Remote and Hybrid Learning Market Research Report

Remote and Hybrid Learning Industry to See Astonishing Growth

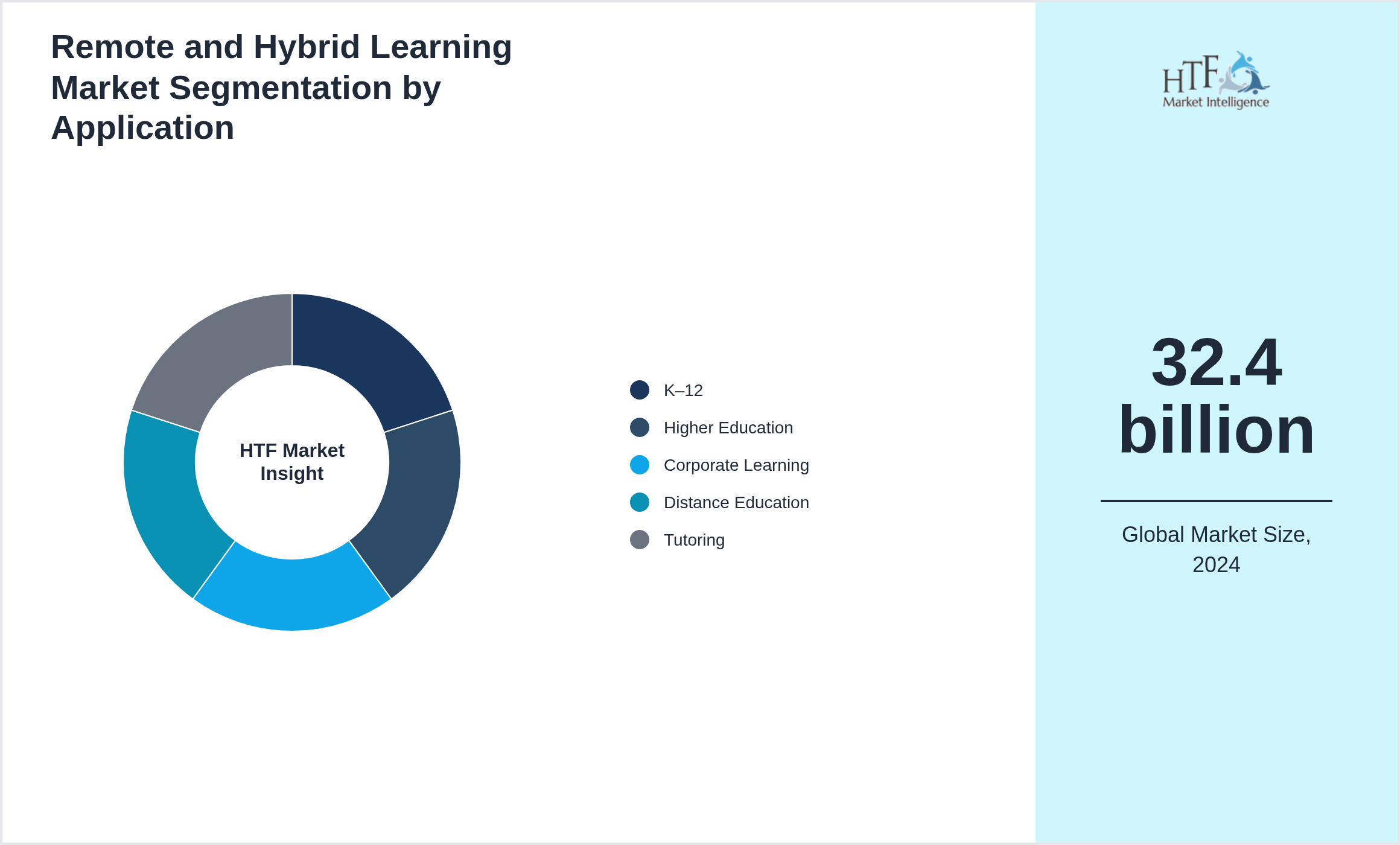

Global Remote and Hybrid Learning Market is segmented by Application (K–12, Higher Education, Corporate Learning, Distance Education, Tutoring), Type (Virtual Classrooms, LMS Platforms, Video Conferencing, Assessment Tools, Collaborative Apps), and Geography (North America, LATAM, West Europe, Central & Eastern Europe, Northern Europe, Southern Europe, East Asia, Southeast Asia, South Asia, Central Asia, Oceania, MEA)

Pricing

Industry Overview

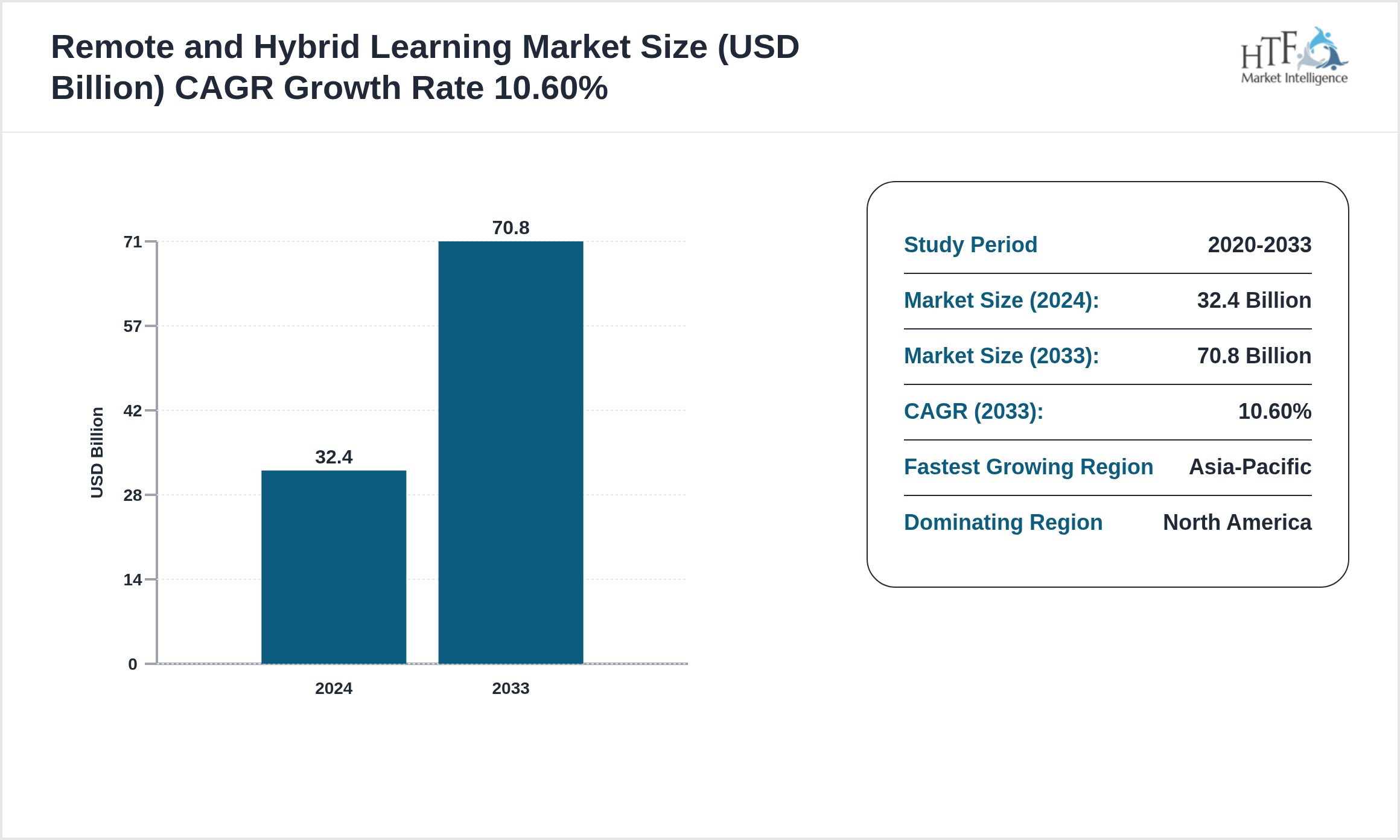

The Remote and Hybrid Learning Market is expected to reach 70.8 billion by 2033 and is growing at a CAGR of10.60% between 2024 to 2033.

The Remote and Hybrid Learning Market refers to digital systems and platforms enabling synchronous and asynchronous learning through online and blended environments. It includes LMS platforms, video conferencing tools, and AI-powered assessment systems. The model promotes accessibility, flexibility, and continuity in education while reshaping institutional delivery frameworks for the digital era.

The consumer goods market consists of various components, including product categories (durable and non-durable goods), distribution channels (retail stores, e-commerce, and wholesalers), and market segmentation based on demographics and consumer behavior. Marketing strategies, such as advertising and branding, play a crucial role in attracting consumers, while trends like sustainability and health consciousness influence purchasing decisions. Additionally, the regulatory environment impacts product development, and effective supply chain management ensures timely delivery. Pricing strategies must consider competition and consumer demand to optimize sales. Together, these elements shape the dynamics of the consumer goods market.

Market Segmentation

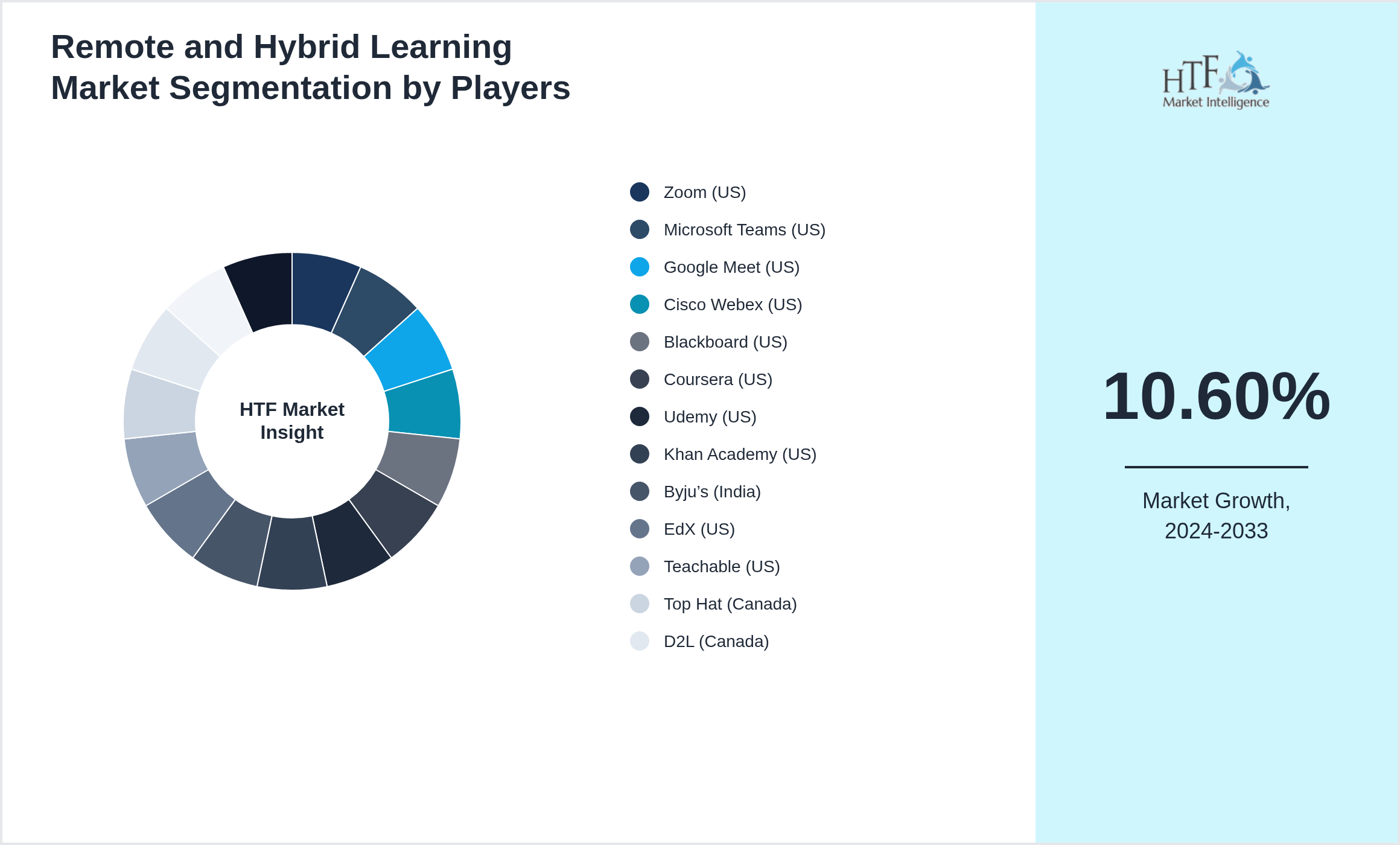

Selecting segmentation criteria in Zoom (US), Microsoft Teams (US), Google Meet (US), Cisco Webex (US), Blackboard (US), Coursera (US), Udemy (US), Khan Academy (US), Byju’s (India), EdX (US), Teachable (US), Top Hat (Canada), D2L (Canada), TalentLMS (Greece), Class Technologies (US) involves several key steps. Researchers begin by defining their objectives, such as understanding consumer behavior or identifying market opportunities. They then gather relevant data on demographics, psychographics, and buying behavior. Next, they identify segmentation variables like age, location, lifestyle, and purchase patterns. Using analytical tools, they analyze the data to find distinct market segments and evaluate their attractiveness based on size, growth potential, and alignment with business goals. Detailed profiles are created for each segment, and the most promising ones are selected for targeting. Finally, tailored marketing strategies are developed, and the performance of these strategies is monitored and adjusted as needed. This process ensures that segmentation effectively identifies valuable market opportunities and aligns with strategic goals.

The North AmericaRegion holds a dominant market share, primarily driven by growing consumption patterns, a rising population, and robust economic activity that fuels market demand. Meanwhile, the Asia-Pacific Region is experiencing the fastest growth, propelled by increasing infrastructure developments, expanding industrial activities, and a surge in consumer demand, positioning it as a key driver for future market expansion.

Segmentation by Type

- • Virtual Classrooms

- • LMS Platforms

- • Video Conferencing

- • Assessment Tools

- • Collaborative Apps

Segmentation by Application

- • K–12

- • Higher Education

- • Corporate Learning

- • Distance Education

- • Tutoring

Regional Insight

The Remote and Hybrid Learning varies widely by region, reflecting diverse economic conditions and consumer preferences. In North America, the focus is on convenience and premium products, driven by high disposable incomes and a strong e-commerce sector. Europe’s market is fragmented, with Western countries emphasizing luxury and organic goods, while Eastern Europe sees rapid growth. Asia-Pacific is a fast-growing region with high demand for both high-tech and affordable products, driven by urbanization and rising middle-class incomes. Latin America prioritizes affordability amidst economic fluctuations, with Brazil and Mexico leading in market growth. In the Middle East and Africa, market trends are influenced by cultural preferences, with luxury goods prominent in the Gulf States and gradual growth in sub-Saharan Africa. Global trends like sustainability and digital transformation are impacting all regions.

The North Americadominant region currently dominates the market share, fueled by increasing consumption, population growth, and sustained economic progress that collectively enhance market demand. Conversely, the Asia-Pacificis thefastest-growing that is rapidly becoming the fastest-growing region, driven by significant infrastructure investments, industrial expansion, and rising consumer demand.

- North America

- LATAM

- West Europe

- Central & Eastern Europe

- Northern Europe

- Southern Europe

- East Asia

- Southeast Asia

- South Asia

- Central Asia

- Oceania

- MEA

Key Players

The companies highlighted in this profile were selected based on insights from primary experts and an evaluation of their market penetration, product offerings, and geographical reach:

- • Zoom (US)

- • Microsoft Teams (US)

- • Google Meet (US)

- • Cisco Webex (US)

- • Blackboard (US)

- • Coursera (US)

- • Udemy (US)

- • Khan Academy (US)

- • Byju’s (India)

- • EdX (US)

- • Teachable (US)

- • Top Hat (Canada)

- • D2L (Canada)

- • TalentLMS (Greece)

- • Class Technologies (US)

Merger & Acquisition

Report Infographics:

| Report Features | Details |

| Base Year | 2024 |

| Based Year Market Size 2024 | 32.4 billion |

| Historical Period Market Size 2020 | USD Million ZZ |

| CAGR (2024to 2033) | 10.60% |

| Forecast Period | 2024 to 2033 |

| Forecasted Period Market Size 2033 | 70.8 billion |

| Scope of the Report | Virtual Classrooms, LMS Platforms, Video Conferencing, Assessment Tools, Collaborative Apps, K–12, Higher Education, Corporate Learning, Distance Education, Tutoring |

| Regions Covered | North America, Europe, Asia Pacific, South America, and MEA |

| Year-on-Year Growth | 8.90% |

| Companies Covered | Zoom (US), Microsoft Teams (US), Google Meet (US), Cisco Webex (US), Blackboard (US), Coursera (US), Udemy (US), Khan Academy (US), Byju’s (India), EdX (US), Teachable (US), Top Hat (Canada), D2L (Canada), TalentLMS (Greece), Class Technologies (US) |

| Customization Scope | 15% Free Customization (For EG) |

| Delivery Format | PDF and Excel through Email |

Remote and Hybrid Learning Market Dynamics

TheRemote and Hybrid Learning is driven by factors such as increasing demand in end-use industries, technological advancements, research and development (R&D), economic growth, and increasing global trade.

Influencing Trend:

- • Adoption of hybrid academic models

- • AI-enhanced LMS platforms

- • cloud collaboration tools

- • mobile learning apps and VR-enabled classrooms.

- • Driven by demand for accessible education

- • global digital transformation and flexibility in learning formats

- • especially after COVID-19.

- • Connectivity gaps

- • lack of engagement

- • cybersecurity threats

- • digital divide and burnout among teachers and students.

- • Integration of VR/AR tools

- • AI-based personalization

- • scalable digital infrastructure and cross-border academic partnerships driving global reach.

Regulatory Framework

The regulatory framework for the Remote and Hybrid Learning ensures product safety, fair competition, and consumer protection. It encompasses setting standards for product quality and safety, enforcing truthful advertising and labeling, and implementing environmental sustainability practices. Regulations include robust procedures for product recalls, data protection, and anti-competitive practices, while also overseeing import/export controls and intellectual property rights. Regulatory bodies enforce these rules through inspections and penalties, and consumer education programs help individuals make informed decisions. This framework aims to protect consumers, promote fair market conditions, and encourage ethical business practices.

Competitive Insights

The key players in the Remote and Hybrid Learning are intensifying their focus on research and development (R&D) activities to innovate and stay competitive. Major companies, such as Zoom (US), Microsoft Teams (US), Google Meet (US), Cisco Webex (US), Blackboard (US), Coursera (US), Udemy (US), Khan Academy (US), Byju’s (India), EdX (US), Teachable (US), Top Hat (Canada), D2L (Canada), TalentLMS (Greece), Class Technologies (US) are heavily investing in R&D to develop new products and improve existing ones. This strategic emphasis on innovation is driving significant advancements in product formulation and the introduction of sustainable and eco-friendly products.

Moreover, these established industry leaders are actively pursuing acquisitions of smaller companies to expand their regional presence and enhance their market share. These acquisitions not only help in diversifying their product portfolios but also provide access to new technologies and markets. This consolidation trend is a critical factor in the growth of the consumer goods industry, as it enables larger companies to streamline operations, reduce costs, and increase their competitive edge.

In addition to R&D and acquisitions, there is a notable shift towards green investments among key players in the consumer goods industry. Companies are increasingly committing resources to sustainable practices and the development of environmentally friendly products. This green investment is in response to growing consumer demand for sustainable solutions and stringent environmental regulations. By prioritizing sustainability, these companies are not only contributing to environmental protection but also positioning themselves as leaders in the green movement, thereby fueling market growth.

Research Methodology

The research methodology for the consumer goods industry involves several key steps to ensure comprehensive and actionable insights. First, the research objectives are clearly defined, focusing on aspects like consumer behavior, market opportunities, competitive dynamics, or regulatory impacts. A thorough literature review follows, drawing from academic journals, industry reports, government publications, and market analyses to establish a knowledge base and identify research gaps. Data collection encompasses both primary methods, such as surveys, interviews, and focus groups with consumers and industry experts, and secondary methods, including analysis of market reports, government data, and industry publications. Quantitative data is analyzed using statistical tools to identify patterns and market segments, while qualitative data from interviews and focus groups is examined to extract key themes and insights.

The market is then segmented based on demographics, psychographics, geography, and purchasing behavior, and competitive analysis is conducted to evaluate key players' strategies and strengths. Trend analysis identifies current and emerging industry trends. Findings are compiled into a detailed report with data visualizations and strategic recommendations. The research is validated and refined through cross-checking and expert feedback, and a framework for continuous monitoring is established to keep the research current and relevant.

Remote and Hybrid Learning - Table of Contents

Chapter 1: Market Preface

Chapter 2: Strategic Overview

Chapter 3: Global Remote and Hybrid Learning Market Business Environment & Changing Dynamics

Chapter 4: Global Remote and Hybrid Learning Industry Factors Assessment

Chapter 5: Remote and Hybrid Learning : Competition Benchmarking & Performance Evaluation

Chapter 6: Global Remote and Hybrid Learning Market: Company Profiles

Chapter 7: Global Remote and Hybrid Learning by Type & Application (2020-2033)

Chapter 8: North America Remote and Hybrid Learning Market Breakdown by Country, Type & Application

Chapter 9: Europe Remote and Hybrid Learning Market Breakdown by Country, Type & Application

Chapter 10: Asia Pacific Remote and Hybrid Learning Market Breakdown by Country, Type & Application

Chapter 11: Latin America Remote and Hybrid Learning Market Breakdown by Country, Type & Application

Chapter 12: Middle East & Africa Remote and Hybrid Learning Market Breakdown by Country, Type & Application

Chapter 13: Research Finding and Conclusion

Frequently Asked Questions (FAQ):

The Compact Track Loaders market is projected to grow at a CAGR of 6.8% from 2025 to 2030, driven by increasing demand in construction and agricultural sectors.

North America currently leads the market with approximately 45% market share, followed by Europe at 28% and Asia-Pacific at 22%. The remaining regions account for 5% of the global market.

Key growth drivers include increasing construction activities, rising demand for versatile equipment in agriculture, technological advancements in track loader design, and growing preference for compact equipment in urban construction projects.