), Amazon Web Services (US), Google Cloud (US), SAP (Germany), Finastra (UK), Temenos (Switzerland), Infosys (India), Accenture (Ireland), IBM (US), Tata Consultancy Services (India), FIS (US), Salesforce (US), CoreLogic (US), Veeva Systems (US) |

|

Customization Scope |

15% Free Customization (For EG) |

|

Delivery Format |

PDF and Excel through Email |

Cloud-native Banking Systems - Table of Contents

Chapter 1: Market Preface

Chapter 2: Strategic Overview

Chapter 3: Global Cloud-native Banking Systems Market Business Environment & Changing Dynamics

Chapter 4: Global Cloud-native Banking Systems Industry Factors Assessment

Chapter 5: Cloud-native Banking Systems : Competition Benchmarking & Performance Evaluation

Chapter 6: Global Cloud-native Banking Systems Market: Company Profiles

Chapter 7: Global Cloud-native Banking Systems by Type & Application (2020-2033)

Chapter 8: North America Cloud-native Banking Systems Market Breakdown by Country, Type & Application

Chapter 9: Europe Cloud-native Banking Systems Market Breakdown by Country, Type & Application

Chapter 10: Asia Pacific Cloud-native Banking Systems Market Breakdown by Country, Type & Application

Chapter 11: Latin America Cloud-native Banking Systems Market Breakdown by Country, Type & Application

Chapter 12: Middle East & Africa Cloud-native Banking Systems Market Breakdown by Country, Type & Application

Chapter 13: Research Finding and Conclusion

Frequently Asked Questions (FAQ):

The Compact Track Loaders market is expected to see value worth 5.3 Billion in 2025.

North America currently leads the market with approximately 45% market share, followed by Europe at 28% and Asia-Pacific at 22%. The remaining regions account for 5% of the global market.

Key growth drivers include increasing construction activities, rising demand for versatile equipment in agriculture, technological advancements in track loader design, and growing preference for compact equipment in urban construction projects.