AI-based Automated Crypto Trading Bots Market Research Report

Global AI-based Automated Crypto Trading Bots Market Roadmap to 2033

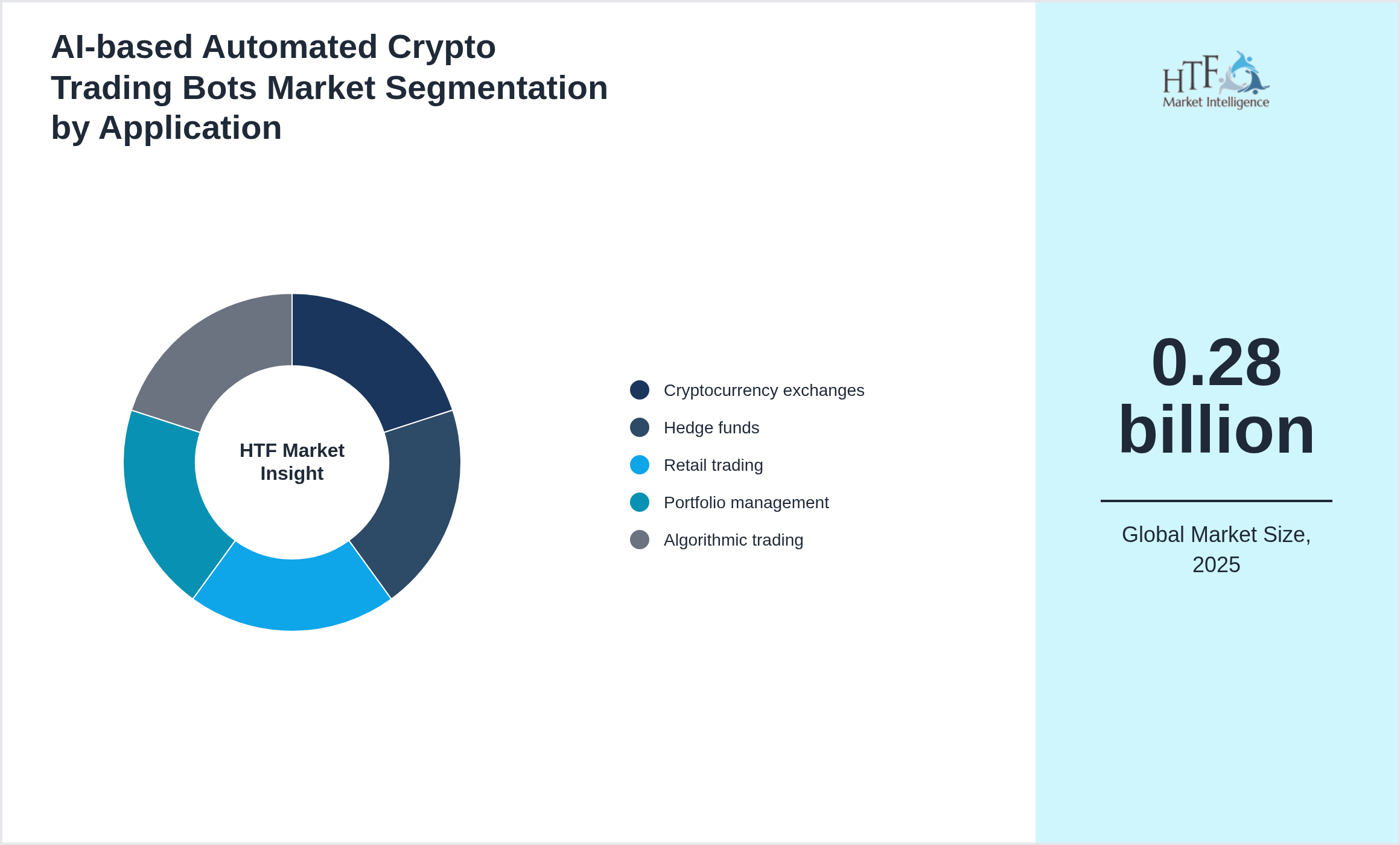

Global AI-based Automated Crypto Trading Bots Market is segmented by Application (Cryptocurrency exchanges, Hedge funds, Retail trading, Portfolio management, Algorithmic trading), Type (Trend-following, Arbitrage, Market-making, Portfolio-rebalancing, AI-optimized), and Geography (North America, LATAM, West Europe, Central & Eastern Europe, Northern Europe, Southern Europe, East Asia, Southeast Asia, South Asia, Central Asia, Oceania, MEA)

Pricing

Market Overview

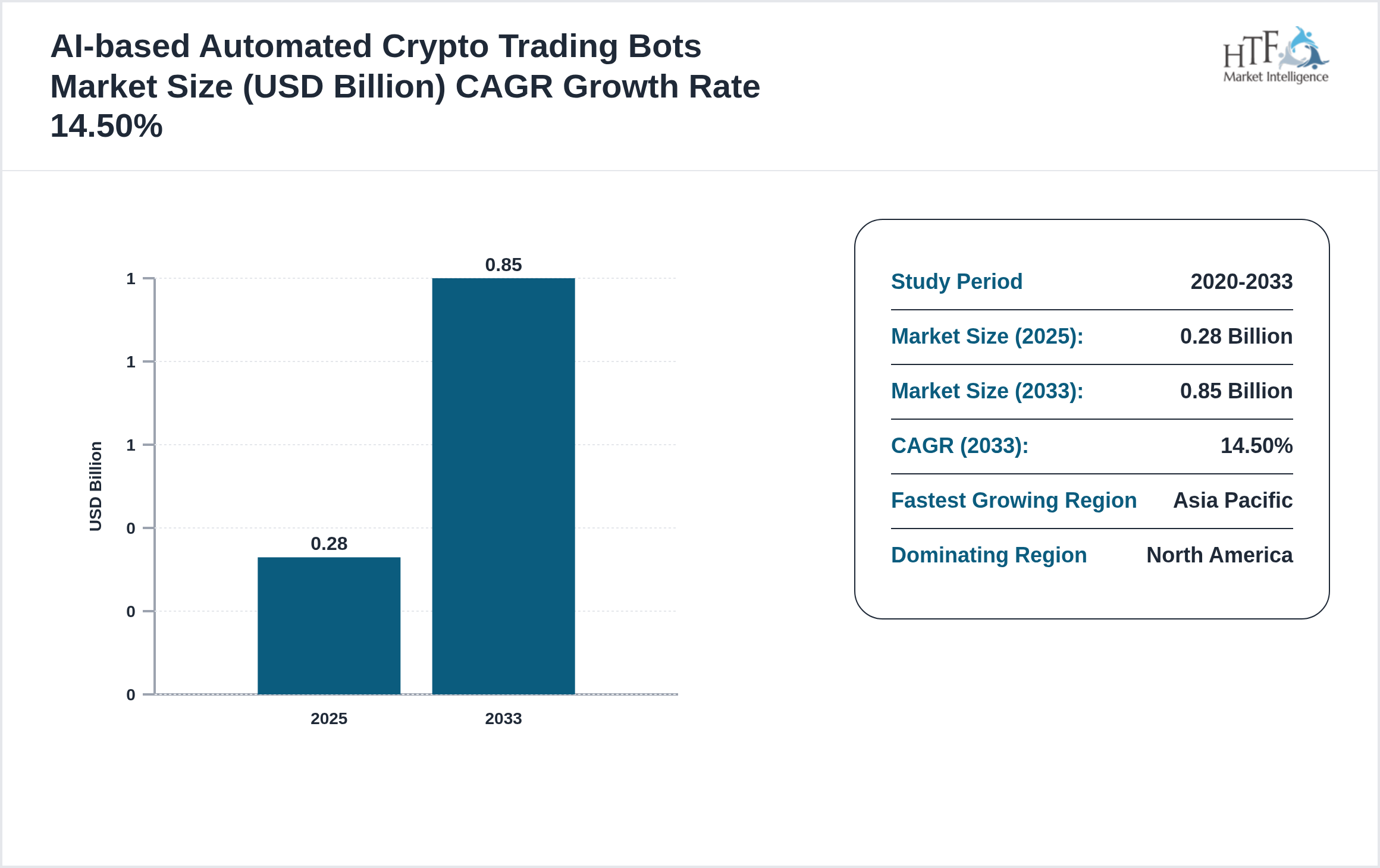

The North America, LATAM, West Europe, Central & Eastern Europe, Northern Europe, Southern Europe, East Asia, Southeast Asia, South Asia, Central Asia, Oceania, MEA AI-based Automated Crypto Trading Bots market was valued at 0.28 billion in 2025 and is expected to reach 0.85 billion by 2020, growing at a compound annual growth rate (CAGR) of 14.50% over the forecast period. This steady growth is driven by factors such as increasing demand, technological innovations, and rising investments across the industry. Furthermore, expanding applications in various sectors, coupled with an emphasis on sustainability and innovation, are anticipated to further propel market expansion. The projected growth reflects the industry's evolving landscape and emerging opportunities within the AI-based Automated Crypto Trading Bots market.

AI-based automated crypto trading bots are software solutions that leverage artificial intelligence to execute cryptocurrency trades automatically. They analyze market trends, price movements, and historical data to optimize trading strategies, including trend-following, arbitrage, market-making, portfolio rebalancing, and AI-optimized approaches. These bots operate across multiple exchanges, integrating machine learning algorithms and sentiment analysis to make rapid, data-driven decisions. Drivers include increasing cryptocurrency adoption, market volatility, demand for efficiency, and AI advancements. Challenges involve regulatory uncertainty, security risks, high market volatility, and reliance on algorithmic accuracy. North America leads due to advanced crypto infrastructure and retail adoption, while Asia-Pacific is fastest-growing with rapid crypto market expansion. Opportunities lie in integrating with DeFi platforms, offering AI-enhanced strategies, cloud-based solutions, subscription models, and portfolio management tools. Automated crypto bots enable traders to optimize returns, reduce manual intervention, and leverage AI capabilities for consistent market performance.

Regulatory Landscape

- • Regulatory focus covers safety

Regional Insights

The AI-based Automated Crypto Trading Bots market exhibits significant regional variation, shaped by different economic conditions and consumer behaviours.

- North America: High disposable incomes and a robust e-commerce sector are driving demand for premium and convenient products.

- Europe: Fragmented market where Western Europe emphasizes luxury and organic products, while Eastern Europe experiences rapid growth.

- Asia-Pacific: Urbanization and a growing middle class drive demand for both high-tech and affordable products, positioning the region as a fast-growing market.

- Latin America: Economic fluctuations make affordability a key factor, with Brazil and Mexico leading the way in market expansion.

- Middle East & Africa: Luxury products are prominent in the Gulf States, while Sub-Saharan Africa sees gradual market growth, influenced by local preferences.

Currently, North America dominates the market due to high consumption, population growth, and sustained economic progress. Meanwhile, Asia Pacific is experiencing the fastest growth, driven by large-scale infrastructure investments, industrial development, and rising consumer demand.

Major Regulatory Bodies Worldwide

- U.S. Food and Drug Administration (FDA): Oversees the approval and regulation of pharmaceuticals, medical devices, and biologics in the U.S., setting high standards for product safety and efficacy.

- European Medicines Agency (EMA): Provides centralized drug approvals in the EU, ensuring uniform safety and efficacy standards across member states.

- Health Canada: and medical devices, maintaining high-quality standards in line with international regulations but adapted to national health needs.

- World Health Organization (WHO): While not a direct regulatory body, WHO sets international health standards that influence North America, LATAM, West Europe, Central & Eastern Europe, Northern Europe, Southern Europe, East Asia, Southeast Asia, South Asia, Central Asia, Oceania, MEA regulations and policies.

- The National Medical Products Administration (NMPA) regulates China's drug and medical device industry, increasingly aligning with North America, LATAM, West Europe, Central & Eastern Europe, Northern Europe, Southern Europe, East Asia, Southeast Asia, South Asia, Central Asia, Oceania, MEA standards to facilitate market access.

SWOT Analysis in the Healthcare Industry

- Strengths: internal advantages such as cutting-edge technology, a skilled workforce, and a strong brand presence (e.g., hospitals with specialized staff and modern equipment).

- Weaknesses: internal challenges, including outdated infrastructure, high operational costs, or inefficiencies in innovation.

- Opportunities: external growth drivers like new medical technologies, expanding markets, and favorable policies.

- Threats: external risks including intensified competition, regulatory changes, and economic fluctuations (e.g., new entrants with disruptive technologies).

Understand Key Market Dynamics

Market Segmentation

Segmentation by Type

- • Trend-following

- • Arbitrage

- • Market-making

- • Portfolio-rebalancing

- • AI-optimized

Segmentation by Application

- • Cryptocurrency exchanges

- • Hedge funds

- • Retail trading

- • Portfolio management

- • Algorithmic trading

Primary and Secondary Research

- Primary Research: The research involves direct data collection through methods like surveys, interviews, and clinical trials, providing real-time insights into patient needs, regulatory impacts, and market demand.

- Secondary Research: Analyzes existing data from sources like industry reports, academic journals, and market studies, offering a broad understanding of market trends and validating primary research findings. Combining both methods enables healthcare organizations to build data-driven strategies and make well-informed decisions.

AI-based Automated Crypto Trading Bots Market Dynamics

Influencing Trend:

- • Multi-exchange trading

- • Machine learning optimization

- • Sentiment analysis

- • Cloud-based bots

- • Portfolio diversification

- • Rising crypto adoption

- • Volatility management

- • Efficiency in trading

- • AI advancements

- • Demand for automated solutions

- • Expansion in retail & institutional trading

- • Integration with DeFi platforms

- • AI-enhanced strategies

- • Subscription-based services

- • Emerging crypto markets

- • Regulatory uncertainty

- • Security risks

- • Market volatility

- • Technical complexity

- • Trust in AI algorithms

Regional Analysis

Market Entropy

Merger & Acquisition

Patent Analysis

Investment and Funding Scenario

Market Estimation Process

Optimizing Market Strategy: Leveraging Bottom-Up, Top-Down Approaches & Data Triangulation

- Bottom-Up Approach: Aggregates granular data, such as individual sales or product units, to calculate overall market size, providing detailed insights into specific segments.

- Top-Down Approach: begins with broader market estimates and breaks them into segments, relying on macroeconomic trends and industry data for strategic planning.

- Data Triangulation: Combines multiple data sources (e.g., surveys, reports, expert interviews) to validate findings, ensuring accuracy and reducing bias.

Key components for success include market segmentation, reliable data sources, and continuous data validation to create robust, actionable market insights.

Report Important Highlights

| Report Features | Details |

| Base Year | 2025 |

| Based Year Market Size 2025 | 0.28 billion |

| Historical Period | 2020 to 2025 |

| CAGR 2025 to 2033 | 14.50% |

| Forecast Period | 2026 to 2033 |

| Forecasted Period Market Size 2033 | 0.85 billion |

| Scope of the Report | Trend-following, Arbitrage, Market-making, Portfolio-rebalancing, AI-optimized, Cryptocurrency exchanges, Hedge funds, Retail trading, Portfolio management, Algorithmic trading |

| Regions Covered | North America, LATAM, West Europe, Central & Eastern Europe, Northern Europe, Southern Europe, East Asia, Southeast Asia, South Asia, Central Asia, Oceania, MEA |

| Companies Covered | Binance (CN), Coinbase (US), Kraken (US), Bitfinex (HK), Huobi (CN), KuCoin (SG), eToro (UK), 3Commas (US), Shrimpy (US), Cryptohopper (NL), HaasOnline (NL), Coinrule (UK), Zignaly (ES), Aluna.Social (UK), Mudrex (IN) |

| Customization Scope | 15% Free Customization |

| Delivery Format | PDF and Excel through Email |

Regulatory Framework of Market

1. The regulatory framework governing market research reports ensures transparency, accuracy, and adherence to ethical standards throughout data collection and reporting. Compliance with relevant legal and industry guidelines is essential for maintaining credibility and avoiding legal repercussions.

2. Data Privacy and Protection: Laws such as the General Data Protection Regulation (GDPR) in the EU and the California Consumer Privacy Act (CCPA) in the US impose strict requirements for handling personal data. Market research firms must ensure that data collection methods adhere to privacy regulations, including securing consent and safeguarding data.

3. Fair Competition: Regulatory agencies like the Federal Trade Commission (FTC) in the US and the Competition and Markets Authority (CMA) in the UK uphold fair competition. Market research reports must be free of bias or misleading content that could distort competition or influence consumer decisions unfairly.

4. Intellectual Property Compliance: Adhering to copyright laws ensures that proprietary data and third-party insights used in research reports are legally sourced and properly cited, protecting against intellectual property infringement.

5. Ethical Standards: Professional bodies like the Market Research Society (MRS) and the American Association for Public Opinion Research (AAPOR) establish ethical guidelines that promote responsible, transparent research practices, ensuring that respondents’ rights are protected and findings are presented objectively.

Research Methodology

The top-down and bottom-up approaches estimate and validate the size of the North America, LATAM, West Europe, Central & Eastern Europe, Northern Europe, Southern Europe, East Asia, Southeast Asia, South Asia, Central Asia, Oceania, MEA AI-based Automated Crypto Trading Bots market. To reach an exhaustive list of functional and relevant players, various industry classification standards are closely followed, such as NAICS, ICB, and SIC, to penetrate deep into critical geographies by players, and a thorough validation test is conducted to reach the most relevant players for survey in the Harbor Management Software market. To make a priority list, companies are sorted based on revenue generated in the latest reporting, using paid sources. Finally, the questionnaire is set and specifically designed to address all the necessities for primary data collection after getting a prior appointment. This helps us gather the data for the player's revenue, OPEX, profit margins, product or service growth, etc. Almost 80% of data is collected through primary sources and further validation is done through various secondary sources that include Regulators, World Bank, Associations, Company Websites, SEC filings, white papers, OTC BB, Annual reports, press releases, etc.

AI-based Automated Crypto Trading Bots - Table of Contents

Chapter 1: Market Preface

Chapter 2: Strategic Overview

Chapter 3: Global AI-based Automated Crypto Trading Bots Market Business Environment & Changing Dynamics

Chapter 4: Global AI-based Automated Crypto Trading Bots Industry Factors Assessment

Chapter 5: AI-based Automated Crypto Trading Bots : Competition Benchmarking & Performance Evaluation

Chapter 6: Global AI-based Automated Crypto Trading Bots Market: Company Profiles

Chapter 7: Global AI-based Automated Crypto Trading Bots by Type & Application (2020-2033)

Chapter 8: North America AI-based Automated Crypto Trading Bots Market Breakdown by Country, Type & Application

Chapter 9: Europe AI-based Automated Crypto Trading Bots Market Breakdown by Country, Type & Application

Chapter 10: Asia Pacific AI-based Automated Crypto Trading Bots Market Breakdown by Country, Type & Application

Chapter 11: Latin America AI-based Automated Crypto Trading Bots Market Breakdown by Country, Type & Application

Chapter 12: Middle East & Africa AI-based Automated Crypto Trading Bots Market Breakdown by Country, Type & Application

Chapter 13: Research Finding and Conclusion

Frequently Asked Questions (FAQ):

The Compact Track Loaders market is expected to see value worth 5.3 Billion in 2025.

North America currently leads the market with approximately 45% market share, followed by Europe at 28% and Asia-Pacific at 22%. The remaining regions account for 5% of the global market.

Key growth drivers include increasing construction activities, rising demand for versatile equipment in agriculture, technological advancements in track loader design, and growing preference for compact equipment in urban construction projects.