Resource Allocation Market Research Report

Resource Allocation Market Segmentation & Regional Sizing

Global Resource Allocation Market is segmented by Application (Healthcare, Disaster Relief, Education, Energy, Urban Planning), Type (Resource Optimization Platforms, Predictive Allocation Engines, Data-Driven Planning Tools, Government Budget Analytics, Workforce Allocation Systems), and Geography (North America, LATAM, West Europe, Central & Eastern Europe, Northern Europe, Southern Europe, East Asia, Southeast Asia, South Asia, Central Asia, Oceania, MEA)

Pricing

INDUSTRY OVERVIEW

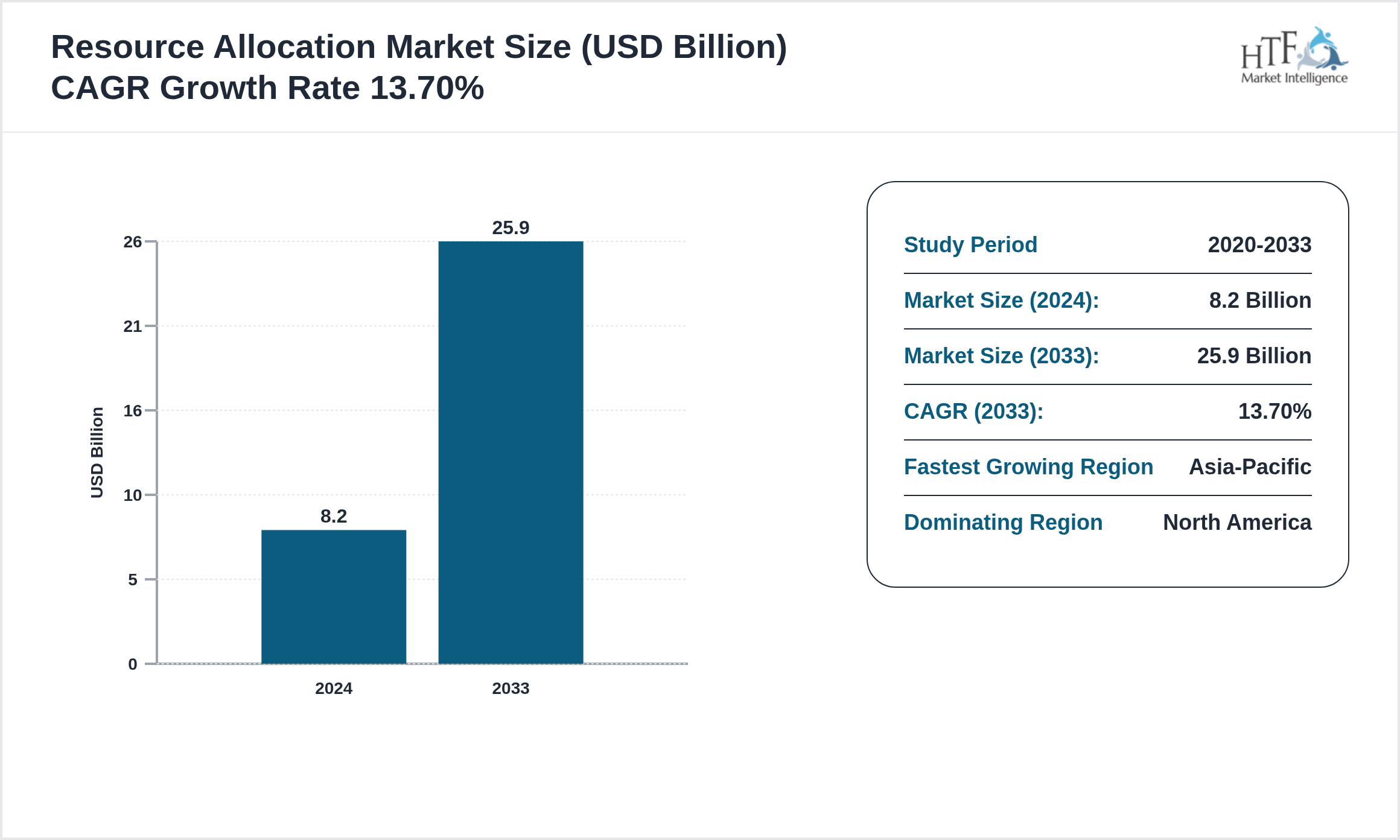

The Resource Allocation is Growing at 13.70% and is expected to reach 25.9 billion by 2033. Below mentioned are some of the dynamics shaping the Resource Allocation.

Resource Allocation solutions use advanced analytics, AI, and data visualization to optimize the distribution of financial, human, and infrastructural resources. Governments, NGOs, and corporations employ these platforms to forecast demand, identify shortages, and ensure equitable resource delivery across regions and programs.

Market Drivers:

The key drivers in the market include technological advancements, increasing demand by consumers for innovative products, and government-friendly policies. Our research company combines industry reports with expert interviews and market analysis tools to identify and quantify drivers such as these. We review the current trends and gather data from leading industry publications and market research firms to decipher exactly how these and other factors are encouraging or dampening market growth.

- • Rising Government Modernization

- • Focus On Data-Driven Planning

- • Adoption Of Predictive Analytics

- • Global Development Funding Growth

- • Integration Of Cloud In Governance

Some of the restraints to market growth may include regulatory challenges, high production costs, and disruptions in the supply chain. Our sources for these limitations include the regulation filings, industry surveys, and direct contributions from active participants within this marketplace. Tracking policy updates and economic reports further helps us to determine what kind of effect these factors have on the industry.

- • Data Fragmentation

- • Lack Of Skilled Data Professionals

- • Resistance To Change

- • Limited Interagency Coordination

- • Cybersecurity Risks

Among the trending ones are sustainability, digital transformation, and increasing importance of data analytics. Our research company is tracking these trends through the use of trend analysis tools, social media sentiment analysis, and industry benchmarking studies. Insights in emerging market preferences and technological advancements also come from surveys and focus groups.

- • AI-Driven Decision Support

- • Scenario-Based Budget Modeling

- • Blockchain Transparency Systems

- • Cross-Sector Data Sharing

- • Geospatial Resource Mapping

These include emerging markets, innovation in product development, and strategic partnerships. We identify these opportunities by performing market segmentation analysis, competitive landscape assessment, and investment trend evaluation. The data is collected based on industry reports, financial performance analysis for major players, and forecasting models for identifying future growth areas.

- • Expansion Into Emerging Economies

- • Collaboration With Donors & NGOs

- • Integration With Climate Adaptation Tools

- • Smart Urban Resource Management

- • National Budget Transparency Projects

Regulation Shaping the Healthcare Industry

The healthcare industry is significantly influenced by a complex framework of regulations designed to ensure patient safety, efficacy of treatments, and the overall quality of care. Key regulatory areas include drug approval processes, medical device standards, and healthcare data protection. These regulations aim to maintain high standards for clinical practices and safeguard public health.

Major Regulatory Bodies Worldwide

1. U.S. Food and Drug Administration (FDA): In the United States, the FDA is a pivotal regulatory authority overseeing the approval and monitoring of pharmaceuticals, medical devices, and biologics. The FDA sets stringent standards for product safety and efficacy, which significantly impacts market entry and ongoing compliance for healthcare companies.

2. European Medicines Agency (EMA): The EMA plays a crucial role in the European Union, evaluating and supervising medicinal products. It provides centralized approval for drugs and ensures that products meet rigorous safety and efficacy standards across member states.

3. Health Canada: This agency regulates pharmaceuticals and medical devices in Canada, ensuring that products are safe, effective, and of high quality. Health Canada's regulations are aligned with international standards but tailored to meet national health needs.

4. World Health Organization (WHO): While not a regulatory body in the traditional sense, the WHO sets international health standards and provides guidelines that influence national regulatory frameworks. It plays a key role in global health policy and emergency response.

5. National Medical Products Administration (NMPA): In China, the NMPA regulates the approval and supervision of drugs and medical devices, with an increasing focus on aligning with global standards and facilitating market access.

SWOT Analysis in the Healthcare Industry

SWOT analysis in the healthcare industry involves a structured assessment of Strengths, Weaknesses, Opportunities, and Threats to identify strategic advantages and areas for improvement.

• Strengths: Evaluates internal factors such as advanced technology, skilled personnel, and strong brand reputation. For example, a hospital with cutting-edge medical equipment and specialized staff is considered to have a strong competitive edge.

• Weaknesses: Identifies internal limitations like outdated facilities, regulatory compliance issues, or high operational costs. Weaknesses could include inefficient processes or lack of innovation.

• Opportunities: Assesses external factors that could drive growth, such as emerging medical technologies, expanding markets, or favorable government policies. Opportunities might involve partnerships or new service lines.

• Threats: Examines external challenges such as increasing competition, changing regulations, or economic downturns. Threats might include new entrants with disruptive technologies or stricter regulatory requirements.

Market Segmentation

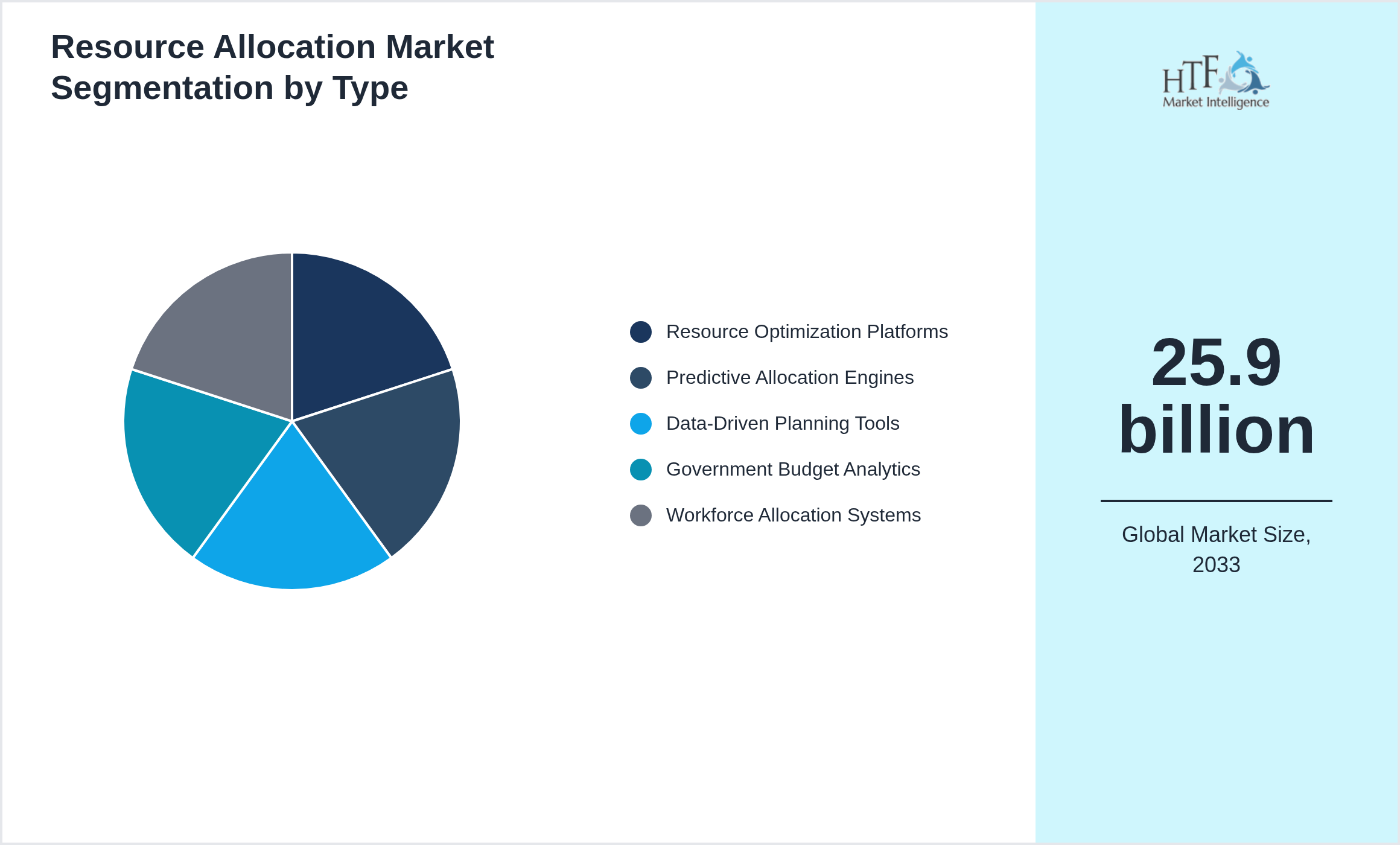

Segmentation by Type

- • Resource Optimization Platforms

- • Predictive Allocation Engines

- • Data-Driven Planning Tools

- • Government Budget Analytics

- • Workforce Allocation Systems

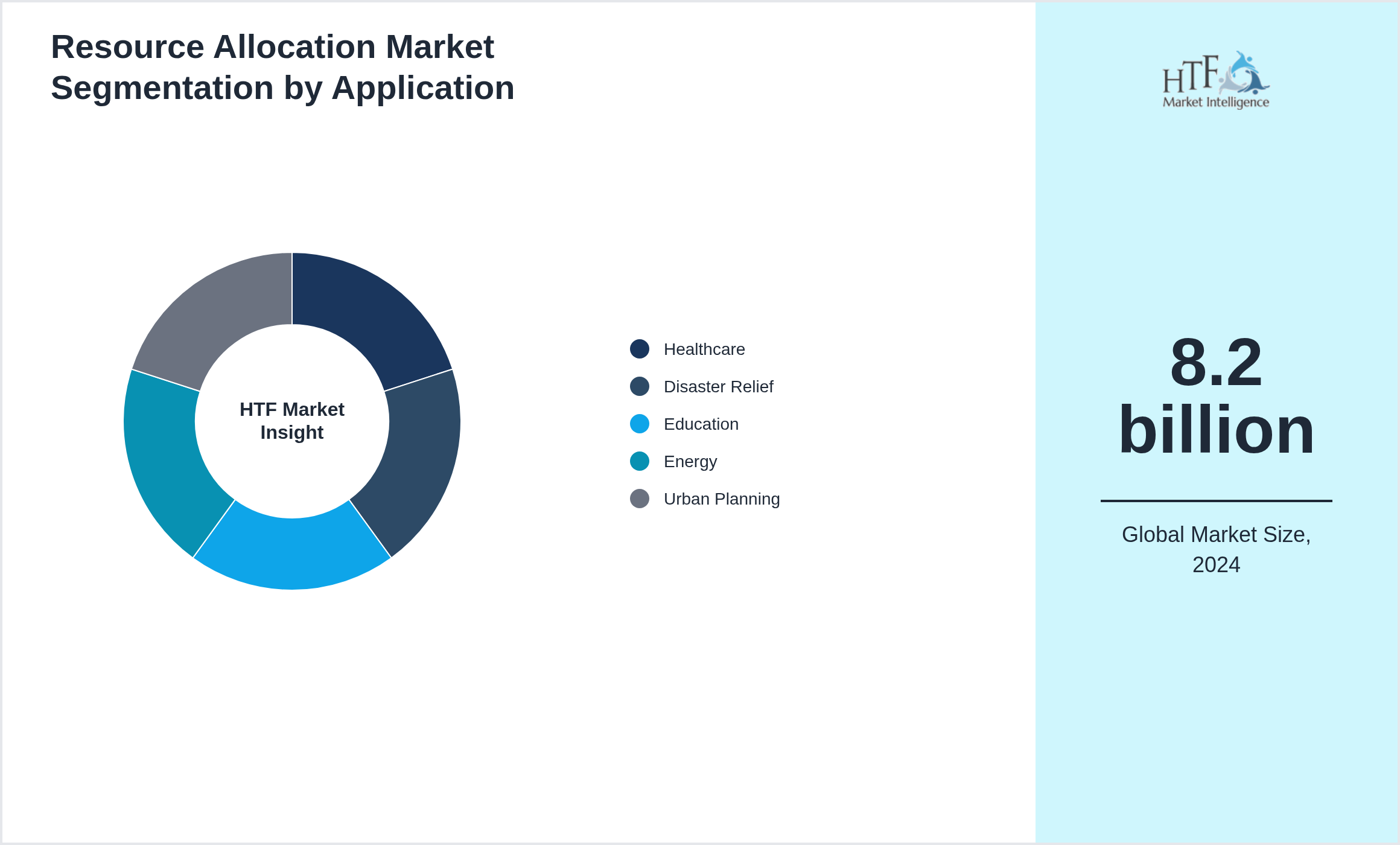

Segmentation by Application

- • Healthcare

- • Disaster Relief

- • Education

- • Energy

- • Urban Planning

Regional Outlook

The North America currently holds a significant share of the market, primarily due to several key factors: increasing consumption rates, a burgeoning population, and robust economic momentum. These elements collectively drive demand, positioning this region as a leader in the market. On the other hand, Asia-Pacific is rapidly emerging as the fastest-growing area within the industry. This remarkable growth can be attributed to swift infrastructure development, the expansion of various industrial sectors, and a marked increase in consumer demand. These dynamics make this region a crucial player in shaping future market growth. In our report, we cover a comprehensive analysis of the regions and countries, including

- North America

- LATAM

- West Europe

- Central & Eastern Europe

- Northern Europe

- Southern Europe

- East Asia

- Southeast Asia

- South Asia

- Central Asia

- Oceania

- MEA

The company consistently allocates significant resources to expand its research capabilities, develop new medical technologies, and enhance its pharmaceutical portfolio. Johnson & Johnson's investments in R&D, coupled with strategic acquisitions and partnerships, reinforce its position as a major contributor to advancements in healthcare. This focus on innovation and market expansion underscores the critical importance of the North American region in the global healthcare landscape.

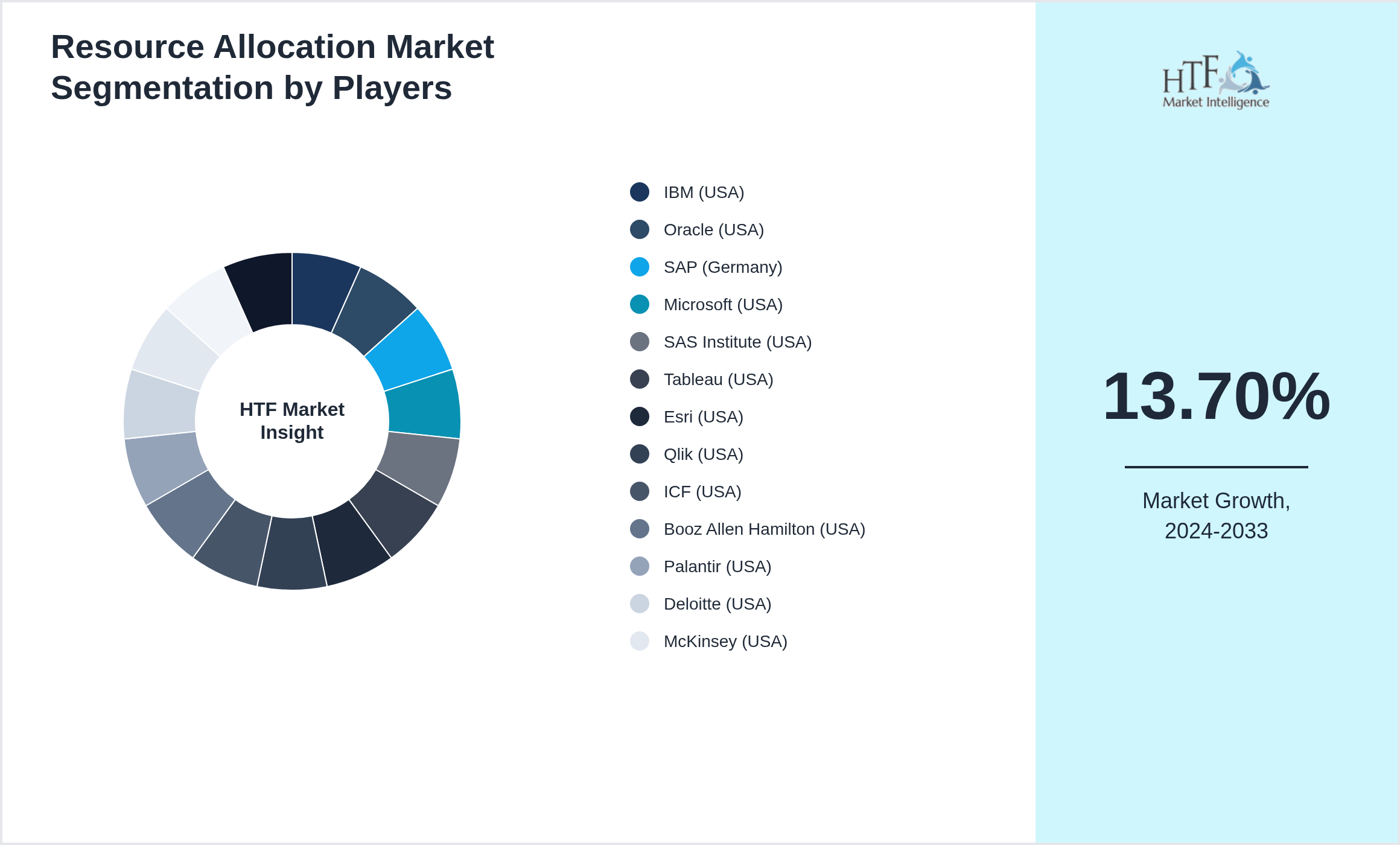

- • IBM (USA)

- • Oracle (USA)

- • SAP (Germany)

- • Microsoft (USA)

- • SAS Institute (USA)

- • Tableau (USA)

- • Esri (USA)

- • Qlik (USA)

- • ICF (USA)

- • Booz Allen Hamilton (USA)

- • Palantir (USA)

- • Deloitte (USA)

- • McKinsey (USA)

- • Capgemini (France)

- • AWS (USA)

Regulatory Landscape

Primary and Secondary Research

Primary research involves the collection of original data directly from sources in the healthcare industry. Approaches include the survey of health professionals, interviews with patients, focus groups, and clinical trials. This gives an overview of the current practice, the needs of the patient, and the interest in emerging trends. Firsthand information on the efficacy of new treatments, an assessment of market demand, and insight into changes in regulation can be sought only with primary research.

Secondary Research: This is the investigation of existing information from a variety of sources, which may include industry reports, academic journals, government publications, and market research studies. Alfred secondary research empowers them to understand trends within industries, historical data, and competitive landscapes. It gives a wide view of the market dynamics and validates findings obtained from primary research. By combining both primary and secondary together, health organizations will be empowered to develop comprehensive strategies and make informed decisions based on a strong foundation built on data.

Report Infographics

|

Report Features |

Details |

|

Base Year |

2024 |

|

Based Year Market Size (2023) |

8.2 billion |

|

Historical Period |

2020 to 2024 |

|

CAGR (2024 to 2033) |

13.70% |

|

Forecast Period |

2024 to 2033 |

|

Forecasted Period Market Size (2033) |

25.9 billion |

|

Scope of the Report |

|

|

Regions Covered |

North America, LATAM, West Europe, Central & Eastern Europe, Northern Europe, Southern Europe, East Asia, Southeast Asia, South Asia, Central Asia, Oceania, MEA |

|

Companies Covered |

IBM (USA), Oracle (USA), SAP (Germany), Microsoft (USA), SAS Institute (USA), Tableau (USA), Esri (USA), Qlik (USA), ICF (USA), Booz Allen Hamilton (USA), Palantir (USA), Deloitte (USA), McKinsey (USA), Capgemini (France), AWS (USA) |

|

Customization Scope |

15% Free Customization (For EG) |

|

Delivery Format |

PDF and Excel through Email |

Resource Allocation - Table of Contents

Chapter 1: Market Preface

Chapter 2: Strategic Overview

Chapter 3: Global Resource Allocation Market Business Environment & Changing Dynamics

Chapter 4: Global Resource Allocation Industry Factors Assessment

Chapter 5: Resource Allocation : Competition Benchmarking & Performance Evaluation

Chapter 6: Global Resource Allocation Market: Company Profiles

Chapter 7: Global Resource Allocation by Type & Application (2020-2033)

Chapter 8: North America Resource Allocation Market Breakdown by Country, Type & Application

Chapter 9: Europe Resource Allocation Market Breakdown by Country, Type & Application

Chapter 10: Asia Pacific Resource Allocation Market Breakdown by Country, Type & Application

Chapter 11: Latin America Resource Allocation Market Breakdown by Country, Type & Application

Chapter 12: Middle East & Africa Resource Allocation Market Breakdown by Country, Type & Application

Chapter 13: Research Finding and Conclusion

Frequently Asked Questions (FAQ):

The Compact Track Loaders market is expected to see value worth 5.3 Billion in 2025.

North America currently leads the market with approximately 45% market share, followed by Europe at 28% and Asia-Pacific at 22%. The remaining regions account for 5% of the global market.

Key growth drivers include increasing construction activities, rising demand for versatile equipment in agriculture, technological advancements in track loader design, and growing preference for compact equipment in urban construction projects.