Industrial Symbiosis Market Research Report

Global Industrial Symbiosis Market Roadmap to 2033

Global Industrial Symbiosis Market is segmented by Application (Manufacturing, Chemical, Energy, Metals, Industrial clusters), Type (Resource-sharing networks, Waste valorization, Energy sharing, Industrial byproduct utilization, Circular process integration), and Geography (North America, LATAM, West Europe, Central & Eastern Europe, Northern Europe, Southern Europe, East Asia, Southeast Asia, South Asia, Central Asia, Oceania, MEA)

Pricing

Key Values Provided by a Industrial Symbiosis Market

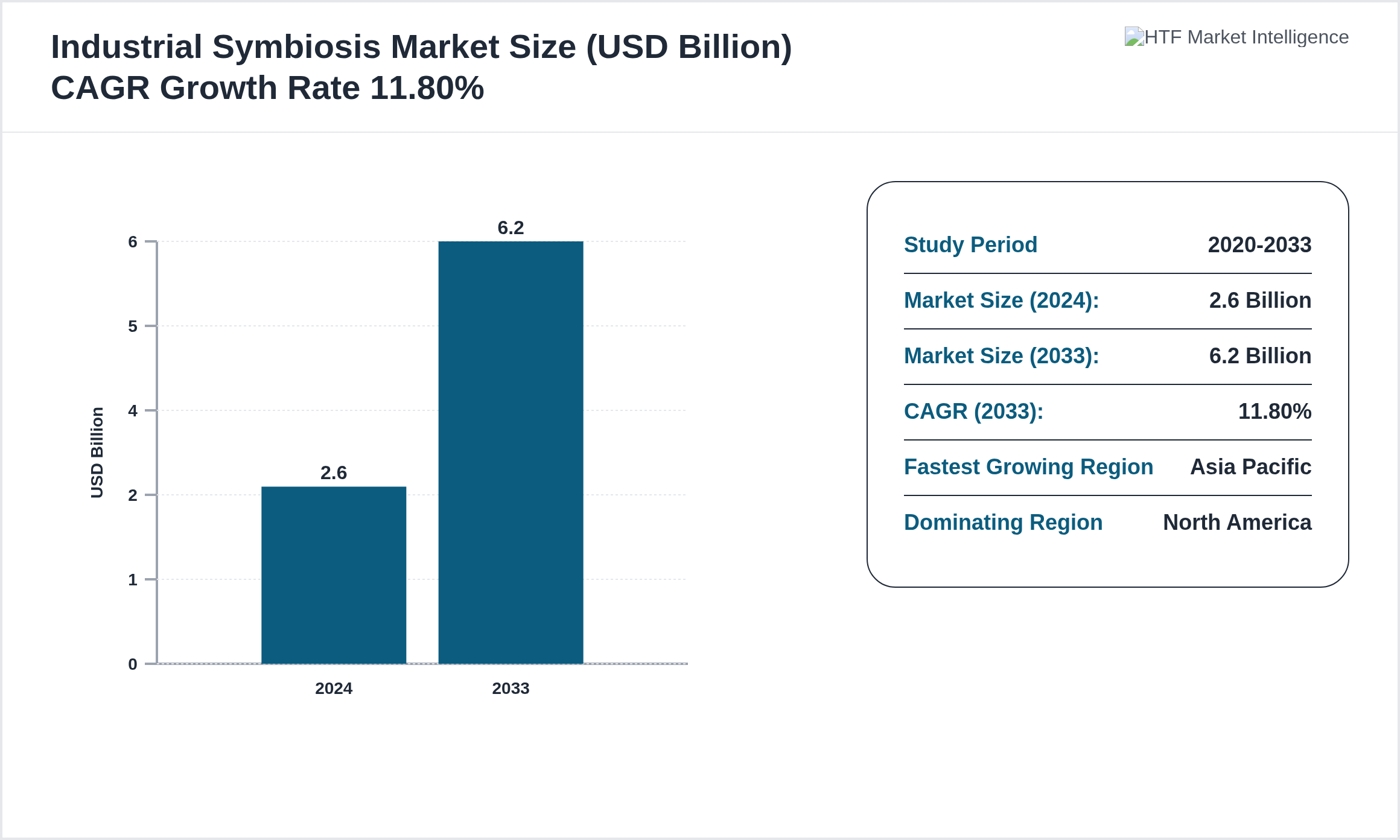

The Industrial Symbiosis is growing at a 11.80% during the forecasted period of 2020 to 2033.

Industrial symbiosis integrates industrial processes to share resources, energy, and byproducts, enabling sustainability, cost reduction, and circular economy practices across manufacturing and industrial clusters.

A market research report study provides invaluable data-driven insights that allow businesses to make informed decisions based on accurate market trends, customer behaviors, and competitor analysis. These reports help organizations better understand the evolving needs of their target audience, enabling more customer-focused strategies.

Additionally, they provide a competitive advantage by revealing competitors' strengths and weaknesses, helping companies refine their positioning and stay ahead. Market research reports also play a crucial role in risk reduction by identifying potential challenges, allowing businesses to anticipate and mitigate risks before entering new markets or launching products.

Moreover, these reports uncover growth opportunities and emerging trends, allowing companies to innovate or expand into underserved markets. They are essential for strategic planning, aligning business goals with market realities to ensure long-term success. Investors also rely on market research reports to evaluate industry potential, making these reports key tools for making low-risk investment decisions. A market research report provides essential insights for growth, competitive positioning, and sound business strategy.

Market Dynamics

Influencing Trend:

- • Digital monitoring

- • IoT-enabled resource tracking

- • AI-assisted optimization

- • Cloud-based analytics

- • Energy sharing platforms

- • Resource efficiency demand

- • Circular economy policies

- • Sustainability initiatives

- • ESG adoption

- • Regulatory compliance

- • Technical complexity

- • Stakeholder coordination

- • Investment requirements

- • Regulatory barriers

- • Data integration

- • Resource optimization

- • Cost reduction

- • Environmental compliance

- • Industrial efficiency

- • Sustainability branding

Asia-Pacific is a fast-growing region with high demand for both high-tech and affordable products, driven by urbanization and rising middle-class incomes. Latin America prioritizes affordability amidst economic fluctuations, with Brazil and Mexico leading in market growth. In the Middle East and Africa, market trends are influenced by cultural preferences, with luxury goods prominent in the Gulf States and gradual growth in sub-Saharan Africa. Global trends like sustainability and digital transformation are impacting all regions.

The North America Dominant Region currently dominates the market share, fueled by increasing consumption, population growth, and sustained economic progress, which collectively enhance market demand. Conversely, the Asia Pacific is the fastest-growing Region is rapidly becoming the fastest-growing region, driven by significant infrastructure investments, industrial expansion, and rising consumer demand.

- North America

- LATAM

- West Europe

- Central & Eastern Europe

- Northern Europe

- Southern Europe

- East Asia

- Southeast Asia

- South Asia

- Central Asia

- Oceania

- MEA

Competitive Insights

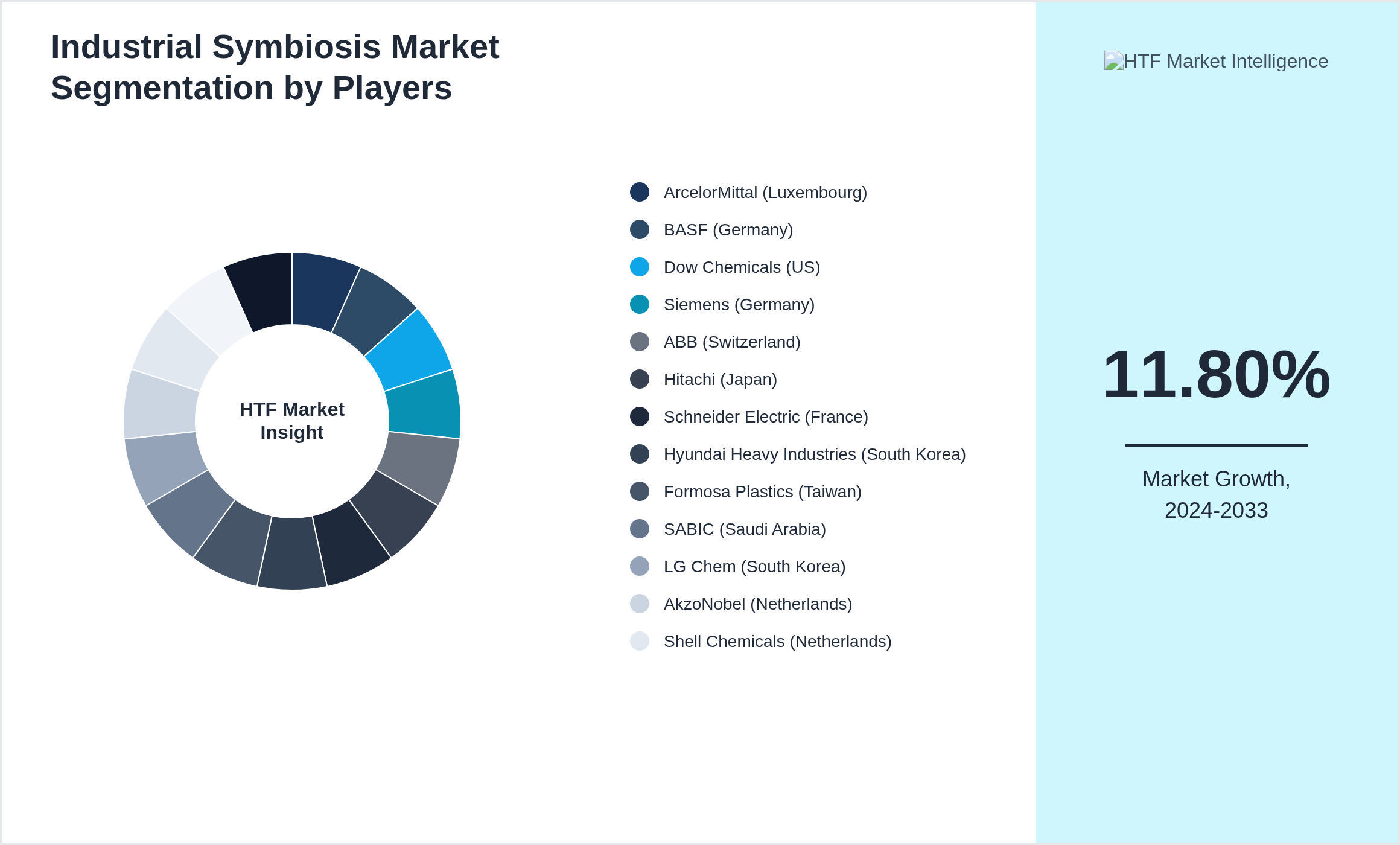

The key players in the Industrial Symbiosis are intensifying their focus on research and development (R&D) activities to innovate and stay competitive. Major companies, such as ArcelorMittal (Luxembourg), BASF (Germany), Dow Chemicals (US), Siemens (Germany), ABB (Switzerland), Hitachi (Japan), Schneider Electric (France), Hyundai Heavy Industries (South Korea), Formosa Plastics (Taiwan), SABIC (Saudi Arabia), LG Chem (South Korea), AkzoNobel (Netherlands), Shell Chemicals (Netherlands), ExxonMobil (US), Mitsubishi Chemical (Japan) are heavily investing in R&D to develop new products and improve existing ones. This strategic emphasis on innovation drives significant advancements in product formulation and the introduction of sustainable and eco-friendly products.

Moreover, these established industry leaders are actively pursuing acquisitions of smaller companies to expand their regional presence and enhance their market share. These acquisitions not only help in diversifying their product portfolios but also provide access to new technologies and markets. This consolidation trend is a critical factor in the growth of the consumer goods industry, as it enables larger companies to streamline operations, reduce costs, and increase their competitive edge.

In addition to R&D and acquisitions, there is a notable shift towards green investments among key players in the consumer goods industry. Companies are increasingly committing resources to sustainable practices and developing environmentally friendly products. This green investment responds to growing consumer demand for sustainable solutions and stringent environmental regulations. By prioritizing sustainability, these companies are not only contributing to environmental protection but also positioning themselves as leaders in the green movement, thereby fueling market growth.

The companies highlighted in this profile were selected based on insights from primary experts and an evaluation of their market penetration, product offerings, and geographical reach:

- • ArcelorMittal (Luxembourg)

- • BASF (Germany)

- • Dow Chemicals (US)

- • Siemens (Germany)

- • ABB (Switzerland)

- • Hitachi (Japan)

- • Schneider Electric (France)

- • Hyundai Heavy Industries (South Korea)

- • Formosa Plastics (Taiwan)

- • SABIC (Saudi Arabia)

- • LG Chem (South Korea)

- • AkzoNobel (Netherlands)

- • Shell Chemicals (Netherlands)

- • ExxonMobil (US)

- • Mitsubishi Chemical (Japan)

Key Highlights

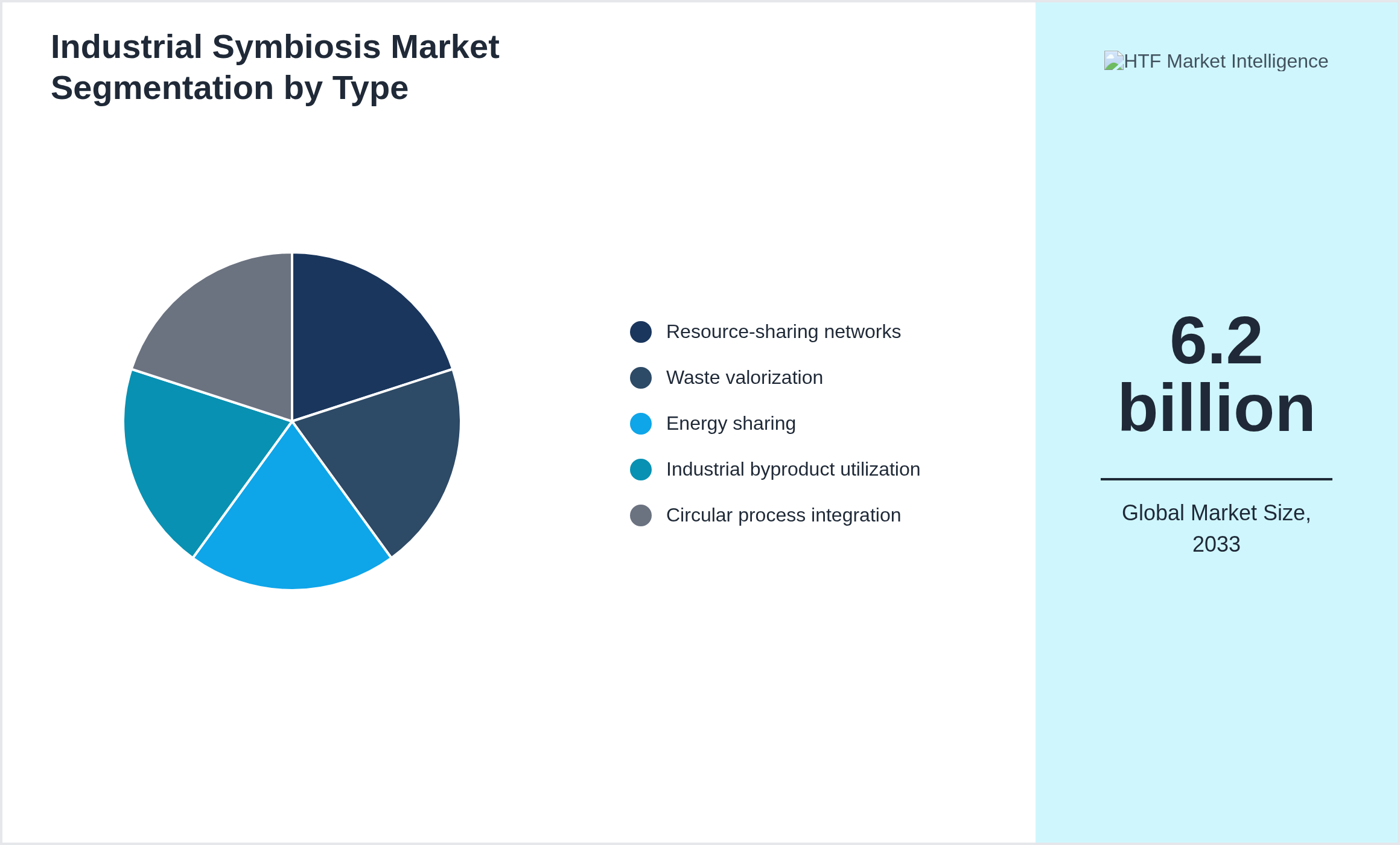

Segmentation by Type

- • Resource-sharing networks

- • Waste valorization

- • Energy sharing

- • Industrial byproduct utilization

- • Circular process integration

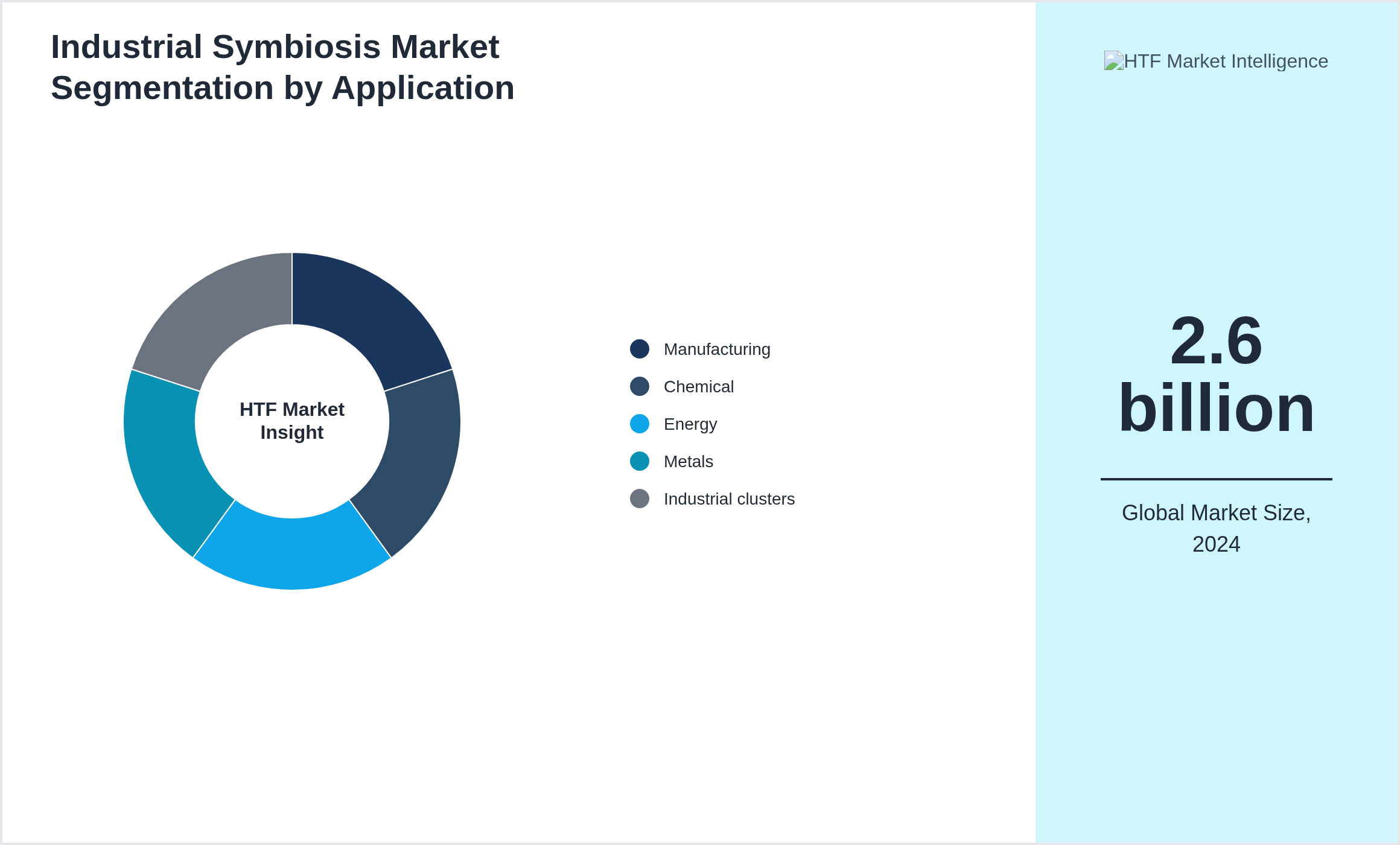

Segmentation by Application

-

- • Manufacturing

- • Chemical

- • Energy

- • Metals

- • Industrial clusters

and Metric Tons will be provided if Applicable based on industry best practice

Regional Analysis

Merger & Acquisition

The Top-Down and Bottom-Up Approaches

The top-down approach begins with a broad theory or hypothesis and breaks it down into specific components for testing. This structured, deductive process involves developing a theory, creating hypotheses, collecting and analyzing data, and drawing conclusions. It is particularly useful when there is substantial theoretical knowledge, but it can be rigid and may overlook new phenomena.

Conversely, the bottom-up approach starts with specific data or observations, from which broader generalizations and theories are developed. This inductive process involves collecting detailed data, analyzing it for patterns, developing hypotheses, formulating theories, and validating them with additional data. While this approach is flexible and encourages the discovery of new phenomena, it can be time-consuming and less structured.

Swot and Pestal Analysis

SWOT Analysis

SWOT Analysis evaluates a company’s internal Strengths and Weaknesses, as well as external Opportunities and Threats. This analysis helps businesses identify their competitive advantages, address internal challenges, and seize external opportunities while mitigating potential risks. It is performed to gain a comprehensive understanding of the organization's position in the market, align strategies with its strengths, and effectively navigate competitive landscapes.

PESTEL Analysis

Political, Economic, Social, Technological, Environmental, and Legal factors impacting the business environment. This analysis helps organizations anticipate external changes, adapt strategies to macroeconomic trends, and ensure compliance with regulatory requirements. It is crucial for understanding the external forces that could influence business operations and for planning long-term strategies that align with evolving market conditions.

Report Infographics:

| Report Features | Details |

| Base Year | 2024 |

| Based Year Market Size 2024 | 2.6 billion |

| Historical Period | 2020 |

| CAGR (2024 to 2033) | 11.80% |

| Forecast Period | 2033 |

| Forecasted Period Market Size (2033) | 6.2 billion |

| Scope of the Report |

Resource-sharing networks, Waste valorization, Energy sharing, Industrial byproduct utilization, Circular process integration Manufacturing, Chemical, Energy, Metals, Industrial clusters |

| Regions Covered | North America, LATAM, West Europe, Central & Eastern Europe, Northern Europe, Southern Europe, East Asia, Southeast Asia, South Asia, Central Asia, Oceania, MEA |

| Companies Covered | ArcelorMittal (Luxembourg), BASF (Germany), Dow Chemicals (US), Siemens (Germany), ABB (Switzerland), Hitachi (Japan), Schneider Electric (France), Hyundai Heavy Industries (South Korea), Formosa Plastics (Taiwan), SABIC (Saudi Arabia), LG Chem (South Korea), AkzoNobel (Netherlands), Shell Chemicals (Netherlands), ExxonMobil (US), Mitsubishi Chemical (Japan) |

| Customization Scope | 15% Free Customization (For EG) |

| Delivery Format | PDF and Excel through Email |

Industrial Symbiosis - Table of Contents

Chapter 1: Market Preface

Chapter 2: Strategic Overview

Chapter 3: Global Industrial Symbiosis Market Business Environment & Changing Dynamics

Chapter 4: Global Industrial Symbiosis Industry Factors Assessment

Chapter 5: Industrial Symbiosis : Competition Benchmarking & Performance Evaluation

Chapter 6: Global Industrial Symbiosis Market: Company Profiles

Chapter 7: Global Industrial Symbiosis by Type & Application (2020-2033)

Chapter 8: North America Industrial Symbiosis Market Breakdown by Country, Type & Application

Chapter 9: Europe Industrial Symbiosis Market Breakdown by Country, Type & Application

Chapter 10: Asia Pacific Industrial Symbiosis Market Breakdown by Country, Type & Application

Chapter 11: Latin America Industrial Symbiosis Market Breakdown by Country, Type & Application

Chapter 12: Middle East & Africa Industrial Symbiosis Market Breakdown by Country, Type & Application

Chapter 13: Research Finding and Conclusion

Frequently Asked Questions (FAQ):

The Compact Track Loaders market is expected to see value worth 5.3 Billion in 2025.

North America currently leads the market with approximately 45% market share, followed by Europe at 28% and Asia-Pacific at 22%. The remaining regions account for 5% of the global market.

Key growth drivers include increasing construction activities, rising demand for versatile equipment in agriculture, technological advancements in track loader design, and growing preference for compact equipment in urban construction projects.