Extruded Polystyrene (XPS) Foam Market Research Report

Extruded Polystyrene (XPS) Foam Market - Global Share, Size & Changing Dynamics 2020-2033

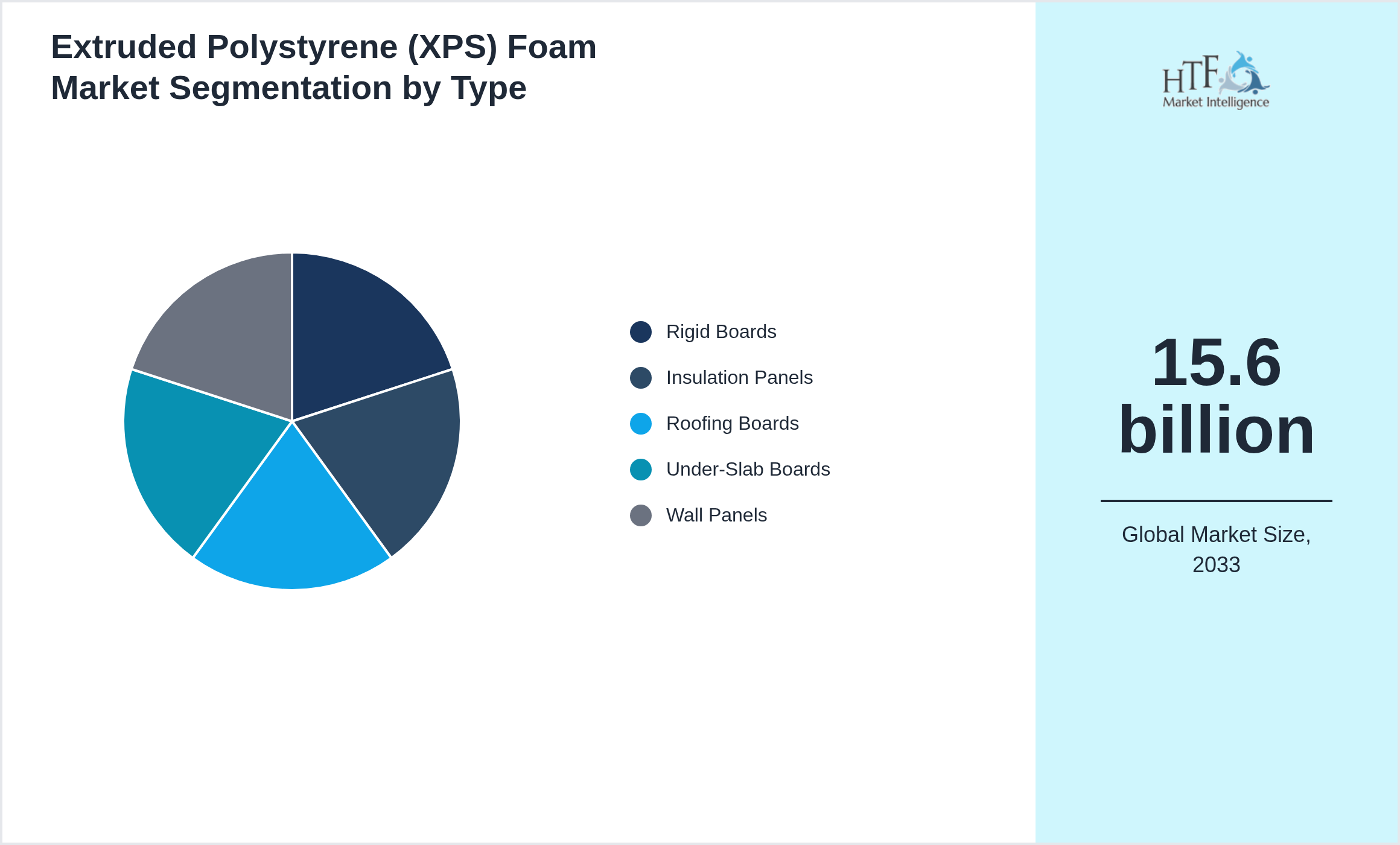

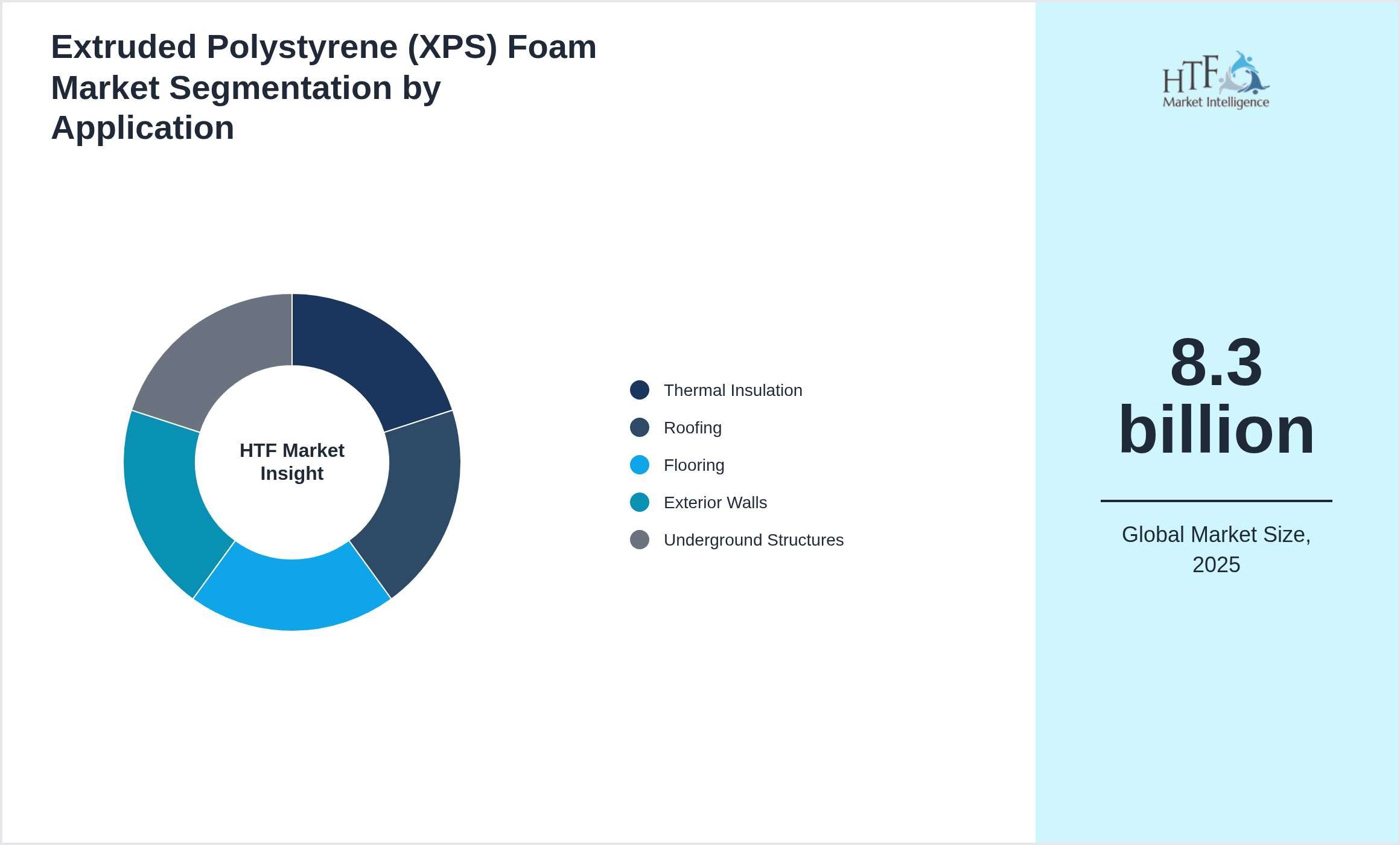

Global Extruded Polystyrene (XPS) Foam Market is segmented by Application (Thermal Insulation, Roofing, Flooring, Exterior Walls, Underground Structures), Type (Rigid Boards, Insulation Panels, Roofing Boards, Under-Slab Boards, Wall Panels), and Geography (North America, LATAM, West Europe, Central & Eastern Europe, Northern Europe, Southern Europe, East Asia, Southeast Asia, South Asia, Central Asia, Oceania, MEA)

Pricing

Industry Overview

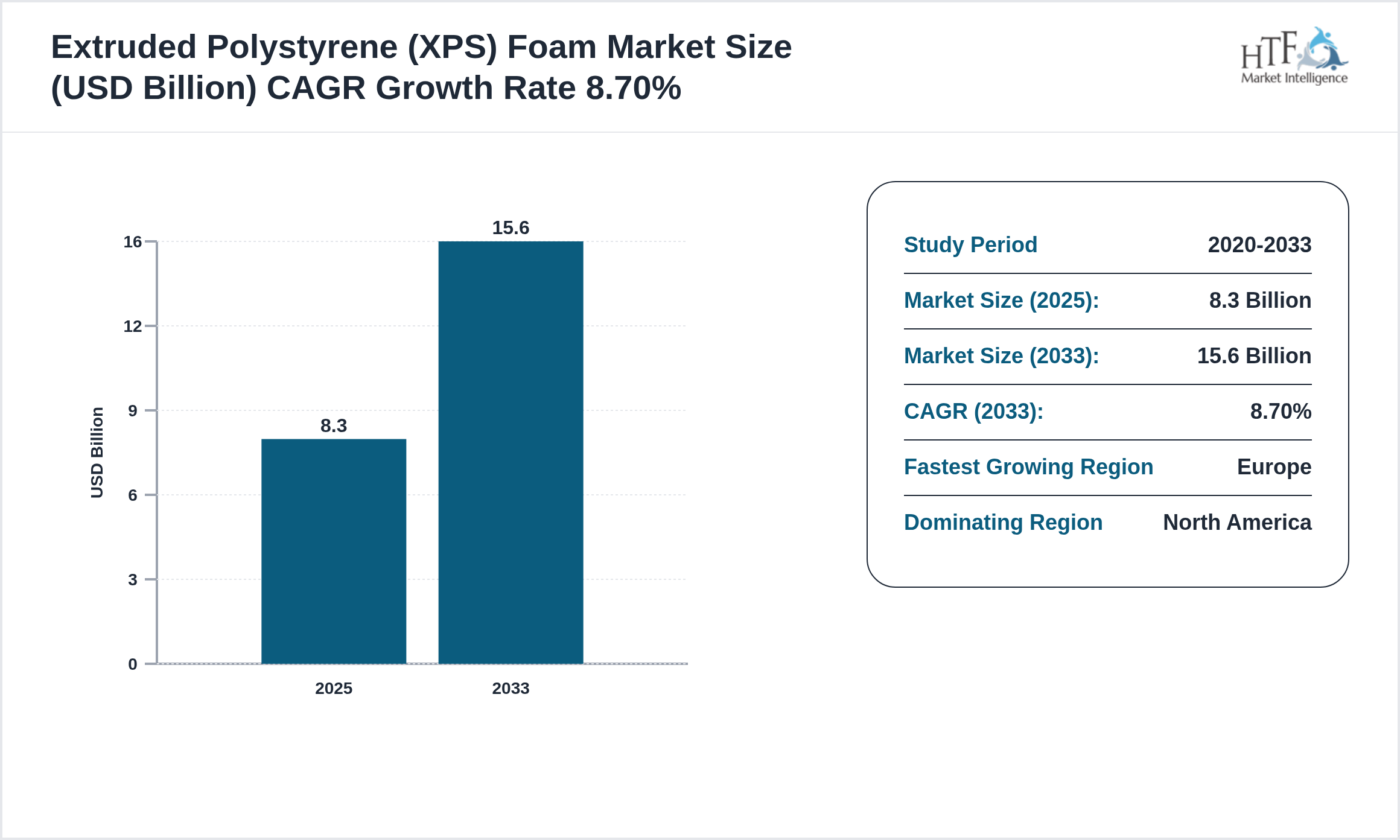

According to the HTF Market Report, the Extruded Polystyrene (XPS) Foam market is expected to see a growth of 8.70% and may reach a market size of 15.6 billion by 2033, currently valued at 8.3 billion.

XPS foam is a rigid, closed-cell insulation material used in building construction, particularly for roofs, walls, and floors. It offers excellent thermal resistance, moisture resistance, and structural stability. XPS is widely used in energy-efficient buildings and sustainable construction. Market growth is driven by construction expansion, government regulations, and increasing demand for high-performance insulation solutions.

The chemical industry is a building block of the world's economy, driving innovation in sectors like pharmaceuticals and agriculture. It covers the production of base materials, including chemicals, polymers, and specialty compounds, integral to practically all products and processes. Companies in this sector are primary actors in supply chains, ensuring raw materials for manufacturing, construction, and consumer goods. With a focus on sustainability, the industry is increasingly investing in green chemistry and circular economy initiatives to reduce environmental impact. This industry will continue to grow with technological advancements, regulatory compliance, and market demand for more sustainable and innovative solutions; hence, it is energetic and a significant contributor in the business arena.

Key Player Analysis

The key players in the Extruded Polystyrene (XPS) Foam are intensifying their focus on research and development (R&D) activities to innovate and stay competitive. Major companies, such as BASF (Germany), Owens Corning (US), Dow (US), Kingspan (Ireland), Knauf Insulation (Germany), Atlas Roofing (US), Armacell (Germany), Recticel (Belgium), ACH Foam Technologies (US), URSA (Spain), XPS Polymers (US), Foamglas (US), Synthos (Poland), Covestro (Germany), Isocell (Austria) are heavily investing in R&D to develop new products and improve existing ones. This strategic emphasis on innovation is driving significant advancements in product formulation and the introduction of sustainable and eco-friendly products.

Additionally, these industry leaders are actively acquiring smaller companies to broaden their regional presence and strengthen their market share. These acquisitions not only diversify product portfolios but also provide access to new technologies and markets, fostering growth within the Extruded Polystyrene (XPS) Foam through operational streamlining and cost reduction.

Moreover, there is a clear shift toward green investments, with companies allocating more resources to sustainable practices and the development of environmentally friendly products. This response to increasing consumer demand for sustainable solutions and stricter environmental regulations positions these companies as leaders in green chemistry, further driving market growth.

The companies highlighted in this profile were selected based on insights from primary experts and an evaluation of their market penetration, product offerings, and geographical reach. We also include recent years' innovation and strategies followed by companies who are growing in the market:

- • BASF (Germany)

- • Owens Corning (US)

- • Dow (US)

- • Kingspan (Ireland)

- • Knauf Insulation (Germany)

- • Atlas Roofing (US)

- • Armacell (Germany)

- • Recticel (Belgium)

- • ACH Foam Technologies (US)

- • URSA (Spain)

- • XPS Polymers (US)

- • Foamglas (US)

- • Synthos (Poland)

- • Covestro (Germany)

- • Isocell (Austria)

Regional Insights

The chemical industry exhibits significant regional variation, driven by factors such as resource availability, regulatory environments, and economic conditions. In North America, the industry is maintained by abundant natural resources, particularly shale gas, which provides a competitive advantage in petrochemical production. The U.S. remains a key player, with ongoing investments in advanced manufacturing technologies and sustainable practices positioning the region as a leader in innovation.

In Europe, stringent environmental regulations and a strong emphasis on sustainability are shaping the chemical industry. The European Green Deal is pushing companies toward greener production methods, fostering growth in bio-based chemicals and recycling initiatives. Despite these opportunities, the region faces challenges from high energy costs and regulatory pressures, which are driving companies to seek efficiencies and explore new markets.

Asia-Pacific is the fastest-growing region, fuelled by rapid industrialization, urbanization, and a growing middle class. China dominates the regional market, supported by substantial investments in infrastructure and innovation. India and Southeast Asia are also emerging as key players, with increasing demand for chemicals in agriculture, construction, and electronics sectors.

Overall, regional dynamics in the chemical industry are shaped by local market conditions, regulatory landscapes, and the global push for sustainability, leading to diverse growth opportunities across different markets.

This report also splits the market by region

- North America

- LATAM

- West Europe

- Central & Eastern Europe

- Northern Europe

- Southern Europe

- East Asia

- Southeast Asia

- South Asia

- Central Asia

- Oceania

- MEA

Market Segmentation

Segmentation by Type

- • Rigid Boards

- • Insulation Panels

- • Roofing Boards

- • Under-Slab Boards

- • Wall Panels

Segmentation by Application

- • Thermal Insulation

- • Roofing

- • Flooring

- • Exterior Walls

- • Underground Structures

Regulatory Overview

The chemical industry is based on a regulatory framework that makes sure the industry does not harm the people, or the environment, or breach international standards. These regulations run from production to handling, storage, and disposal. The key legislations generally include the EU's REACH system and the US TSCA, which have also put stringent testing, reporting, and labeling requirements for chemical substances. Compliance with the above legislation requires that companies implement good safety management systems, conduct periodic audits, and monitor environmental performance continually. Apart from that, industry players also have to be abreast of changing legislation and newly emerging global standards on hazardous substances, waste management, and sustainability undertakings. Non-compliance can lead to substantial penalties, reputational damage, and operational discontinuations, which make adherence a key business issue.

Market Growth Drivers:

The Extruded Polystyrene (XPS) Foam Market is experiencing significant growth due to various factors.

- • Growing Construction Industry

- • Need For High Thermal Insulation

- • Expansion Of Green Buildings

- • Lightweight Construction Demand

- • Government Energy Efficiency Policies Drive Growth.

Influencing Trend:

The Extruded Polystyrene (XPS) Foam Market is growing rapidly due to various factors.

- • Growth In Energy-Efficient Buildings

- • Integration With Sustainable Construction

- • Increased Use In Cold Storage And Refrigeration

- • Expansion Of Prefabricated Buildings

- • Development Of Water-Resistant XPS Are Trends.

Opportunities:

The Extruded Polystyrene (XPS) Foam has several opportunities, particularly in developing countries where industrialization is growing.

- • High Raw Material Costs

- • Limited Recycling Options

- • Environmental Concerns

- • Price Competition

- • Volatility In Styrene Prices Are Challenges.

Challenges:

The market for fluid power systems faces several obstacles despite its promising growth possibilities.

- • Expansion Into Emerging Markets

- • Development Of High-Performance XPS

- • Growth In Residential And Commercial Insulation

- • Investment In Sustainable Manufacturing Practices

- • Adoption In Industrial Applications Present Opportunities.

Report Infographics:

Report Features

|

Details

|

Base Year

|

2025

|

Based Year Market Size

|

8.3 billion

|

Historical Period

|

2020

|

CAGR (2025 to 2033)

|

8.70%

|

Forecast Period

|

2033

|

Forecasted Period Market Size (2033)

|

15.6 billion

|

Scope of the Report

|

Rigid Boards, Insulation Panels, Roofing Boards, Under-Slab Boards, Wall Panels, Thermal Insulation, Roofing, Flooring, Exterior Walls, Underground Structures

|

Regions Covered

|

North America, Europe, Asia Pacific, Latin America, and MEA

|

Companies Covered

|

BASF (Germany), Owens Corning (US), Dow (US), Kingspan (Ireland), Knauf Insulation (Germany), Atlas Roofing (US), Armacell (Germany), Recticel (Belgium), ACH Foam Technologies (US), URSA (Spain), XPS Polymers (US), Foamglas (US), Synthos (Poland), Covestro (Germany), Isocell (Austria)

|

Customization Scope

|

15% Free Customization (For EG)

|

Delivery Format

|

PDF and Excel through Email

|

Report Coverage

The study on the Extruded Polystyrene (XPS) Foam market provides a thorough examination of the sector. Important company profiles, new product releases, significant mergers, acquisitions, and collaborations, as well as the incidence of osteoarthritis in important nations, are also highlighted in the research.

Extruded Polystyrene (XPS) Foam - Table of Contents

Chapter 1: Market Preface

Chapter 2: Strategic Overview

Chapter 3: Global Extruded Polystyrene (XPS) Foam Market Business Environment & Changing Dynamics

Chapter 4: Global Extruded Polystyrene (XPS) Foam Industry Factors Assessment

Chapter 5: Extruded Polystyrene (XPS) Foam : Competition Benchmarking & Performance Evaluation

Chapter 6: Global Extruded Polystyrene (XPS) Foam Market: Company Profiles

Chapter 7: Global Extruded Polystyrene (XPS) Foam by Type & Application (2020-2033)

Chapter 8: North America Extruded Polystyrene (XPS) Foam Market Breakdown by Country, Type & Application

Chapter 9: Europe Extruded Polystyrene (XPS) Foam Market Breakdown by Country, Type & Application

Chapter 10: Asia Pacific Extruded Polystyrene (XPS) Foam Market Breakdown by Country, Type & Application

Chapter 11: Latin America Extruded Polystyrene (XPS) Foam Market Breakdown by Country, Type & Application

Chapter 12: Middle East & Africa Extruded Polystyrene (XPS) Foam Market Breakdown by Country, Type & Application

Chapter 13: Research Finding and Conclusion

Frequently Asked Questions (FAQ):

The Compact Track Loaders market is projected to grow at a CAGR of 6.8% from 2025 to 2030, driven by increasing demand in construction and agricultural sectors.

North America currently leads the market with approximately 45% market share, followed by Europe at 28% and Asia-Pacific at 22%. The remaining regions account for 5% of the global market.

Key growth drivers include increasing construction activities, rising demand for versatile equipment in agriculture, technological advancements in track loader design, and growing preference for compact equipment in urban construction projects.